CEPAL Review no. 124

April 2018

April 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CEPAL</strong> <strong>Review</strong> N° <strong>124</strong> • April 2018 197<br />

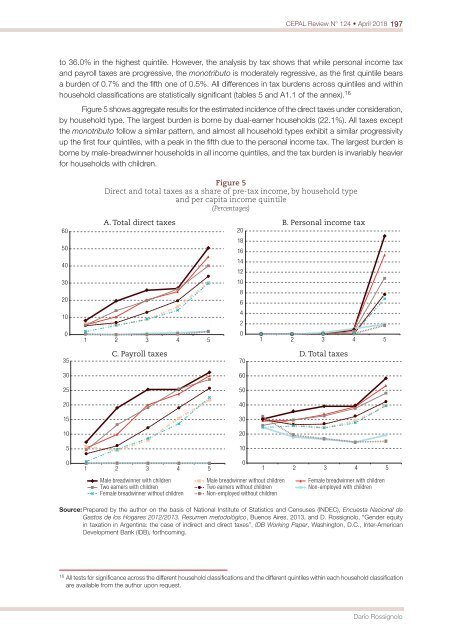

to 36.0% in the highest quintile. However, the analysis by tax shows that while personal income tax<br />

and payroll taxes are progressive, the mo<strong>no</strong>tributo is moderately regressive, as the first quintile bears<br />

a burden of 0.7% and the fifth one of 0.5%. All differences in tax burdens across quintiles and within<br />

household classifications are statistically significant (tables 5 and A1.1 of the annex). 16<br />

Figure 5 shows aggregate results for the estimated incidence of the direct taxes under consideration,<br />

by household type. The largest burden is borne by dual-earner households (22.1%). All taxes except<br />

the mo<strong>no</strong>tributo follow a similar pattern, and almost all household types exhibit a similar progressivity<br />

up the first four quintiles, with a peak in the fifth due to the personal income tax. The largest burden is<br />

borne by male-breadwinner households in all income quintiles, and the tax burden is invariably heavier<br />

for households with children.<br />

Figure 5<br />

Direct and total taxes as a share of pre-tax income, by household type<br />

and per capita income quintile<br />

(Percentages)<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

A. Total direct taxes B. Personal income tax<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1 2 3 4 5<br />

1 2 3 4 5<br />

C. Payroll taxes D. Total taxes<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

1 2 3 4 5<br />

0<br />

1 2 3 4 5<br />

Male breadwinner with children Male breadwinner without children Female breadwinner with children<br />

Two earners with children Two earners without children Non-employed with children<br />

Female breadwinner without children Non-employed without children<br />

Source: Prepared by the author on the basis of National Institute of Statistics and Censuses (INDEC), Encuesta Nacional de<br />

Gastos de los Hogares 2012/2013. Resumen metodológico, Bue<strong>no</strong>s Aires, 2013, and D. Rossig<strong>no</strong>lo, “Gender equity<br />

in taxation in Argentina: the case of indirect and direct taxes”, IDB Working Paper, Washington, D.C., Inter-American<br />

Development Bank (IDB), forthcoming.<br />

16<br />

All tests for significance across the different household classifications and the different quintiles within each household classification<br />

are available from the author upon request.<br />

Darío Rossig<strong>no</strong>lo