Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

164 Chapter III Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC)<br />

Figure III.10 (concluded)<br />

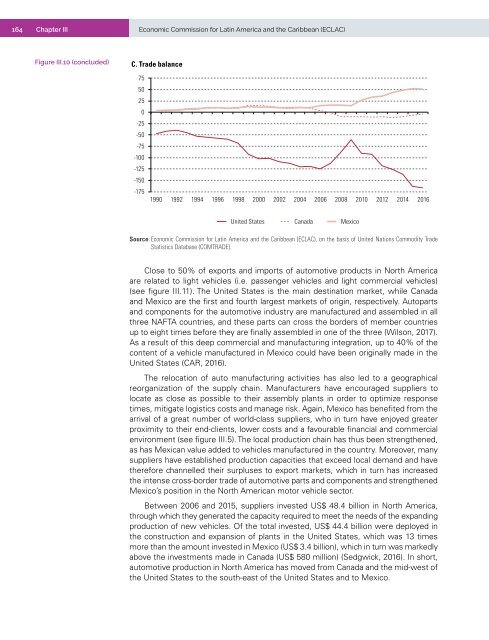

C. Trade balance<br />

75<br />

50<br />

25<br />

0<br />

-25<br />

-50<br />

-75<br />

-100<br />

-125<br />

-150<br />

-175<br />

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016<br />

United States<br />

Canada<br />

Mexico<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of United Nations Commodity Trade<br />

Statistics Database (COMTRADE).<br />

Close to 50% of exports <strong>and</strong> imports of automotive products <strong>in</strong> North <strong>America</strong><br />

are related to light vehicles (i.e. passenger vehicles <strong>and</strong> light commercial vehicles)<br />

(see figure III.11). The United States is <strong>the</strong> ma<strong>in</strong> dest<strong>in</strong>ation market, while Canada<br />

<strong>and</strong> Mexico are <strong>the</strong> first <strong>and</strong> fourth largest markets of orig<strong>in</strong>, respectively. Autoparts<br />

<strong>and</strong> components for <strong>the</strong> automotive <strong>in</strong>dustry are manufactured <strong>and</strong> assembled <strong>in</strong> all<br />

three NAFTA countries, <strong>and</strong> <strong>the</strong>se parts can cross <strong>the</strong> borders of member countries<br />

up to eight times before <strong>the</strong>y are f<strong>in</strong>ally assembled <strong>in</strong> one of <strong>the</strong> three (Wilson, <strong>2017</strong>).<br />

As a result of this deep commercial <strong>and</strong> manufactur<strong>in</strong>g <strong>in</strong>tegration, up to 40% of <strong>the</strong><br />

content of a vehicle manufactured <strong>in</strong> Mexico could have been orig<strong>in</strong>ally made <strong>in</strong> <strong>the</strong><br />

United States (CAR, 2016).<br />

The relocation of auto manufactur<strong>in</strong>g activities has also led to a geographical<br />

reorganization of <strong>the</strong> supply cha<strong>in</strong>. Manufacturers have encouraged suppliers to<br />

locate as close as possible to <strong>the</strong>ir assembly plants <strong>in</strong> order to optimize response<br />

times, mitigate logistics costs <strong>and</strong> manage risk. Aga<strong>in</strong>, Mexico has benefited from <strong>the</strong><br />

arrival of a great number of world-class suppliers, who <strong>in</strong> turn have enjoyed greater<br />

proximity to <strong>the</strong>ir end-clients, lower costs <strong>and</strong> a favourable f<strong>in</strong>ancial <strong>and</strong> commercial<br />

environment (see figure III.5). The local production cha<strong>in</strong> has thus been streng<strong>the</strong>ned,<br />

as has Mexican value added to vehicles manufactured <strong>in</strong> <strong>the</strong> country. Moreover, many<br />

suppliers have established production capacities that exceed local dem<strong>and</strong> <strong>and</strong> have<br />

<strong>the</strong>refore channelled <strong>the</strong>ir surpluses to export markets, which <strong>in</strong> turn has <strong>in</strong>creased<br />

<strong>the</strong> <strong>in</strong>tense cross-border trade of automotive parts <strong>and</strong> components <strong>and</strong> streng<strong>the</strong>ned<br />

Mexico’s position <strong>in</strong> <strong>the</strong> North <strong>America</strong>n motor vehicle sector.<br />

Between 2006 <strong>and</strong> 2015, suppliers <strong>in</strong>vested US$ 48.4 billion <strong>in</strong> North <strong>America</strong>,<br />

through which <strong>the</strong>y generated <strong>the</strong> capacity required to meet <strong>the</strong> needs of <strong>the</strong> exp<strong>and</strong><strong>in</strong>g<br />

production of new vehicles. Of <strong>the</strong> total <strong>in</strong>vested, US$ 44.4 billion were deployed <strong>in</strong><br />

<strong>the</strong> construction <strong>and</strong> expansion of plants <strong>in</strong> <strong>the</strong> United States, which was 13 times<br />

more than <strong>the</strong> amount <strong>in</strong>vested <strong>in</strong> Mexico (US$ 3.4 billion), which <strong>in</strong> turn was markedly<br />

above <strong>the</strong> <strong>in</strong>vestments made <strong>in</strong> Canada (US$ 580 million) (Sedgwick, 2016). In short,<br />

automotive production <strong>in</strong> North <strong>America</strong> has moved from Canada <strong>and</strong> <strong>the</strong> mid-west of<br />

<strong>the</strong> United States to <strong>the</strong> south-east of <strong>the</strong> United States <strong>and</strong> to Mexico.