Download - African Bank

Download - African Bank

Download - African Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management discussion continued<br />

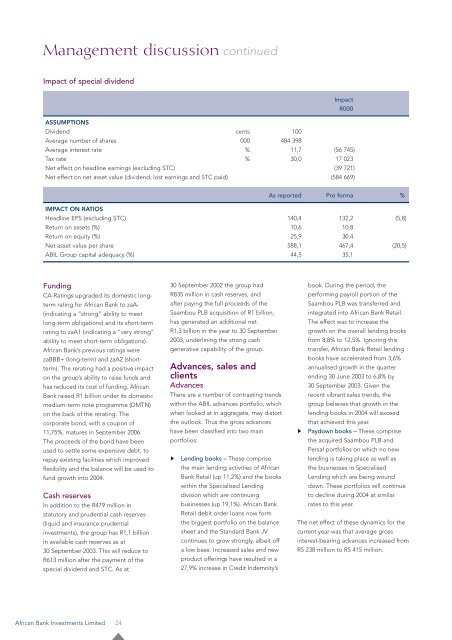

Impact of special dividend<br />

Funding<br />

CA-Ratings upgraded its domestic longterm<br />

rating for <strong>African</strong> <strong>Bank</strong> to zaA-<br />

(indicating a “strong” ability to meet<br />

long-term obligations) and its short-term<br />

rating to zaA1 (indicating a “very strong”<br />

ability to meet short-term obligations).<br />

<strong>African</strong> <strong>Bank</strong>’s previous ratings were<br />

zaBBB+ (long-term) and zaA2 (shortterm).<br />

The rerating had a positive impact<br />

on the group’s ability to raise funds and<br />

has reduced its cost of funding. <strong>African</strong><br />

<strong>Bank</strong> raised R1 billion under its domestic<br />

medium-term note programme (DMTN)<br />

on the back of the rerating. The<br />

corporate bond, with a coupon of<br />

11,75%, matures in September 2006.<br />

The proceeds of the bond have been<br />

used to settle some expensive debt, to<br />

repay existing facilities which improved<br />

flexibility and the balance will be used to<br />

fund growth into 2004.<br />

Cash reserves<br />

In addition to the R479 million in<br />

statutory and prudential cash reserves<br />

(liquid and insurance prudential<br />

investments), the group has R1,1 billion<br />

in available cash reserves as at<br />

30 September 2003. This will reduce to<br />

R613 million after the payment of the<br />

special dividend and STC. As at<br />

<strong>African</strong> <strong>Bank</strong> Investments Limited 24<br />

30 September 2002 the group had<br />

R835 million in cash reserves, and<br />

after paying the full proceeds of the<br />

Saambou PLB acquisition of R1 billion,<br />

has generated an additional net<br />

R1,3 billion in the year to 30 September<br />

2003, underlining the strong cash<br />

generative capability of the group.<br />

Advances, sales and<br />

clients<br />

Advances<br />

There are a number of contrasting trends<br />

within the ABIL advances portfolio, which<br />

when looked at in aggregate, may distort<br />

the outlook. Thus the gross advances<br />

have been classified into two main<br />

portfolios:<br />

Lending books – These comprise<br />

the main lending activities of <strong>African</strong><br />

<strong>Bank</strong> Retail (up 11,2%) and the books<br />

within the Specialised Lending<br />

division which are continuing<br />

businesses (up 19,1%). <strong>African</strong> <strong>Bank</strong><br />

Retail debit order loans now form<br />

the biggest portfolio on the balance<br />

sheet and the Standard <strong>Bank</strong> JV<br />

continues to grow strongly, albeit off<br />

a low base. Increased sales and new<br />

product offerings have resulted in a<br />

27,9% increase in Credit Indemnity’s<br />

Impact<br />

ASSUMPTIONS<br />

Dividend cents 100<br />

Average number of shares 000 484 398<br />

Average interest rate % 11,7 (56 745)<br />

Tax rate % 30,0 17 023<br />

Net effect on headline earnings (excluding STC) (39 721)<br />

Net effect on net asset value (dividend, lost earnings and STC paid) (584 669)<br />

R000<br />

As reported Pro forma %<br />

IMPACT ON RATIOS<br />

Headline EPS (excluding STC) 140,4 132,2 (5,8)<br />

Return on assets (%) 10,6 10,8<br />

Return on equity (%) 25,9 30,4<br />

Net asset value per share 588,1 467,4 (20,5)<br />

ABIL Group capital adequacy (%) 44,5 35,1<br />

book. During the period, the<br />

performing payroll portion of the<br />

Saambou PLB was transferred and<br />

integrated into <strong>African</strong> <strong>Bank</strong> Retail.<br />

The effect was to increase the<br />

growth on the overall lending books<br />

from 8,8% to 12,5%. Ignoring this<br />

transfer, <strong>African</strong> <strong>Bank</strong> Retail lending<br />

books have accelerated from 3,6%<br />

annualised growth in the quarter<br />

ending 30 June 2003 to 6,8% by<br />

30 September 2003. Given the<br />

recent vibrant sales trends, the<br />

group believes that growth in the<br />

lending books in 2004 will exceed<br />

that achieved this year.<br />

Paydown books – These comprise<br />

the acquired Saambou PLB and<br />

Persal portfolios on which no new<br />

lending is taking place as well as<br />

the businesses in Specialised<br />

Lending which are being wound<br />

down. These portfolios will continue<br />

to decline during 2004 at similar<br />

rates to this year.<br />

The net effect of these dynamics for the<br />

current year was that average gross<br />

interest-bearing advances increased from<br />

R5 238 million to R5 415 million.