Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

66 Chapter I Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC)<br />

cont<strong>in</strong>ue to <strong>in</strong>vest <strong>in</strong> mobile telephony. <strong>Investment</strong>s <strong>in</strong> telecommunications are expected<br />

to rise <strong>in</strong> <strong>the</strong> next few years, as a result of <strong>the</strong> Red Compartida project, a public-private<br />

partnership that seeks to <strong>in</strong>crease coverage of advanced 4G LTE services <strong>and</strong> is expected<br />

to generate more than US$ 7 billion <strong>in</strong> <strong>in</strong>vestment over <strong>the</strong> next 20 years, which was<br />

put out to tender <strong>in</strong> <strong>2017</strong>.— The w<strong>in</strong>n<strong>in</strong>g bid was made by Altán Redes, a mult<strong>in</strong>ational<br />

consortium whose strategic partner is <strong>the</strong> Spanish Groupo Multitel <strong>and</strong> whose ma<strong>in</strong><br />

<strong>in</strong>vestor is North Haven Infrastructure Partners II, an <strong>in</strong>frastructure fund managed by<br />

Morgan Stanley Infrastructure, <strong>and</strong> which comprises o<strong>the</strong>r <strong>in</strong>ternational <strong>in</strong>vestment<br />

funds <strong>and</strong> Mexican partners. In April <strong>2017</strong>, this consortium completed <strong>the</strong> US$ 2.3 billion<br />

f<strong>in</strong>anc<strong>in</strong>g process: 33% <strong>in</strong> <strong>the</strong> form of capital contributions by <strong>the</strong> partners, 37% <strong>in</strong> <strong>the</strong><br />

form of loans from technology suppliers (Ch<strong>in</strong>a’s Huawei <strong>and</strong> F<strong>in</strong>l<strong>and</strong>’s Nokia) <strong>and</strong> <strong>the</strong><br />

rema<strong>in</strong><strong>in</strong>g 30% will be provided by national development banks (<strong>the</strong> National Bank for<br />

Public Works <strong>and</strong> Services, Nacional F<strong>in</strong>anciera <strong>and</strong> <strong>the</strong> National <strong>Foreign</strong> Trade Bank).<br />

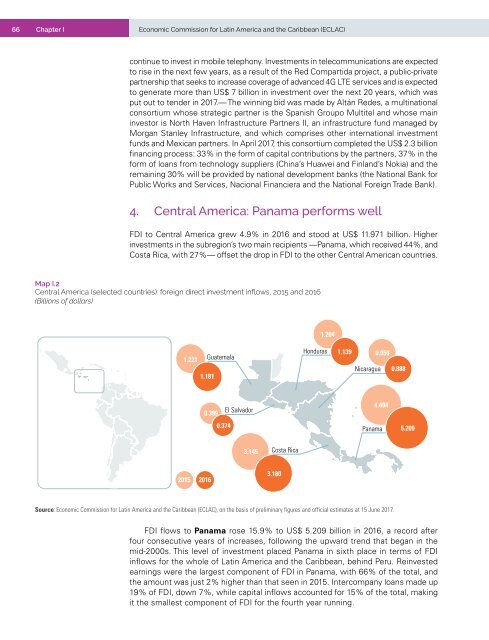

4. Central <strong>America</strong>: Panama performs well<br />

FDI to Central <strong>America</strong> grew 4.9% <strong>in</strong> 2016 <strong>and</strong> stood at US$ 11.971 billion. Higher<br />

<strong>in</strong>vestments <strong>in</strong> <strong>the</strong> subregion’s two ma<strong>in</strong> recipients —Panama, which received 44%, <strong>and</strong><br />

Costa Rica, with 27%— offset <strong>the</strong> drop <strong>in</strong> FDI to <strong>the</strong> o<strong>the</strong>r Central <strong>America</strong>n countries.<br />

Map I.2<br />

Central <strong>America</strong> (selected countries): foreign direct <strong>in</strong>vestment <strong>in</strong>flows, 2015 <strong>and</strong> 2016<br />

(Billions of dollars)<br />

1.204<br />

1.221<br />

Guatemala<br />

1.181<br />

Honduras<br />

1.139 0.950<br />

Nicaragua 0.888<br />

0.399<br />

0.374<br />

El Salvador<br />

4.494<br />

Panama<br />

5.209<br />

3.145<br />

Costa Rica<br />

2015 2016<br />

3.180<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of prelim<strong>in</strong>ary figures <strong>and</strong> official estimates at 15 June <strong>2017</strong>.<br />

FDI flows to Panama rose 15.9% to US$ 5.209 billion <strong>in</strong> 2016, a record after<br />

four consecutive years of <strong>in</strong>creases, follow<strong>in</strong>g <strong>the</strong> upward trend that began <strong>in</strong> <strong>the</strong><br />

mid-2000s. This level of <strong>in</strong>vestment placed Panama <strong>in</strong> sixth place <strong>in</strong> terms of FDI<br />

<strong>in</strong>flows for <strong>the</strong> whole of Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>, beh<strong>in</strong>d Peru. Re<strong>in</strong>vested<br />

earn<strong>in</strong>gs were <strong>the</strong> largest component of FDI <strong>in</strong> Panama, with 66% of <strong>the</strong> total, <strong>and</strong><br />

<strong>the</strong> amount was just 2% higher than that seen <strong>in</strong> 2015. Intercompany loans made up<br />

19% of FDI, down 7%, while capital <strong>in</strong>flows accounted for 15% of <strong>the</strong> total, mak<strong>in</strong>g<br />

it <strong>the</strong> smallest component of FDI for <strong>the</strong> fourth year runn<strong>in</strong>g.