Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2017</strong><br />

Chapter III<br />

175<br />

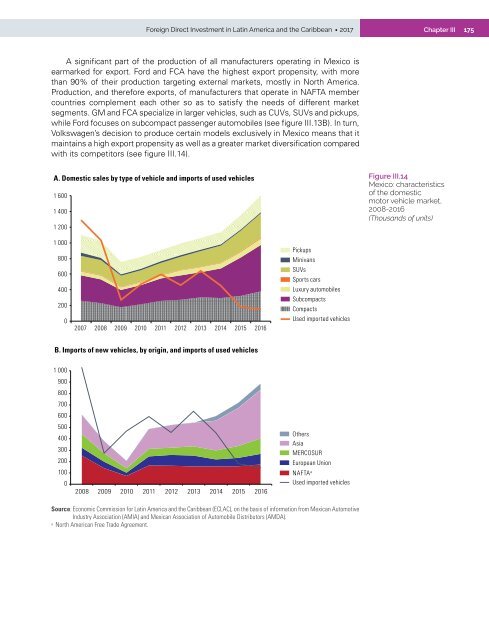

A significant part of <strong>the</strong> production of all manufacturers operat<strong>in</strong>g <strong>in</strong> Mexico is<br />

earmarked for export. Ford <strong>and</strong> FCA have <strong>the</strong> highest export propensity, with more<br />

than 90% of <strong>the</strong>ir production target<strong>in</strong>g external markets, mostly <strong>in</strong> North <strong>America</strong>.<br />

Production, <strong>and</strong> <strong>the</strong>refore exports, of manufacturers that operate <strong>in</strong> NAFTA member<br />

countries complement each o<strong>the</strong>r so as to satisfy <strong>the</strong> needs of different market<br />

segments. GM <strong>and</strong> FCA specialize <strong>in</strong> larger vehicles, such as CUVs, SUVs <strong>and</strong> pickups,<br />

while Ford focuses on subcompact passenger automobiles (see figure III.13B). In turn,<br />

Volkswagen’s decision to produce certa<strong>in</strong> models exclusively <strong>in</strong> Mexico means that it<br />

ma<strong>in</strong>ta<strong>in</strong>s a high export propensity as well as a greater market diversification compared<br />

with its competitors (see figure III.14).<br />

A. Domestic sales by type of vehicle <strong>and</strong> imports of used vehicles<br />

1 600<br />

1 400<br />

1 200<br />

Figure III.14<br />

Mexico: characteristics<br />

of <strong>the</strong> domestic<br />

motor vehicle market,<br />

2008-2016<br />

(Thous<strong>and</strong>s of units)<br />

1 000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016<br />

Pickups<br />

M<strong>in</strong>ivans<br />

SUVs<br />

Sports cars<br />

Luxury automobiles<br />

Subcompacts<br />

Compacts<br />

Used imported vehicles<br />

B. Imports of new vehicles, by orig<strong>in</strong>, <strong>and</strong> imports of used vehicles<br />

1 000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2008 2009 2010 2011 2012 2013 2014 2015 2016<br />

O<strong>the</strong>rs<br />

Asia<br />

MERCOSUR<br />

European Union<br />

NAFTA a<br />

Used imported vehicles<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of <strong>in</strong>formation from Mexican Automotive<br />

Industry Association (AMIA) <strong>and</strong> Mexican Association of Automobile Distributors (AMDA).<br />

a<br />

North <strong>America</strong>n Free Trade Agreement.