Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2017</strong><br />

Contents<br />

7<br />

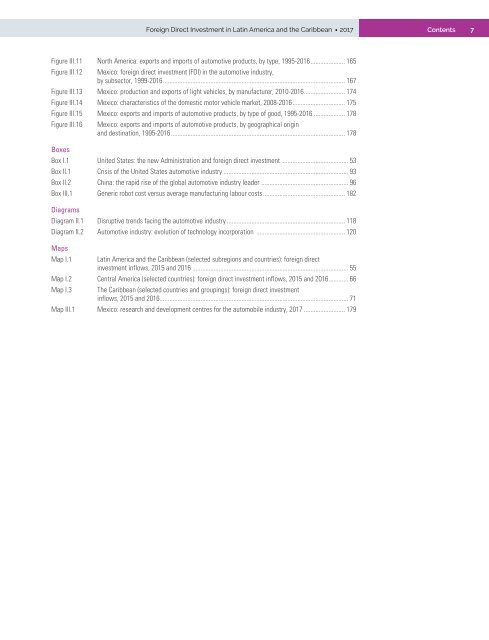

Figure III.11 North <strong>America</strong>: exports <strong>and</strong> imports of automotive products, by type, 1995-2016...................... 165<br />

Figure III.12<br />

Mexico: foreign direct <strong>in</strong>vestment (FDI) <strong>in</strong> <strong>the</strong> automotive <strong>in</strong>dustry,<br />

by subsector, 1999-2016................................................................................................................ 167<br />

Figure III.13 Mexico: production <strong>and</strong> exports of light vehicles, by manufacturer, 2010-2016.......................... 174<br />

Figure III.14 Mexico: characteristics of <strong>the</strong> domestic motor vehicle market, 2008-2016................................. 175<br />

Figure III.15 Mexico: exports <strong>and</strong> imports of automotive products, by type of good, 1995-2016.................... 178<br />

Figure III.16<br />

Mexico: exports <strong>and</strong> imports of automotive products, by geographical orig<strong>in</strong><br />

<strong>and</strong> dest<strong>in</strong>ation, 1995-2016........................................................................................................... 178<br />

Boxes<br />

Box I.1 United States: <strong>the</strong> new Adm<strong>in</strong>istration <strong>and</strong> foreign direct <strong>in</strong>vestment ......................................... 53<br />

Box II.1 Crisis of <strong>the</strong> United States automotive <strong>in</strong>dustry............................................................................. 93<br />

Box II.2 Ch<strong>in</strong>a: <strong>the</strong> rapid rise of <strong>the</strong> global automotive <strong>in</strong>dustry leader ...................................................... 96<br />

Box III.1 Generic robot cost versus average manufactur<strong>in</strong>g labour costs................................................... 182<br />

Diagrams<br />

Diagram II.1 Disruptive trends fac<strong>in</strong>g <strong>the</strong> automotive <strong>in</strong>dustry......................................................................... 118<br />

Diagram II.2 Automotive <strong>in</strong>dustry: evolution of technology <strong>in</strong>corporation ....................................................... 120<br />

Maps<br />

Map I.1<br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (selected subregions <strong>and</strong> countries): foreign direct<br />

<strong>in</strong>vestment <strong>in</strong>flows, 2015 <strong>and</strong> 2016................................................................................................ 55<br />

Map I.2 Central <strong>America</strong> (selected countries): foreign direct <strong>in</strong>vestment <strong>in</strong>flows, 2015 <strong>and</strong> 2016............. 66<br />

Map I.3 The <strong>Caribbean</strong> (selected countries <strong>and</strong> group<strong>in</strong>gs): foreign direct <strong>in</strong>vestment<br />

<strong>in</strong>flows, 2015 <strong>and</strong> 2016................................................................................................................... 71<br />

Map III.1 Mexico: research <strong>and</strong> development centres for <strong>the</strong> automobile <strong>in</strong>dustry, <strong>2017</strong>.......................... 179