FRANCE The

FRANCE The

FRANCE The

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

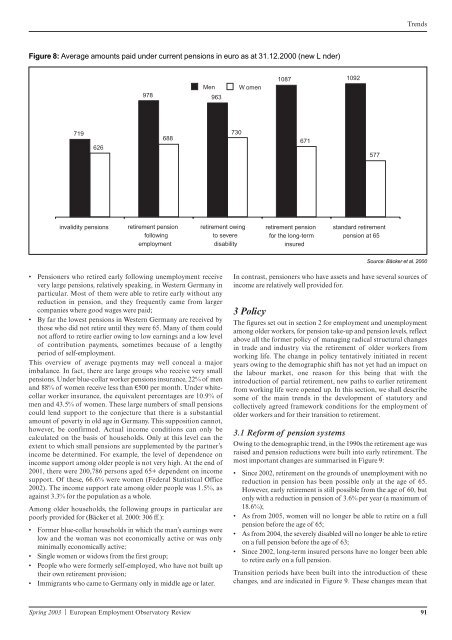

Figure 8: Average amounts paid under current pensions in euro as at 31.12.2000 (new L nder)<br />

719<br />

626<br />

invalidity pensions<br />

978 963<br />

688<br />

retirement pension<br />

following<br />

employment<br />

• Pensioners who retired early following unemployment receive<br />

very large pensions, relatively speaking, in Western Germany in<br />

particular. Most of them were able to retire early without any<br />

reduction in pension, and they frequently came from larger<br />

companies where good wages were paid;<br />

• By far the lowest pensions in Western Germany are received by<br />

those who did not retire until they were 65. Many of them could<br />

not afford to retire earlier owing to low earnings and a low level<br />

of contribution payments, sometimes because of a lengthy<br />

period of self-employment.<br />

This overview of average payments may well conceal a major<br />

imbalance. In fact, there are large groups who receive very small<br />

pensions. Under blue-collar worker pensions insurance, 22% of men<br />

and 88% of women receive less than €500 per month. Under whitecollar<br />

worker insurance, the equivalent percentages are 10.9% of<br />

men and 43.5% of women. <strong>The</strong>se large numbers of small pensions<br />

could lend support to the conjecture that there is a substantial<br />

amount of poverty in old age in Germany. This supposition cannot,<br />

however, be confirmed. Actual income conditions can only be<br />

calculated on the basis of households. Only at this level can the<br />

extent to which small pensions are supplemented by the partner’s<br />

income be determined. For example, the level of dependence on<br />

income support among older people is not very high. At the end of<br />

2001, there were 200,786 persons aged 65+ dependent on income<br />

support. Of these, 66.6% were women (Federal Statistical Office<br />

2002). <strong>The</strong> income support rate among older people was 1.5%, as<br />

against 3.3% for the population as a whole.<br />

Among older households, the following groups in particular are<br />

poorly provided for (Bäcker et al. 2000: 306 ff.):<br />

• Former blue-collar households in which the man’s earnings were<br />

low and the woman was not economically active or was only<br />

minimally economically active;<br />

• Single women or widows from the first group;<br />

• People who were formerly self-employed, who have not built up<br />

their own retirement provision;<br />

• Immigrants who came to Germany only in middle age or later.<br />

Men W omen<br />

Spring 2003 | European Employment Observatory Review 91<br />

730<br />

retirement owing<br />

to severe<br />

disability<br />

1087<br />

671<br />

retirement pension<br />

for the long-term<br />

insured<br />

1092<br />

577<br />

standard retirement<br />

pension at 65<br />

Trends<br />

Source: Bäcker et al. 2000<br />

In contrast, pensioners who have assets and have several sources of<br />

income are relatively well provided for.<br />

3 Policy<br />

<strong>The</strong> figures set out in section 2 for employment and unemployment<br />

among older workers, for pension take-up and pension levels, reflect<br />

above all the former policy of managing radical structural changes<br />

in trade and industry via the retirement of older workers from<br />

working life. <strong>The</strong> change in policy tentatively initiated in recent<br />

years owing to the demographic shift has not yet had an impact on<br />

the labour market, one reason for this being that with the<br />

introduction of partial retirement, new paths to earlier retirement<br />

from working life were opened up. In this section, we shall describe<br />

some of the main trends in the development of statutory and<br />

collectively agreed framework conditions for the employment of<br />

older workers and for their transition to retirement.<br />

3.1 Reform of pension systems<br />

Owing to the demographic trend, in the 1990s the retirement age was<br />

raised and pension reductions were built into early retirement. <strong>The</strong><br />

most important changes are summarised in Figure 9:<br />

• Since 2002, retirement on the grounds of unemployment with no<br />

reduction in pension has been possible only at the age of 65.<br />

However, early retirement is still possible from the age of 60, but<br />

only with a reduction in pension of 3.6% per year (a maximum of<br />

18.6%);<br />

• As from 2005, women will no longer be able to retire on a full<br />

pension before the age of 65;<br />

• As from 2004, the severely disabled will no longer be able to retire<br />

on a full pension before the age of 63;<br />

• Since 2002, long-term insured persons have no longer been able<br />

to retire early on a full pension.<br />

Transition periods have been built into the introduction of these<br />

changes, and are indicated in Figure 9. <strong>The</strong>se changes mean that