Download - African Bank

Download - African Bank

Download - African Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

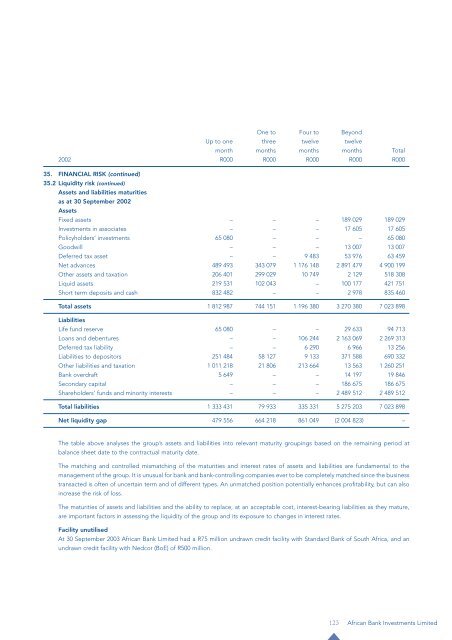

One to Four to Beyond<br />

Up to one three twelve twelve<br />

month months months months Total<br />

2002 R000 R000 R000 R000 R000<br />

35. FINANCIAL RISK (continued)<br />

35.2 Liquidity risk (continued)<br />

Assets and liabilities maturities<br />

as at 30 September 2002<br />

Assets<br />

Fixed assets – – – 189 029 189 029<br />

Investments in associates – – – 17 605 17 605<br />

Policyholders’ investments 65 080 – – – 65 080<br />

Goodwill – – – 13 007 13 007<br />

Deferred tax asset – – 9 483 53 976 63 459<br />

Net advances 489 493 343 079 1 176 148 2 891 479 4 900 199<br />

Other assets and taxation 206 401 299 029 10 749 2 129 518 308<br />

Liquid assets 219 531 102 043 – 100 177 421 751<br />

Short term deposits and cash 832 482 – – 2 978 835 460<br />

Total assets 1 812 987 744 151 1 196 380 3 270 380 7 023 898<br />

Liabilities<br />

Life fund reserve 65 080 – – 29 633 94 713<br />

Loans and debentures – – 106 244 2 163 069 2 269 313<br />

Deferred tax liability – – 6 290 6 966 13 256<br />

Liabilities to depositors 251 484 58 127 9 133 371 588 690 332<br />

Other liabilities and taxation 1 011 218 21 806 213 664 13 563 1 260 251<br />

<strong>Bank</strong> overdraft 5 649 – – 14 197 19 846<br />

Secondary capital – – – 186 675 186 675<br />

Shareholders’ funds and minority interests – – – 2 489 512 2 489 512<br />

Total liabilities 1 333 431 79 933 335 331 5 275 203 7 023 898<br />

Net liquidity gap 479 556 664 218 861 049 (2 004 823) –<br />

The table above analyses the group’s assets and liabilities into relevant maturity groupings based on the remaining period at<br />

balance sheet date to the contractual maturity date.<br />

The matching and controlled mismatching of the maturities and interest rates of assets and liabilities are fundamental to the<br />

management of the group. It is unusual for bank and bank-controlling companies ever to be completely matched since the business<br />

transacted is often of uncertain term and of different types. An unmatched position potentially enhances profitability, but can also<br />

increase the risk of loss.<br />

The maturities of assets and liabilities and the ability to replace, at an acceptable cost, interest-bearing liabilities as they mature,<br />

are important factors in assessing the liquidity of the group and its exposure to changes in interest rates.<br />

Facility unutilised<br />

At 30 September 2003 <strong>African</strong> <strong>Bank</strong> Limited had a R75 million undrawn credit facility with Standard <strong>Bank</strong> of South Africa, and an<br />

undrawn credit facility with Nedcor (BoE) of R500 million.<br />

123<br />

<strong>African</strong> <strong>Bank</strong> Investments Limited