Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2017</strong><br />

Executive summary<br />

17<br />

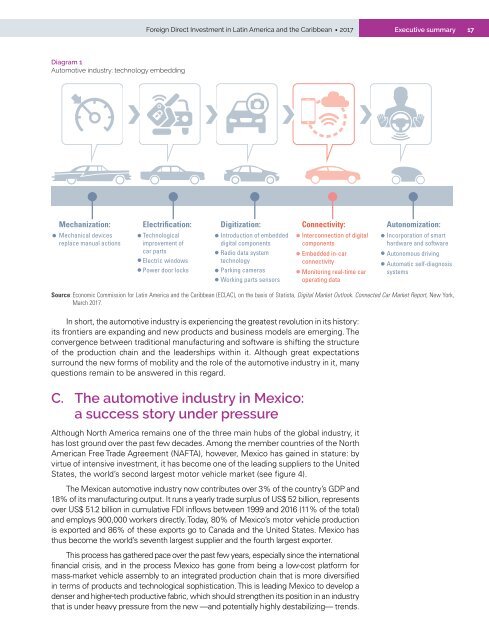

Diagram 1<br />

Automotive <strong>in</strong>dustry: technology embedd<strong>in</strong>g<br />

Mechanization:<br />

Mechanical devices<br />

replace manual actions<br />

Electrification:<br />

Technological<br />

improvement of<br />

car parts<br />

Electric w<strong>in</strong>dows<br />

Power door locks<br />

Digitization:<br />

Introduction of embedded<br />

digital components<br />

Radio data system<br />

technology<br />

Park<strong>in</strong>g cameras<br />

Work<strong>in</strong>g parts sensors<br />

Connectivity:<br />

Interconnection of digital<br />

components<br />

Embedded <strong>in</strong>-car<br />

connectivity<br />

Monitor<strong>in</strong>g real-time car<br />

operat<strong>in</strong>g data<br />

Autonomization:<br />

Incorporation of smart<br />

hardware <strong>and</strong> software<br />

Autonomous driv<strong>in</strong>g<br />

Automatic self-diagnosis<br />

systems<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of Statista, Digital Market Outlook. Connected Car Market Report, New York,<br />

March <strong>2017</strong>.<br />

In short, <strong>the</strong> automotive <strong>in</strong>dustry is experienc<strong>in</strong>g <strong>the</strong> greatest revolution <strong>in</strong> its history:<br />

its frontiers are exp<strong>and</strong><strong>in</strong>g <strong>and</strong> new products <strong>and</strong> bus<strong>in</strong>ess models are emerg<strong>in</strong>g. The<br />

convergence between traditional manufactur<strong>in</strong>g <strong>and</strong> software is shift<strong>in</strong>g <strong>the</strong> structure<br />

of <strong>the</strong> production cha<strong>in</strong> <strong>and</strong> <strong>the</strong> leaderships with<strong>in</strong> it. Although great expectations<br />

surround <strong>the</strong> new forms of mobility <strong>and</strong> <strong>the</strong> role of <strong>the</strong> automotive <strong>in</strong>dustry <strong>in</strong> it, many<br />

questions rema<strong>in</strong> to be answered <strong>in</strong> this regard.<br />

C. The automotive <strong>in</strong>dustry <strong>in</strong> Mexico:<br />

a success story under pressure<br />

Although North <strong>America</strong> rema<strong>in</strong>s one of <strong>the</strong> three ma<strong>in</strong> hubs of <strong>the</strong> global <strong>in</strong>dustry, it<br />

has lost ground over <strong>the</strong> past few decades. Among <strong>the</strong> member countries of <strong>the</strong> North<br />

<strong>America</strong>n Free Trade Agreement (NAFTA), however, Mexico has ga<strong>in</strong>ed <strong>in</strong> stature: by<br />

virtue of <strong>in</strong>tensive <strong>in</strong>vestment, it has become one of <strong>the</strong> lead<strong>in</strong>g suppliers to <strong>the</strong> United<br />

States, <strong>the</strong> world’s second largest motor vehicle market (see figure 4).<br />

The Mexican automotive <strong>in</strong>dustry now contributes over 3% of <strong>the</strong> country’s GDP <strong>and</strong><br />

18% of its manufactur<strong>in</strong>g output. It runs a yearly trade surplus of US$ 52 billion, represents<br />

over US$ 51.2 billion <strong>in</strong> cumulative FDI <strong>in</strong>flows between 1999 <strong>and</strong> 2016 (11% of <strong>the</strong> total)<br />

<strong>and</strong> employs 900,000 workers directly. Today, 80% of Mexico’s motor vehicle production<br />

is exported <strong>and</strong> 86% of <strong>the</strong>se exports go to Canada <strong>and</strong> <strong>the</strong> United States. Mexico has<br />

thus become <strong>the</strong> world’s seventh largest supplier <strong>and</strong> <strong>the</strong> fourth largest exporter.<br />

This process has ga<strong>the</strong>red pace over <strong>the</strong> past few years, especially s<strong>in</strong>ce <strong>the</strong> <strong>in</strong>ternational<br />

f<strong>in</strong>ancial crisis, <strong>and</strong> <strong>in</strong> <strong>the</strong> process Mexico has gone from be<strong>in</strong>g a low-cost platform for<br />

mass-market vehicle assembly to an <strong>in</strong>tegrated production cha<strong>in</strong> that is more diversified<br />

<strong>in</strong> terms of products <strong>and</strong> technological sophistication. This is lead<strong>in</strong>g Mexico to develop a<br />

denser <strong>and</strong> higher-tech productive fabric, which should streng<strong>the</strong>n its position <strong>in</strong> an <strong>in</strong>dustry<br />

that is under heavy pressure from <strong>the</strong> new —<strong>and</strong> potentially highly destabiliz<strong>in</strong>g— trends.