Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

18 Executive summary<br />

Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC)<br />

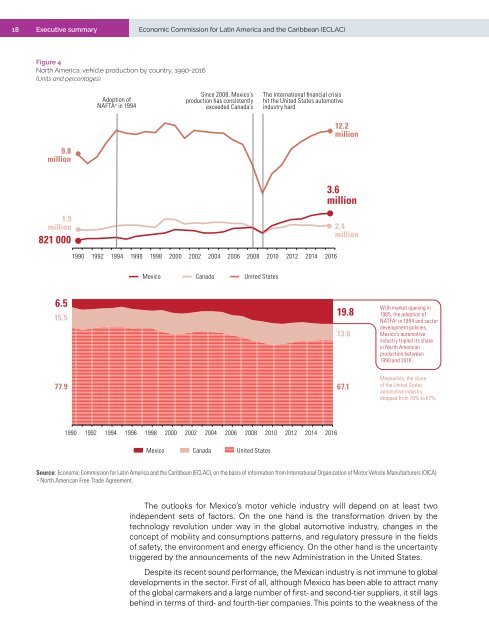

Figure 4<br />

North <strong>America</strong>: vehicle production by country, 1990-2016<br />

(Units <strong>and</strong> percentages)<br />

Adoption of<br />

NAFTA a <strong>in</strong> 1994<br />

S<strong>in</strong>ce 2008, Mexico’s<br />

production has consistently<br />

exceeded Canada’s<br />

The <strong>in</strong>ternational f<strong>in</strong>ancial crisis<br />

hit <strong>the</strong> United States automotive<br />

<strong>in</strong>dustry hard<br />

12.2<br />

million<br />

9.8<br />

million<br />

3.6<br />

million<br />

1.9<br />

million<br />

821 000<br />

2.4<br />

million<br />

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016<br />

Mexico<br />

Canada<br />

United States<br />

6.5<br />

15.5<br />

77.9<br />

19.8<br />

13.0<br />

67.1<br />

With market open<strong>in</strong>g <strong>in</strong><br />

1985, <strong>the</strong> adoption of<br />

NATFA a <strong>in</strong> 1994 <strong>and</strong> sector<br />

development policies,<br />

Mexico’s automotive<br />

<strong>in</strong>dustry tripled its share<br />

<strong>in</strong> North <strong>America</strong>n<br />

production between<br />

1990 <strong>and</strong> 2016.<br />

Meanwhile, <strong>the</strong> share<br />

of <strong>the</strong> United States<br />

automotive <strong>in</strong>dustry<br />

dropped from 78% to 67%.<br />

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016<br />

Mexico<br />

Canada<br />

United States<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of <strong>in</strong>formation from International Organization of Motor Vehicle Manufacturers (OICA).<br />

a<br />

North <strong>America</strong>n Free Trade Agreement.<br />

The outlooks for Mexico’s motor vehicle <strong>in</strong>dustry will depend on at least two<br />

<strong>in</strong>dependent sets of factors. On <strong>the</strong> one h<strong>and</strong> is <strong>the</strong> transformation driven by <strong>the</strong><br />

technology revolution under way <strong>in</strong> <strong>the</strong> global automotive <strong>in</strong>dustry, changes <strong>in</strong> <strong>the</strong><br />

concept of mobility <strong>and</strong> consumptions patterns, <strong>and</strong> regulatory pressure <strong>in</strong> <strong>the</strong> fields<br />

of safety, <strong>the</strong> environment <strong>and</strong> energy efficiency. On <strong>the</strong> o<strong>the</strong>r h<strong>and</strong> is <strong>the</strong> uncerta<strong>in</strong>ty<br />

triggered by <strong>the</strong> announcements of <strong>the</strong> new Adm<strong>in</strong>istration <strong>in</strong> <strong>the</strong> United States.<br />

Despite its recent sound performance, <strong>the</strong> Mexican <strong>in</strong>dustry is not immune to global<br />

developments <strong>in</strong> <strong>the</strong> sector. First of all, although Mexico has been able to attract many<br />

of <strong>the</strong> global carmakers <strong>and</strong> a large number of first- <strong>and</strong> second-tier suppliers, it still lags<br />

beh<strong>in</strong>d <strong>in</strong> terms of third- <strong>and</strong> fourth-tier companies. This po<strong>in</strong>ts to <strong>the</strong> weakness of <strong>the</strong>