Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2017</strong><br />

Chapter I<br />

51<br />

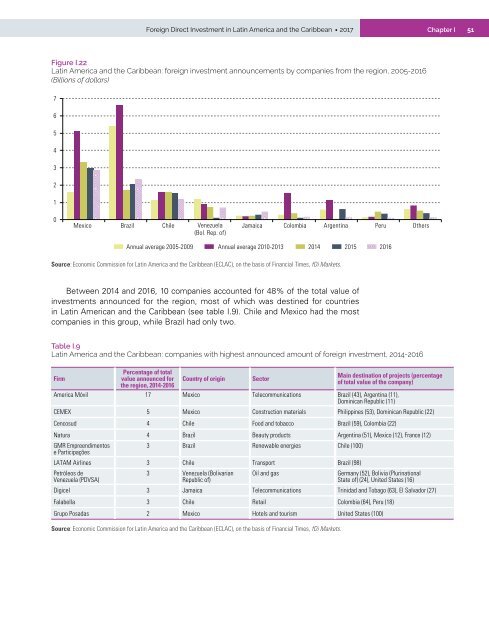

Figure I.22<br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>: foreign <strong>in</strong>vestment announcements by companies from <strong>the</strong> region, 2005-2016<br />

(Billions of dollars)<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Mexico Brazil Chile Venezuela<br />

(Bol. Rep. of)<br />

Jamaica Colombia Argent<strong>in</strong>a Peru O<strong>the</strong>rs<br />

Annual average 2005-2009 Annual average 2010-2013 2014 2015 2016<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of F<strong>in</strong>ancial Times, fDi Markets.<br />

Between 2014 <strong>and</strong> 2016, 10 companies accounted for 48% of <strong>the</strong> total value of<br />

<strong>in</strong>vestments announced for <strong>the</strong> region, most of which was dest<strong>in</strong>ed for countries<br />

<strong>in</strong> Lat<strong>in</strong> <strong>America</strong>n <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (see table I.9). Chile <strong>and</strong> Mexico had <strong>the</strong> most<br />

companies <strong>in</strong> this group, while Brazil had only two.<br />

Table I.9<br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>: companies with highest announced amount of foreign <strong>in</strong>vestment, 2014-2016<br />

Firm<br />

Percentage of total<br />

value announced for<br />

<strong>the</strong> region, 2014-2016<br />

Country of orig<strong>in</strong><br />

Sector<br />

Ma<strong>in</strong> dest<strong>in</strong>ation of projects (percentage<br />

of total value of <strong>the</strong> company)<br />

<strong>America</strong> Móvil 17 Mexico Telecommunications Brazil (43), Argent<strong>in</strong>a (11),<br />

Dom<strong>in</strong>ican Republic (11)<br />

CEMEX 5 Mexico Construction materials Philipp<strong>in</strong>es (53), Dom<strong>in</strong>ican Republic (22)<br />

Cencosud 4 Chile Food <strong>and</strong> tobacco Brazil (59), Colombia (22)<br />

Natura 4 Brazil Beauty products Argent<strong>in</strong>a (51), Mexico (12), France (12)<br />

GMR Empreendimentos<br />

e Participações<br />

3 Brazil Renewable energies Chile (100)<br />

LATAM Airl<strong>in</strong>es 3 Chile Transport Brazil (98)<br />

Petróleos de<br />

Venezuela (PDVSA)<br />

3 Venezuela (Bolivarian<br />

Republic of)<br />

Oil <strong>and</strong> gas<br />

Germany (52), Bolivia (Plur<strong>in</strong>ational<br />

State of) (24), United States (16)<br />

Digicel 3 Jamaica Telecommunications Tr<strong>in</strong>idad <strong>and</strong> Tobago (63), El Salvador (27)<br />

Falabella 3 Chile Retail Colombia (64), Peru (18)<br />

Grupo Posadas 2 Mexico Hotels <strong>and</strong> tourism United States (100)<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of F<strong>in</strong>ancial Times, fDi Markets.