Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2017</strong><br />

Chapter I<br />

37<br />

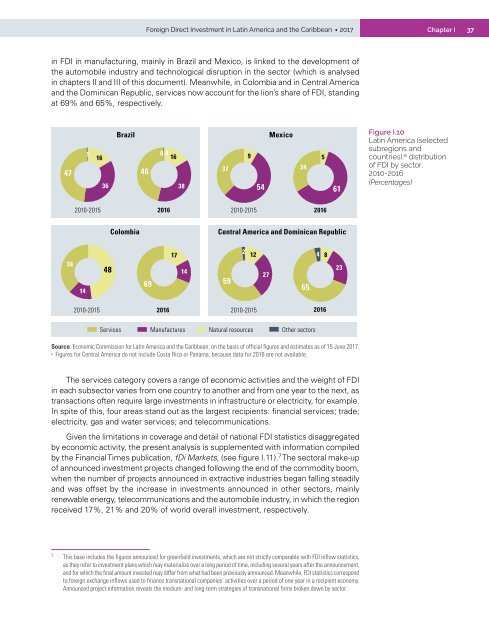

<strong>in</strong> FDI <strong>in</strong> manufactur<strong>in</strong>g, ma<strong>in</strong>ly <strong>in</strong> Brazil <strong>and</strong> Mexico, is l<strong>in</strong>ked to <strong>the</strong> development of<br />

<strong>the</strong> automobile <strong>in</strong>dustry <strong>and</strong> technological disruption <strong>in</strong> <strong>the</strong> sector (which is analysed<br />

<strong>in</strong> chapters II <strong>and</strong> III of this document). Meanwhile, <strong>in</strong> Colombia <strong>and</strong> <strong>in</strong> Central <strong>America</strong><br />

<strong>and</strong> <strong>the</strong> Dom<strong>in</strong>ican Republic, services now account for <strong>the</strong> lion’s share of FDI, st<strong>and</strong><strong>in</strong>g<br />

at 69% <strong>and</strong> 65%, respectively.<br />

47<br />

1<br />

16<br />

36<br />

Brazil<br />

46<br />

0,4<br />

16<br />

38<br />

37<br />

9<br />

54<br />

Mexico<br />

34<br />

5<br />

61<br />

Figure I.10<br />

Lat<strong>in</strong> <strong>America</strong> (selected<br />

subregions <strong>and</strong><br />

countries): a distribution<br />

of FDI by sector,<br />

2010-2016<br />

(Percentages)<br />

2010-2015<br />

2016<br />

2010-2015<br />

2016<br />

Colombia<br />

Central <strong>America</strong> <strong>and</strong> Dom<strong>in</strong>ican Republic<br />

38<br />

14<br />

48<br />

69<br />

17<br />

14<br />

59<br />

2<br />

12<br />

27<br />

65<br />

4<br />

8<br />

23<br />

2010-2015<br />

2016<br />

2010-2015<br />

2016<br />

Services<br />

Manufactures<br />

Natural resources<br />

O<strong>the</strong>r sectors<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>, on <strong>the</strong> basis of official figures <strong>and</strong> estimates as of 15 June <strong>2017</strong>.<br />

a<br />

Figures for Central <strong>America</strong> do not <strong>in</strong>clude Costa Rica or Panama, because data for 2016 are not available.<br />

The services category covers a range of economic activities <strong>and</strong> <strong>the</strong> weight of FDI<br />

<strong>in</strong> each subsector varies from one country to ano<strong>the</strong>r <strong>and</strong> from one year to <strong>the</strong> next, as<br />

transactions often require large <strong>in</strong>vestments <strong>in</strong> <strong>in</strong>frastructure or electricity, for example.<br />

In spite of this, four areas st<strong>and</strong> out as <strong>the</strong> largest recipients: f<strong>in</strong>ancial services; trade;<br />

electricity, gas <strong>and</strong> water services; <strong>and</strong> telecommunications.<br />

Given <strong>the</strong> limitations <strong>in</strong> coverage <strong>and</strong> detail of national FDI statistics disaggregated<br />

by economic activity, <strong>the</strong> present analysis is supplemented with <strong>in</strong>formation compiled<br />

by <strong>the</strong> F<strong>in</strong>ancial Times publication, fDi Markets, (see figure I.11). 7 The sectoral make-up<br />

of announced <strong>in</strong>vestment projects changed follow<strong>in</strong>g <strong>the</strong> end of <strong>the</strong> commodity boom,<br />

when <strong>the</strong> number of projects announced <strong>in</strong> extractive <strong>in</strong>dustries began fall<strong>in</strong>g steadily<br />

<strong>and</strong> was offset by <strong>the</strong> <strong>in</strong>crease <strong>in</strong> <strong>in</strong>vestments announced <strong>in</strong> o<strong>the</strong>r sectors, ma<strong>in</strong>ly<br />

renewable energy, telecommunications <strong>and</strong> <strong>the</strong> automobile <strong>in</strong>dustry, <strong>in</strong> which <strong>the</strong> region<br />

received 17%, 21% <strong>and</strong> 20% of world overall <strong>in</strong>vestment, respectively.<br />

7<br />

This base <strong>in</strong>cludes <strong>the</strong> figures announced for greenfield <strong>in</strong>vestments, which are not strictly comparable with FDI <strong>in</strong>flow statistics,<br />

as <strong>the</strong>y refer to <strong>in</strong>vestment plans which may materialize over a long period of time, <strong>in</strong>clud<strong>in</strong>g several years after <strong>the</strong> announcement,<br />

<strong>and</strong> for which <strong>the</strong> f<strong>in</strong>al amount <strong>in</strong>vested may differ from what had been previously announced. Meanwhile, FDI statistics correspond<br />

to foreign exchange <strong>in</strong>flows used to f<strong>in</strong>ance transnational companies’ activities over a period of one year <strong>in</strong> a recipient economy.<br />

Announced project <strong>in</strong>formation reveals <strong>the</strong> medium- <strong>and</strong> long-term strategies of transnational firms broken down by sector.