Download - African Bank

Download - African Bank

Download - African Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management discussion continued<br />

Provisions<br />

Provision coverage of NPLs decreased<br />

from 79,5% to 74,7%, mainly as a result<br />

of heavy bad debt write-offs against the<br />

portion of the non-performing book that<br />

is 100% provided for and improved cash<br />

collections during the year. The<br />

provisions have been calculated in<br />

accordance with AC133 and accordingly<br />

the general provision previously held has<br />

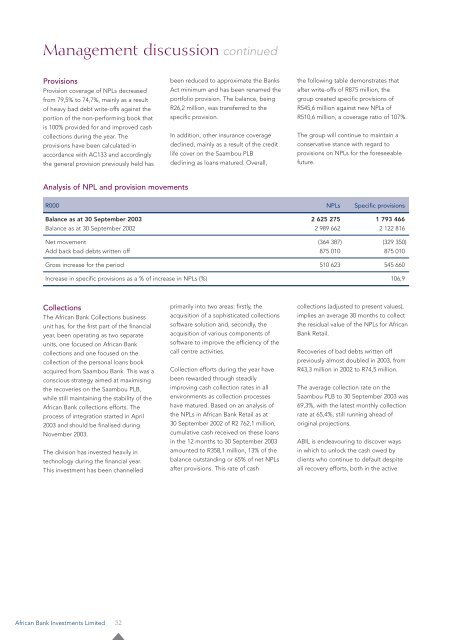

Analysis of NPL and provision movements<br />

R000 NPLs Specific provisions<br />

Balance as at 30 September 2003 2 625 275 1 793 466<br />

Balance as at 30 September 2002 2 989 662 2 122 816<br />

Net movement (364 387) (329 350)<br />

Add back bad debts written off 875 010 875 010<br />

Gross increase for the period 510 623 545 660<br />

Increase in specific provisions as a % of increase in NPLs (%) 106,9<br />

Collections<br />

The <strong>African</strong> <strong>Bank</strong> Collections business<br />

unit has, for the first part of the financial<br />

year, been operating as two separate<br />

units, one focused on <strong>African</strong> <strong>Bank</strong><br />

collections and one focused on the<br />

collection of the personal loans book<br />

acquired from Saambou <strong>Bank</strong>. This was a<br />

conscious strategy aimed at maximising<br />

the recoveries on the Saambou PLB,<br />

while still maintaining the stability of the<br />

<strong>African</strong> <strong>Bank</strong> collections efforts. The<br />

process of integration started in April<br />

2003 and should be finalised during<br />

November 2003.<br />

The division has invested heavily in<br />

technology during the financial year.<br />

This investment has been channelled<br />

<strong>African</strong> <strong>Bank</strong> Investments Limited 32<br />

been reduced to approximate the <strong>Bank</strong>s<br />

Act minimum and has been renamed the<br />

portfolio provision. The balance, being<br />

R26,2 million, was transferred to the<br />

specific provision.<br />

In addition, other insurance coverage<br />

declined, mainly as a result of the credit<br />

life cover on the Saambou PLB<br />

declining as loans matured. Overall,<br />

primarily into two areas: firstly, the<br />

acquisition of a sophisticated collections<br />

software solution and, secondly, the<br />

acquisition of various components of<br />

software to improve the efficiency of the<br />

call centre activities.<br />

Collection efforts during the year have<br />

been rewarded through steadily<br />

improving cash collection rates in all<br />

environments as collection processes<br />

have matured. Based on an analysis of<br />

the NPLs in <strong>African</strong> <strong>Bank</strong> Retail as at<br />

30 September 2002 of R2 762,1 million,<br />

cumulative cash received on these loans<br />

in the 12 months to 30 September 2003<br />

amounted to R358,1 million, 13% of the<br />

balance outstanding or 65% of net NPLs<br />

after provisions. This rate of cash<br />

the following table demonstrates that<br />

after write-offs of R875 million, the<br />

group created specific provisions of<br />

R545,6 million against new NPLs of<br />

R510,6 million, a coverage ratio of 107%.<br />

The group will continue to maintain a<br />

conservative stance with regard to<br />

provisions on NPLs for the foreseeable<br />

future.<br />

collections (adjusted to present values),<br />

implies an average 30 months to collect<br />

the residual value of the NPLs for <strong>African</strong><br />

<strong>Bank</strong> Retail.<br />

Recoveries of bad debts written off<br />

previously almost doubled in 2003, from<br />

R43,3 million in 2002 to R74,5 million.<br />

The average collection rate on the<br />

Saambou PLB to 30 September 2003 was<br />

69,3%, with the latest monthly collection<br />

rate at 65,4%, still running ahead of<br />

original projections.<br />

ABIL is endeavouring to discover ways<br />

in which to unlock the cash owed by<br />

clients who continue to default despite<br />

all recovery efforts, both in the active