Download - African Bank

Download - African Bank

Download - African Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management discussion continued<br />

Capital, cash flow<br />

and funding<br />

Capital management<br />

Effective capital management is a key<br />

determinant in the sustainability of any<br />

bank. The strength of this process was<br />

most evident when in 2002 ABIL<br />

withstood the liquidity and confidence<br />

crisis that swept the banking sector, and<br />

emerged stronger and well positioned to<br />

participate in the consolidation process<br />

that followed.<br />

Capital adequacy<br />

ABIL has stated in the past that the build<br />

up of capital over the last two years was<br />

excessive, and that given the necessary<br />

steps of a credit rating upgrade and a<br />

new benchmark debt issue, it would set<br />

about addressing the surplus capital.<br />

In arriving at an optimal level of capital<br />

to be maintained, ABIL has developed<br />

the following methodology which is<br />

applied to its different asset classes as<br />

set out below:<br />

Non-performing loans – these are<br />

assets that are considered impaired<br />

and for accounting purposes are<br />

<strong>African</strong> <strong>Bank</strong> Investments Limited 22<br />

Capital optimisation requires the careful<br />

balancing of two key factors, namely<br />

capital adequacy and return on equity.<br />

Capital adequacy<br />

While the <strong>Bank</strong>s Act sets a minimum<br />

level of capital of 10% to risk weighted<br />

assets, ABIL operates in an environment<br />

in which it believes higher levels should<br />

be maintained. Capital is required to<br />

ensure that there is a sufficient risk<br />

cushion to protect the balance sheet<br />

provided for in terms of AC133. The<br />

group however considers it prudent<br />

to maintain capital equal to 100% of<br />

the residual NPLs that are not<br />

covered by the total provisions held.<br />

Performing loans – these assets,<br />

while fully performing, contain<br />

inherent risk of default within them<br />

and the group believes that it<br />

should maintain capital equal to<br />

three times the average annual<br />

credit losses expected on these<br />

loans. The expected losses are a<br />

function of the credit vintage charts<br />

and the net collections recoveries.<br />

Current expected credit losses for<br />

from shocks as well as to provide a<br />

sufficient level of credit enhancement for<br />

the raising of debt at competitive rates.<br />

The capital adequacy for ABIL as at<br />

30 September 2003 was 44,5%<br />

(2002: 38,1%).<br />

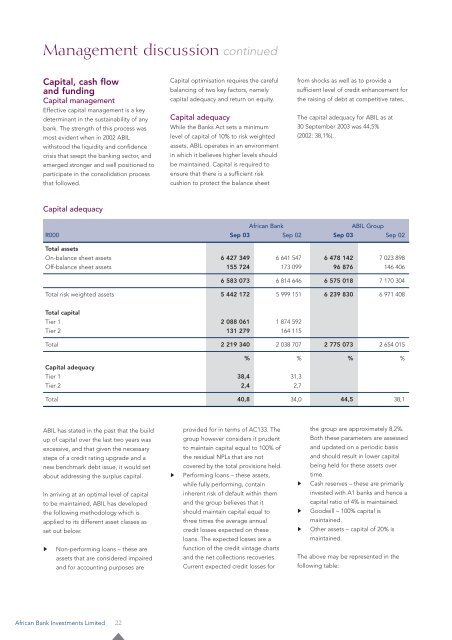

<strong>African</strong> <strong>Bank</strong> ABIL Group<br />

R000 Sep 03 Sep 02 Sep 03 Sep 02<br />

Total assets<br />

On-balance sheet assets 6 427 349 6 641 547 6 478 142 7 023 898<br />

Off-balance sheet assets 155 724 173 099 96 876 146 406<br />

6 583 073 6 814 646 6 575 018 7 170 304<br />

Total risk weighted assets 5 442 172 5 999 151 6 239 830 6 971 408<br />

Total capital<br />

Tier 1 2 088 061 1 874 592<br />

Tier 2 131 279 164 115<br />

Total 2 219 340 2 038 707 2 775 073 2 654 015<br />

% % % %<br />

Capital adequacy<br />

Tier 1 38,4 31,3<br />

Tier 2 2,4 2,7<br />

Total 40,8 34,0 44,5 38,1<br />

the group are approximately 8,2%.<br />

Both these parameters are assessed<br />

and updated on a periodic basis<br />

and should result in lower capital<br />

being held for these assets over<br />

time.<br />

Cash reserves – these are primarily<br />

invested with A1 banks and hence a<br />

capital ratio of 4% is maintained.<br />

Goodwill – 100% capital is<br />

maintained.<br />

Other assets – capital of 20% is<br />

maintained.<br />

The above may be represented in the<br />

following table: