Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2017</strong><br />

Chapter III<br />

159<br />

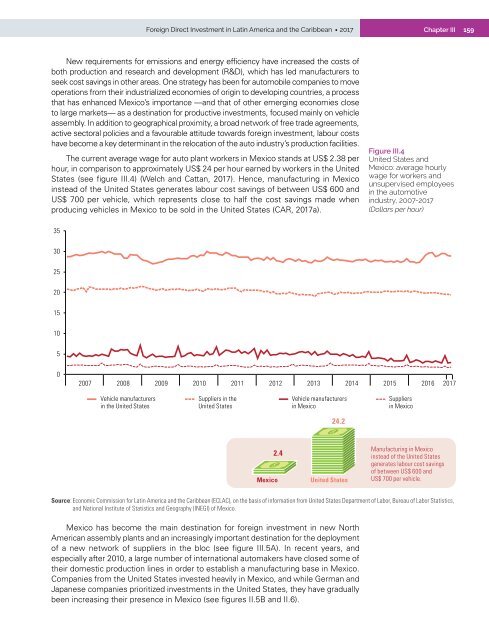

New requirements for emissions <strong>and</strong> energy efficiency have <strong>in</strong>creased <strong>the</strong> costs of<br />

both production <strong>and</strong> research <strong>and</strong> development (R&D), which has led manufacturers to<br />

seek cost sav<strong>in</strong>gs <strong>in</strong> o<strong>the</strong>r areas. One strategy has been for automobile companies to move<br />

operations from <strong>the</strong>ir <strong>in</strong>dustrialized economies of orig<strong>in</strong> to develop<strong>in</strong>g countries, a process<br />

that has enhanced Mexico’s importance —<strong>and</strong> that of o<strong>the</strong>r emerg<strong>in</strong>g economies close<br />

to large markets— as a dest<strong>in</strong>ation for productive <strong>in</strong>vestments, focused ma<strong>in</strong>ly on vehicle<br />

assembly. In addition to geographical proximity, a broad network of free trade agreements,<br />

active sectoral policies <strong>and</strong> a favourable attitude towards foreign <strong>in</strong>vestment, labour costs<br />

have become a key determ<strong>in</strong>ant <strong>in</strong> <strong>the</strong> relocation of <strong>the</strong> auto <strong>in</strong>dustry’s production facilities.<br />

The current average wage for auto plant workers <strong>in</strong> Mexico st<strong>and</strong>s at US$ 2.38 per<br />

hour, <strong>in</strong> comparison to approximately US$ 24 per hour earned by workers <strong>in</strong> <strong>the</strong> United<br />

States (see figure III.4) (Welch <strong>and</strong> Cattan, <strong>2017</strong>). Hence, manufactur<strong>in</strong>g <strong>in</strong> Mexico<br />

<strong>in</strong>stead of <strong>the</strong> United States generates labour cost sav<strong>in</strong>gs of between US$ 600 <strong>and</strong><br />

US$ 700 per vehicle, which represents close to half <strong>the</strong> cost sav<strong>in</strong>gs made when<br />

produc<strong>in</strong>g vehicles <strong>in</strong> Mexico to be sold <strong>in</strong> <strong>the</strong> United States (CAR, <strong>2017</strong>a).<br />

Figure III.4<br />

United States <strong>and</strong><br />

Mexico: average hourly<br />

wage for workers <strong>and</strong><br />

unsupervised employees<br />

<strong>in</strong> <strong>the</strong> automotive<br />

<strong>in</strong>dustry, 2007-<strong>2017</strong><br />

(Dollars per hour)<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 <strong>2017</strong><br />

Vehicle manufacturers<br />

<strong>in</strong> <strong>the</strong> United States<br />

Suppliers <strong>in</strong> <strong>the</strong><br />

United States<br />

Vehicle manufacturers<br />

<strong>in</strong> Mexico<br />

Suppliers<br />

<strong>in</strong> Mexico<br />

24.2<br />

Mexico<br />

2.4<br />

United States<br />

Manufactur<strong>in</strong>g <strong>in</strong> Mexico<br />

<strong>in</strong>stead of <strong>the</strong> United States<br />

generates labour cost sav<strong>in</strong>gs<br />

of between US$ 600 <strong>and</strong><br />

US$ 700 per vehicle.<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of <strong>in</strong>formation from United States Department of Labor, Bureau of Labor Statistics,<br />

<strong>and</strong> National Institute of Statistics <strong>and</strong> Geography (INEGI) of Mexico.<br />

Mexico has become <strong>the</strong> ma<strong>in</strong> dest<strong>in</strong>ation for foreign <strong>in</strong>vestment <strong>in</strong> new North<br />

<strong>America</strong>n assembly plants <strong>and</strong> an <strong>in</strong>creas<strong>in</strong>gly important dest<strong>in</strong>ation for <strong>the</strong> deployment<br />

of a new network of suppliers <strong>in</strong> <strong>the</strong> bloc (see figure III.5A). In recent years, <strong>and</strong><br />

especially after 2010, a large number of <strong>in</strong>ternational automakers have closed some of<br />

<strong>the</strong>ir domestic production l<strong>in</strong>es <strong>in</strong> order to establish a manufactur<strong>in</strong>g base <strong>in</strong> Mexico.<br />

Companies from <strong>the</strong> United States <strong>in</strong>vested heavily <strong>in</strong> Mexico, <strong>and</strong> while German <strong>and</strong><br />

Japanese companies prioritized <strong>in</strong>vestments <strong>in</strong> <strong>the</strong> United States, <strong>the</strong>y have gradually<br />

been <strong>in</strong>creas<strong>in</strong>g <strong>the</strong>ir presence <strong>in</strong> Mexico (see figures II.5B <strong>and</strong> II.6).