FRANCE The

FRANCE The

FRANCE The

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

level. No taxes and social premiums have to be paid with respect to<br />

pension premiums. Increasingly, flexible pension and pre-pension<br />

schemes are established that enable a worker – on the basis of a<br />

saving scheme - to retire before the age of 65 and/or retire part-time<br />

first and full-time later. <strong>The</strong>se flexible schemes tend to replace the<br />

existing early retirement schemes, VUT (vervroegde uittreding),<br />

which are no longer supported fiscally by the Government, see<br />

section 3.<br />

One of the main problems regarding the second tier pension has<br />

been the so-called “breach of pension” (pensioenbreuk) which<br />

occurs when participation in a company or sector pension funds<br />

stops. This can happen, for example, when a worker changes jobs,<br />

becomes unemployed or disabled. Workers who temporarily leave<br />

paid employment to take care of their children can also suffer from<br />

loss of pension. Legal measures have been (and are being) taken to<br />

reduce this problem. For example, regulations exist for the transfer<br />

of pensions, thus enabling workers to transfer their pension<br />

entitlements to the company fund of their new employer without<br />

suffering a loss of entitlements.<br />

A fairly recent innovation concerns the main collective agreement<br />

for temporary work agencies (ABU-CAO). This collective<br />

agreement stipulates that temporary agency workers at the age of 21<br />

and over who have worked for 26 weeks for the same temporary<br />

work agency have a right to be included in a pension scheme. If the<br />

worker starts working for another temporary work agency he or she<br />

will continue to participate in the pension scheme. However, if he<br />

interrupts work for one year or more, this participation ends and he<br />

or she will have to “build up” another 26 weeks before participation<br />

can be resumed. <strong>The</strong> pension entitlements that were already<br />

obtained are maintained. Participation in the pension scheme is<br />

mandatory for the temporary agency worker. <strong>The</strong> premium rate is<br />

3.5% of the gross wage. <strong>The</strong> worker himself or herself pays a<br />

maximum of one third of the premium. To give an example:<br />

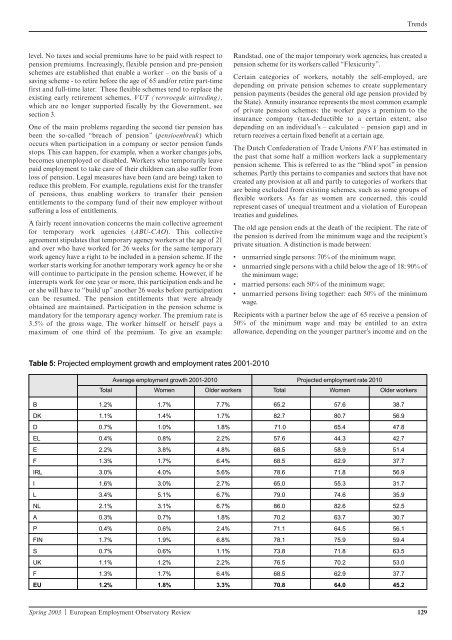

Table 5: Projected employment growth and employment rates 2001-2010<br />

Spring 2003 | European Employment Observatory Review 129<br />

Trends<br />

Randstad, one of the major temporary work agencies, has created a<br />

pension scheme for its workers called “Flexicurity”.<br />

Certain categories of workers, notably the self-employed, are<br />

depending on private pension schemes to create supplementary<br />

pension payments (besides the general old age pension provided by<br />

the State). Annuity insurance represents the most common example<br />

of private pension schemes: the worker pays a premium to the<br />

insurance company (tax-deductible to a certain extent, also<br />

depending on an individual’s – calculated – pension gap) and in<br />

return receives a certain fixed benefit at a certain age.<br />

<strong>The</strong> Dutch Confederation of Trade Unions FNV has estimated in<br />

the past that some half a million workers lack a supplementary<br />

pension scheme. This is referred to as the “blind spot” in pension<br />

schemes. Partly this pertains to companies and sectors that have not<br />

created any provision at all and partly to categories of workers that<br />

are being excluded from existing schemes, such as some groups of<br />

flexible workers. As far as women are concerned, this could<br />

represent cases of unequal treatment and a violation of European<br />

treaties and guidelines.<br />

<strong>The</strong> old age pension ends at the death of the recipient. <strong>The</strong> rate of<br />

the pension is derived from the minimum wage and the recipient’s<br />

private situation. A distinction is made between:<br />

• unmarried single persons: 70% of the minimum wage;<br />

• unmarried single persons with a child below the age of 18: 90% of<br />

the minimum wage;<br />

• married persons: each 50% of the minimum wage;<br />

• unmarried persons living together: each 50% of the minimum<br />

wage.<br />

Recipients with a partner below the age of 65 receive a pension of<br />

50% of the minimum wage and may be entitled to an extra<br />

allowance, depending on the younger partner’s income and on the<br />

Average employment growth 2001-2010 Projected employment rate 2010<br />

Total Women Older workers Total Women Older workers<br />

B 1.2% 1.7% 7.7% 65.2 57.6 38.7<br />

DK 1.1% 1.4% 1.7% 82.7 80.7 56.9<br />

D 0.7% 1.0% 1.8% 71.0 65.4 47.8<br />

EL 0.4% 0.8% 2.2% 57.6 44.3 42.7<br />

E 2.2% 3.8% 4.8% 68.5 58.9 51.4<br />

F 1.3% 1.7% 6.4% 68.5 62.9 37.7<br />

IRL 3.0% 4.0% 5.6% 78.6 71.8 56.9<br />

I 1.6% 3.0% 2.7% 65.0 55.3 31.7<br />

L 3.4% 5.1% 6.7% 79.0 74.6 35.9<br />

NL 2.1% 3.1% 6.7% 86.0 82.6 52.5<br />

A 0.3% 0.7% 1.8% 70.2 63.7 30.7<br />

P 0.4% 0.6% 2.4% 71.1 64.5 56.1<br />

FIN 1.7% 1.9% 6.8% 78.1 75.9 59.4<br />

S 0.7% 0.6% 1.1% 73.8 71.8 63.5<br />

UK 1.1% 1.2% 2.2% 76.5 70.2 53.0<br />

F 1.3% 1.7% 6.4% 68.5 62.9 37.7<br />

EU 1.2% 1.8% 3.3% 70.8 64.0 45.2