FRANCE The

FRANCE The

FRANCE The

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Trends<br />

result of not being liable to pay contributions, farmers receive<br />

welfare pensions from OGA, the agricultural community fund. <strong>The</strong><br />

minimum pension administered by OGA in 2002 amounted to<br />

53.201 drs (€156) or just 41% of the minimum pension issued by<br />

IKA (the urban fund). Although OGA’s pensions have been<br />

improving markedly since 1993, they are still at levels grossly<br />

inadequate for sustaining a decent living standard. Thus it would<br />

appear that the increased participation rate of older people in rural<br />

areas recorded earlier on, is attributed to the lack of attractive<br />

retirement and income options, and is thus involuntary.<br />

Third, partly because of demographic ageing, there is clearly a<br />

financial sustainability problem. Public pensions expenditure is<br />

projected to rise steeply, from 12.4% of GDP in 2000, to 17.3% in<br />

2030 and from there on to 22.6% in 2050, the largest projected<br />

increase among EU Member States. Addressing this financial<br />

challenge will require a huge effort and, inter alia, a broad social<br />

consensus among the dominant socio-political actors.<br />

General retirement limits are set at 65 for men and 60 for women and,<br />

for those who began working after 1993, at 65 for both men and<br />

women. According to the Greek Report on Pension Strategy (2002),<br />

however, “the complexity of the legislative framework makes these<br />

general limits as something of purely theoretical significance”. It is<br />

thought that the structure of benefits is such that usually individuals<br />

decide to retire officially as early as possible and then continue to<br />

work unofficially (while drawing a pension) 9 . This observation<br />

receives some support from the examination of the age distribution<br />

of retired persons in 1998. According to information drawn from the<br />

LFS, a respectable part of males (252,225 persons, or 26.1% of the<br />

total) were already in retirement prior to reaching the general<br />

retirement age (65). <strong>The</strong> corresponding estimate for women was<br />

smaller (79,893 persons, 11.5% of the total) yet significant. In<br />

general, the effective (rather than the statutory) retirement age<br />

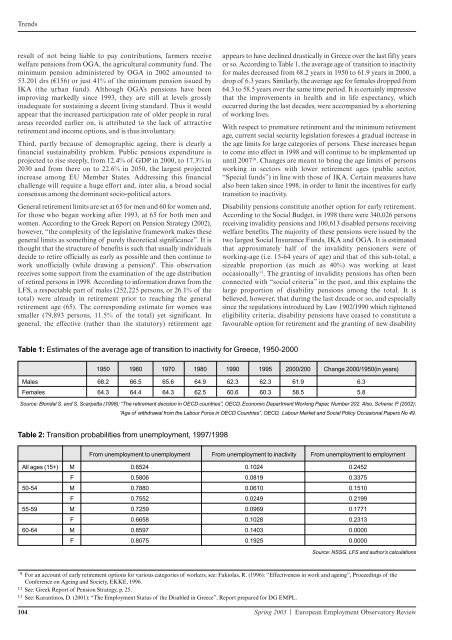

Table 1: Estimates of the average age of transition to inactivity for Greece, 1950-2000<br />

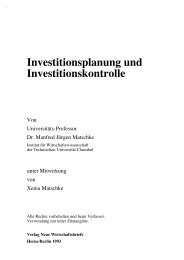

Table 2: Transition probabilities from unemployment, 1997/1998<br />

appears to have declined drastically in Greece over the last fifty years<br />

or so. According to Table 1, the average age of transition to inactivity<br />

for males decreased from 68.2 years in 1950 to 61.9 years in 2000, a<br />

drop of 6.3 years. Similarly, the average age for females dropped from<br />

64.3 to 58.5 years over the same time period. It is certainly impressive<br />

that the improvements in health and in life expectancy, which<br />

occurred during the last decades, were accompanied by a shortening<br />

of working lives.<br />

With respect to premature retirement and the minimum retirement<br />

age, current social security legislation foresees a gradual increase in<br />

the age limits for large categories of persons. <strong>The</strong>se increases began<br />

to come into effect in 1998 and will continue to be implemented up<br />

until 200710 . Changes are meant to bring the age limits of persons<br />

working in sectors with lower retirement ages (public sector,<br />

“Special funds”) in line with those of IKA. Certain measures have<br />

also been taken since 1998, in order to limit the incentives for early<br />

transition to inactivity.<br />

Disability pensions constitute another option for early retirement.<br />

According to the Social Budget, in 1998 there were 340,026 persons<br />

receiving invalidity pensions and 100,613 disabled persons receiving<br />

welfare benefits. <strong>The</strong> majority of these pensions were issued by the<br />

two largest Social Insurance Funds, IKA and OGA. It is estimated<br />

that approximately half of the invalidity pensioners were of<br />

working-age (i.e. 15-64 years of age) and that of this sub-total, a<br />

sizeable proportion (as much as 40%) was working at least<br />

occasionally11 . <strong>The</strong> granting of invalidity pensions has often been<br />

connected with “social criteria” in the past, and this explains the<br />

large proportion of disability pensions among the total. It is<br />

believed, however, that during the last decade or so, and especially<br />

since the regulations introduced by Law 1902/1990 which tightened<br />

eligibility criteria, disability pensions have ceased to constitute a<br />

favourable option for retirement and the granting of new disability<br />

1950 1960 1970 1980 1990 1995 2000/200 Change 2000/1950(in years)<br />

Males 68.2 66.5 65.6 64.9 62.3 62.3 61.9 6.3<br />

Females 64.3 64.4 64.3 62.5 60.6 60.3 58.5 5.8<br />

Source: Blondal S. and S. Scarpetta (1998): “<strong>The</strong> retirement decision in OECD countries”, OECD, Economic Department Working Paper, Number 202. Also, Scherer, P. (2002):<br />

“Age of withdrawal from the Labour Force in OECD Countries”, OECD, Labour Market and Social Policy Occasional Papers No 49.<br />

From unemployment to unemployment From unemployment to inactivity From unemployment to employment<br />

All ages (15+) M 0.6524 0.1024 0.2452<br />

F 0.5806 0.0819 0.3375<br />

50-54 M 0.7880 0.0610 0.1510<br />

F 0.7552 0.0249 0.2199<br />

55-59 M 0.7259 0.0969 0.1771<br />

F 0.6658 0.1028 0.2313<br />

60-64 M 0.8597 0.1403 0.0000<br />

F 0.8075 0.1925 0.0000<br />

Source: NSSG, LFS and author’s calculations<br />

9 For an account of early retirement options for various categories of workers, see: Fakiolas, R. (1996): “Effectiveness in work and ageing”, Proceedings of the<br />

Conference on Ageing and Society, EKKE, 1996.<br />

11 See: Greek Report of Pension Strategy, p. 25.<br />

11 See: Karantinos, D. (2001): “<strong>The</strong> Employment Status of the Disabled in Greece”, Report prepared for DG EMPL.<br />

104 Spring 2003 | European Employment Observatory Review