Download - African Bank

Download - African Bank

Download - African Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Letter to stakeholders continued<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

transactions is finding a<br />

sustainable funding solution.<br />

ABIL is evaluating several<br />

alternatives and anticipates<br />

some progress within the next<br />

reporting period. Currently<br />

about 26 000 of the more than<br />

32 000 registered shareholders<br />

of ABIL are PDIs. These<br />

shareholders hold in aggregate<br />

some 500 000 shares, which<br />

constitutes only 0,1% of the<br />

total number of shares in issue.<br />

The aim would be to increase<br />

the effective holding in the<br />

company. ABIL does not expect<br />

to issue any new shares in order<br />

to further its BEE objectives.<br />

– Indirect shareholding<br />

In January 2003, The<br />

BusinessMap Foundation<br />

undertook an independent<br />

study to estimate black<br />

ownership of the South <strong>African</strong><br />

banking industry. This study<br />

estimated that black beneficial<br />

ownership based on market<br />

capitalisation ranged from<br />

14% to 17%. Using this as<br />

a proxy on ABIL’s 73% local<br />

shareholding yields an<br />

indirect BEE shareholding<br />

range of 10% to 12%.<br />

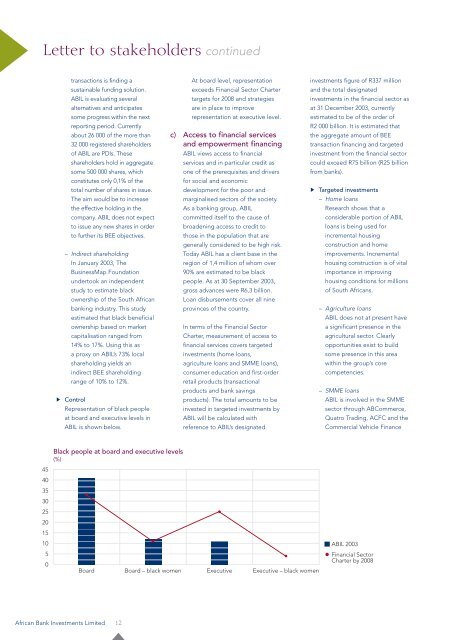

Control<br />

Representation of black people<br />

at board and executive levels in<br />

ABIL is shown below.<br />

Black people at board and executive levels<br />

(%)<br />

Board<br />

<strong>African</strong> <strong>Bank</strong> Investments Limited 12<br />

At board level, representation<br />

exceeds Financial Sector Charter<br />

targets for 2008 and strategies<br />

are in place to improve<br />

representation at executive level.<br />

c) Access to financial services<br />

and empowerment financing<br />

ABIL views access to financial<br />

services and in particular credit as<br />

one of the prerequisites and drivers<br />

for social and economic<br />

development for the poor and<br />

marginalised sectors of the society.<br />

As a banking group, ABIL<br />

committed itself to the cause of<br />

broadening access to credit to<br />

those in the population that are<br />

generally considered to be high risk.<br />

Today ABIL has a client base in the<br />

region of 1,4 million of whom over<br />

90% are estimated to be black<br />

people. As at 30 September 2003,<br />

gross advances were R6,3 billion.<br />

Loan disbursements cover all nine<br />

provinces of the country.<br />

In terms of the Financial Sector<br />

Charter, measurement of access to<br />

financial services covers targeted<br />

investments (home loans,<br />

agriculture loans and SMME loans),<br />

consumer education and first-order<br />

retail products (transactional<br />

products and bank savings<br />

products). The total amounts to be<br />

invested in targeted investments by<br />

ABIL will be calculated with<br />

reference to ABIL’s designated<br />

Board – black women Executive Executive – black women<br />

investments figure of R337 million<br />

and the total designated<br />

investments in the financial sector as<br />

at 31 December 2003, currently<br />

estimated to be of the order of<br />

R2 000 billion. It is estimated that<br />

the aggregate amount of BEE<br />

transaction financing and targeted<br />

investment from the financial sector<br />

could exceed R75 billion (R25 billion<br />

from banks).<br />

Targeted investments<br />

– Home loans<br />

Research shows that a<br />

considerable portion of ABIL<br />

loans is being used for<br />

incremental housing<br />

construction and home<br />

improvements. Incremental<br />

housing construction is of vital<br />

importance in improving<br />

housing conditions for millions<br />

of South <strong>African</strong>s.<br />

– Agriculture loans<br />

ABIL does not at present have<br />

a significant presence in the<br />

agricultural sector. Clearly<br />

opportunities exist to build<br />

some presence in this area<br />

within the group’s core<br />

competencies.<br />

– SMME loans<br />

ABIL is involved in the SMME<br />

sector through ABCommerce,<br />

Quatro Trading, ACFC and the<br />

Commercial Vehicle Finance<br />

ABIL 2003<br />

Financial Sector<br />

Charter by 2008