FRANCE The

FRANCE The

FRANCE The

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Trends<br />

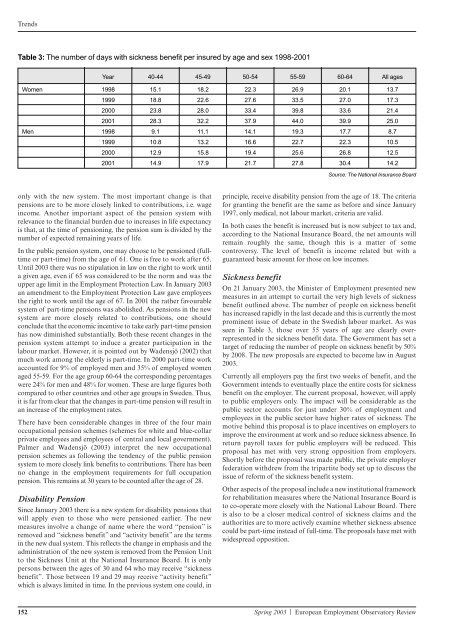

Table 3: <strong>The</strong> number of days with sickness benefit per insured by age and sex 1998-2001<br />

Year 40-44 45-49 50-54 55-59 60-64 All ages<br />

Women 1998 15.1 18.2 22.3 26.9 20.1 13.7<br />

1999 18.8 22.6 27.6 33.5 27.0 17.3<br />

2000 23.8 28.0 33.4 39.8 33.6 21.4<br />

2001 28.3 32.2 37.9 44.0 39.9 25.0<br />

Men 1998 9.1 11.1 14.1 19.3 17.7 8.7<br />

1999 10.8 13.2 16.6 22.7 22.3 10.5<br />

2000 12.9 15.8 19.4 25.6 26.8 12.5<br />

2001 14.9 17.9 21.7 27.8 30.4 14.2<br />

only with the new system. <strong>The</strong> most important change is that<br />

pensions are to be more closely linked to contributions, i.e. wage<br />

income. Another important aspect of the pension system with<br />

relevance to the financial burden due to increases in life expectancy<br />

is that, at the time of pensioning, the pension sum is divided by the<br />

number of expected remaining years of life.<br />

In the public pension system, one may choose to be pensioned (fulltime<br />

or part-time) from the age of 61. One is free to work after 65.<br />

Until 2003 there was no stipulation in law on the right to work until<br />

a given age, even if 65 was considered to be the norm and was the<br />

upper age limit in the Employment Protection Law. In January 2003<br />

an amendment to the Employment Protection Law gave employees<br />

the right to work until the age of 67. In 2001 the rather favourable<br />

system of part-time pensions was abolished. As pensions in the new<br />

system are more closely related to contributions, one should<br />

conclude that the economic incentive to take early part-time pension<br />

has now diminished substantially. Both these recent changes in the<br />

pension system attempt to induce a greater participation in the<br />

labour market. However, it is pointed out by Wadensjö (2002) that<br />

much work among the elderly is part-time. In 2000 part-time work<br />

accounted for 9% of employed men and 35% of employed women<br />

aged 55-59. For the age group 60-64 the corresponding percentages<br />

were 24% for men and 48% for women. <strong>The</strong>se are large figures both<br />

compared to other countries and other age groups in Sweden. Thus,<br />

it is far from clear that the changes in part-time pension will result in<br />

an increase of the employment rates.<br />

<strong>The</strong>re have been considerable changes in three of the four main<br />

occupational pension schemes (schemes for white and blue-collar<br />

private employees and employees of central and local government).<br />

Palmer and Wadensjö (2003) interpret the new occupational<br />

pension schemes as following the tendency of the public pension<br />

system to more closely link benefits to contributions. <strong>The</strong>re has been<br />

no change in the employment requirements for full occupation<br />

pension. This remains at 30 years to be counted after the age of 28.<br />

Disability Pension<br />

Since January 2003 there is a new system for disability pensions that<br />

will apply even to those who were pensioned earlier. <strong>The</strong> new<br />

measures involve a change of name where the word “pension” is<br />

removed and “sickness benefit” and “activity benefit” are the terms<br />

in the new dual system. This reflects the change in emphasis and the<br />

administration of the new system is removed from the Pension Unit<br />

to the Sickness Unit at the National Insurance Board. It is only<br />

persons between the ages of 30 and 64 who may receive “sickness<br />

benefit”. Those between 19 and 29 may receive “activity benefit”<br />

which is always limited in time. In the previous system one could, in<br />

Source: <strong>The</strong> National Insurance Board<br />

principle, receive disability pension from the age of 18. <strong>The</strong> criteria<br />

for granting the benefit are the same as before and since January<br />

1997, only medical, not labour market, criteria are valid.<br />

In both cases the benefit is increased but is now subject to tax and,<br />

according to the National Insurance Board, the net amounts will<br />

remain roughly the same, though this is a matter of some<br />

controversy. <strong>The</strong> level of benefit is income related but with a<br />

guaranteed basic amount for those on low incomes.<br />

Sickness benefit<br />

On 21 January 2003, the Minister of Employment presented new<br />

measures in an attempt to curtail the very high levels of sickness<br />

benefit outlined above. <strong>The</strong> number of people on sickness benefit<br />

has increased rapidly in the last decade and this is currently the most<br />

prominent issue of debate in the Swedish labour market. As was<br />

seen in Table 3, those over 55 years of age are clearly overrepresented<br />

in the sickness benefit data. <strong>The</strong> Government has set a<br />

target of reducing the number of people on sickness benefit by 50%<br />

by 2008. <strong>The</strong> new proposals are expected to become law in August<br />

2003.<br />

Currently all employers pay the first two weeks of benefit, and the<br />

Government intends to eventually place the entire costs for sickness<br />

benefit on the employer. <strong>The</strong> current proposal, however, will apply<br />

to public employers only. <strong>The</strong> impact will be considerable as the<br />

public sector accounts for just under 30% of employment and<br />

employees in the public sector have higher rates of sickness. <strong>The</strong><br />

motive behind this proposal is to place incentives on employers to<br />

improve the environment at work and so reduce sickness absence. In<br />

return payroll taxes for public employers will be reduced. This<br />

proposal has met with very strong opposition from employers.<br />

Shortly before the proposal was made public, the private employer<br />

federation withdrew from the tripartite body set up to discuss the<br />

issue of reform of the sickness benefit system.<br />

Other aspects of the proposal include a new institutional framework<br />

for rehabilitation measures where the National Insurance Board is<br />

to co-operate more closely with the National Labour Board. <strong>The</strong>re<br />

is also to be a closer medical control of sickness claims and the<br />

authorities are to more actively examine whether sickness absence<br />

could be part-time instead of full-time. <strong>The</strong> proposals have met with<br />

widespread opposition.<br />

152 Spring 2003 | European Employment Observatory Review