Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2017</strong><br />

Chapter III<br />

179<br />

More than 90% of <strong>the</strong> world’s top 100 autoparts suppliers have operations <strong>in</strong> Mexico<br />

(Sedgwick, 2016). The 10% that is absent corresponds to Ch<strong>in</strong>ese companies currently<br />

undergo<strong>in</strong>g <strong>in</strong>tense restructur<strong>in</strong>g <strong>and</strong> consolidation processes. In total, <strong>the</strong>re are some<br />

1,400 autoparts suppliers operat<strong>in</strong>g at present <strong>in</strong> Mexico, 65% of which are foreign firms<br />

(ITA, 2016), with <strong>the</strong> majority be<strong>in</strong>g from <strong>the</strong> United States (29%), Japan (27%) <strong>and</strong> Germany<br />

(18%) (INA, 2015). Of <strong>the</strong>se, 600 are first-tier companies, mean<strong>in</strong>g <strong>the</strong>y have <strong>the</strong> capacity<br />

to fully satisfy <strong>the</strong> needs of manufacturers operat<strong>in</strong>g <strong>in</strong> Mexico. However, <strong>the</strong>re are only<br />

400 second-tier suppliers, <strong>and</strong> ano<strong>the</strong>r 400 <strong>in</strong> <strong>the</strong> third tier, which <strong>in</strong> aggregate falls short of<br />

<strong>the</strong> volume needed to satisfy <strong>the</strong> <strong>in</strong>dustry’s present <strong>and</strong> future dem<strong>and</strong> (Modern Mach<strong>in</strong>e<br />

Shop, <strong>2017</strong>). With a few exceptions, most domestic autoparts suppliers have been unable<br />

to adapt to a more competitive environment, although it seems that <strong>the</strong> <strong>in</strong>dustry on <strong>the</strong><br />

whole is beg<strong>in</strong>n<strong>in</strong>g to <strong>in</strong>crease its capacity (CEIGB, <strong>2017</strong>). Despite manufactur<strong>in</strong>g autoparts<br />

worth over US$ 88 billion —with exports valued at close to US$ 26.3 billion— Mexico<br />

still has to import second- <strong>and</strong> third-tier <strong>in</strong>puts valued at US$ 23 billion, such as electrical<br />

components, harness parts, fabrics, lea<strong>the</strong>r <strong>and</strong> v<strong>in</strong>yl for seat upholster<strong>in</strong>g, seat-belt<br />

components, airbags <strong>and</strong> tyres.<br />

Although production costs have been <strong>the</strong> ma<strong>in</strong> driver of <strong>the</strong> Mexican motor vehicle<br />

<strong>in</strong>dustry’s expansion, <strong>the</strong>re are o<strong>the</strong>r relevant competiveness factors beh<strong>in</strong>d its growth<br />

<strong>and</strong> future susta<strong>in</strong>ability: (i) higher levels of local value added ow<strong>in</strong>g to technical progress<br />

<strong>and</strong> <strong>the</strong> streng<strong>the</strong>n<strong>in</strong>g of <strong>the</strong> production cha<strong>in</strong>, thanks to a greater number of eng<strong>in</strong>eers<br />

<strong>and</strong> <strong>the</strong> <strong>in</strong>creased use of qualified labour, (ii) greater flexibility to respond to dem<strong>and</strong>, <strong>and</strong><br />

(iii) <strong>in</strong>clusion of substantial <strong>in</strong>novations, especially <strong>in</strong> <strong>the</strong> production of new models.<br />

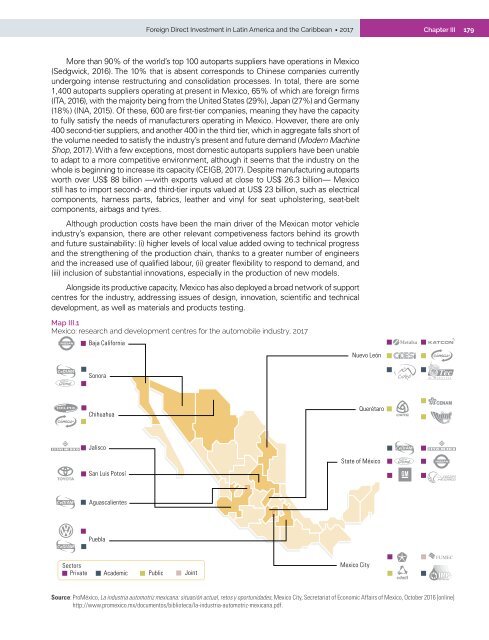

Alongside its productive capacity, Mexico has also deployed a broad network of support<br />

centres for <strong>the</strong> <strong>in</strong>dustry, address<strong>in</strong>g issues of design, <strong>in</strong>novation, scientific <strong>and</strong> technical<br />

development, as well as materials <strong>and</strong> products test<strong>in</strong>g.<br />

Map III.1<br />

Mexico: research <strong>and</strong> development centres for <strong>the</strong> automobile <strong>in</strong>dustry, <strong>2017</strong><br />

Baja California<br />

Nuevo León<br />

Sonora<br />

Chihuahua<br />

Querétaro<br />

Jalisco<br />

State of México<br />

San Luis Potosí<br />

Aguascalientes<br />

Puebla<br />

Sectors<br />

Private Academic Public Jo<strong>in</strong>t<br />

Mexico City<br />

Source: ProMéxico, La <strong>in</strong>dustria automotriz mexicana: situación actual, retos y oportunidades, Mexico City, Secretariat of Economic Affairs of Mexico, October 2016 [onl<strong>in</strong>e]<br />

http://www.promexico.mx/documentos/biblioteca/la-<strong>in</strong>dustria-automotriz-mexicana.pdf.