Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

172 Chapter III Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC)<br />

without ab<strong>and</strong>on<strong>in</strong>g its established large scale operations, Mexico has <strong>in</strong> recent years begun<br />

target<strong>in</strong>g more dem<strong>and</strong><strong>in</strong>g segments, such as CUVs, SUVs <strong>and</strong> pickups. It has achieved<br />

this through sizeable <strong>in</strong>vestments <strong>in</strong> state-of-<strong>the</strong>-art platforms, which allow high degrees<br />

of flexibility <strong>in</strong> <strong>the</strong> scal<strong>in</strong>g up of production to manufacture models that are <strong>in</strong>creas<strong>in</strong>gly<br />

geared towards <strong>the</strong> global market. Additionally, <strong>and</strong> <strong>in</strong> response to <strong>the</strong> dem<strong>and</strong>s of <strong>the</strong><br />

United States market, Mexican vehicles now <strong>in</strong>corporate <strong>the</strong> latest technological advances<br />

<strong>in</strong> connectivity <strong>and</strong> passenger enterta<strong>in</strong>ment, thus establish<strong>in</strong>g <strong>the</strong> foundations for some of<br />

<strong>the</strong> key features of tomorrow’s <strong>in</strong>dustry, such as electric-powered <strong>and</strong> self-driv<strong>in</strong>g vehicles.<br />

The recent arrivals that specialize <strong>in</strong> high-end automobiles will be key players <strong>in</strong> this new<br />

scenario <strong>in</strong>sofar as <strong>the</strong>ir more global production outlook will support Mexico’s commercial<br />

diversification, foster <strong>the</strong> arrival of new suppliers <strong>and</strong> streng<strong>the</strong>n <strong>the</strong> country’s research,<br />

development <strong>and</strong> <strong>in</strong>novation activities.<br />

C. Streng<strong>the</strong>n<strong>in</strong>g <strong>the</strong> network of suppliers<br />

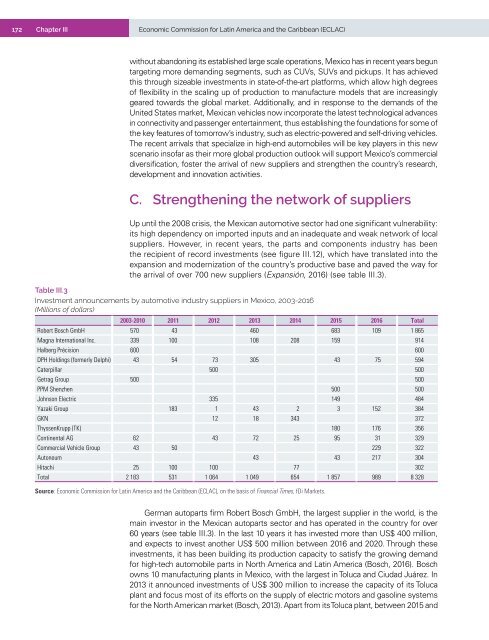

Up until <strong>the</strong> 2008 crisis, <strong>the</strong> Mexican automotive sector had one significant vulnerability:<br />

its high dependency on imported <strong>in</strong>puts <strong>and</strong> an <strong>in</strong>adequate <strong>and</strong> weak network of local<br />

suppliers. However, <strong>in</strong> recent years, <strong>the</strong> parts <strong>and</strong> components <strong>in</strong>dustry has been<br />

<strong>the</strong> recipient of record <strong>in</strong>vestments (see figure III.12), which have translated <strong>in</strong>to <strong>the</strong><br />

expansion <strong>and</strong> modernization of <strong>the</strong> country’s productive base <strong>and</strong> paved <strong>the</strong> way for<br />

<strong>the</strong> arrival of over 700 new suppliers (Expansión, 2016) (see table III.3).<br />

Table III.3<br />

<strong>Investment</strong> announcements by automotive <strong>in</strong>dustry suppliers <strong>in</strong> Mexico, 2003-2016<br />

(Millions of dollars)<br />

2003-2010 2011 2012 2013 2014 2015 2016 Total<br />

Robert Bosch GmbH 570 43 460 683 109 1 865<br />

Magna International Inc. 339 100 108 208 159 914<br />

Halberg Précision 600 600<br />

DPH Hold<strong>in</strong>gs (formerly Delphi) 43 54 73 305 43 75 594<br />

Caterpillar 500 500<br />

Getrag Group 500 500<br />

PPM Shenzhen 500 500<br />

Johnson Electric 335 149 484<br />

Yazaki Group 183 1 43 2 3 152 384<br />

GKN 12 18 343 372<br />

ThyssenKrupp (TK) 180 176 356<br />

Cont<strong>in</strong>ental AG 62 43 72 25 95 31 329<br />

Commercial Vehicle Group 43 50 229 322<br />

Autoneum 43 43 217 304<br />

Hitachi 25 100 100 77 302<br />

Total 2 183 531 1 064 1 049 654 1 857 989 8 328<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of F<strong>in</strong>ancial Times, fDi Markets.<br />

German autoparts firm Robert Bosch GmbH, <strong>the</strong> largest supplier <strong>in</strong> <strong>the</strong> world, is <strong>the</strong><br />

ma<strong>in</strong> <strong>in</strong>vestor <strong>in</strong> <strong>the</strong> Mexican autoparts sector <strong>and</strong> has operated <strong>in</strong> <strong>the</strong> country for over<br />

60 years (see table III.3). In <strong>the</strong> last 10 years it has <strong>in</strong>vested more than US$ 400 million,<br />

<strong>and</strong> expects to <strong>in</strong>vest ano<strong>the</strong>r US$ 500 million between 2016 <strong>and</strong> 2020. Through <strong>the</strong>se<br />

<strong>in</strong>vestments, it has been build<strong>in</strong>g its production capacity to satisfy <strong>the</strong> grow<strong>in</strong>g dem<strong>and</strong><br />

for high-tech automobile parts <strong>in</strong> North <strong>America</strong> <strong>and</strong> Lat<strong>in</strong> <strong>America</strong> (Bosch, 2016). Bosch<br />

owns 10 manufactur<strong>in</strong>g plants <strong>in</strong> Mexico, with <strong>the</strong> largest <strong>in</strong> Toluca <strong>and</strong> Ciudad Juárez. In<br />

2013 it announced <strong>in</strong>vestments of US$ 300 million to <strong>in</strong>crease <strong>the</strong> capacity of its Toluca<br />

plant <strong>and</strong> focus most of its efforts on <strong>the</strong> supply of electric motors <strong>and</strong> gasol<strong>in</strong>e systems<br />

for <strong>the</strong> North <strong>America</strong>n market (Bosch, 2013). Apart from its Toluca plant, between 2015 <strong>and</strong>