Gulf and European Energy Supply Security - Feem-project.net

Gulf and European Energy Supply Security - Feem-project.net

Gulf and European Energy Supply Security - Feem-project.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Energy</strong> <strong>Security</strong>: Potential for EU-GCC Cooperation<br />

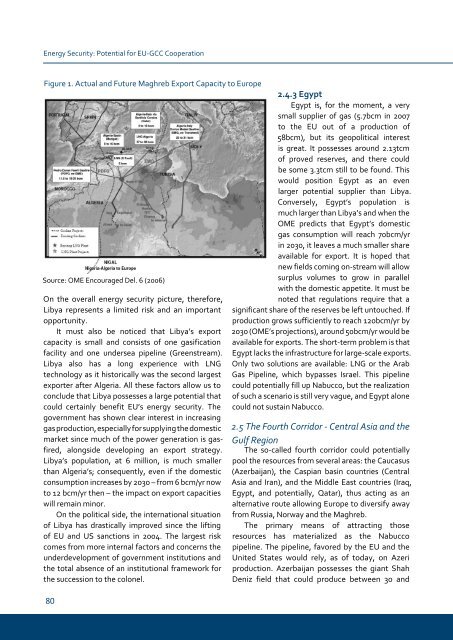

Figure 1. Actual <strong>and</strong> Future Maghreb Export Capacity to Europe<br />

Source: OME Encouraged Del. 6 (2006)<br />

On the overall energy security picture, therefore,<br />

Libya represents a limited risk <strong>and</strong> an important<br />

opportunity.<br />

It must also be noticed that Libya’s export<br />

capacity is small <strong>and</strong> consists of one gasification<br />

facility <strong>and</strong> one undersea pipeline (Greenstream).<br />

Libya also has a long experience with LNG<br />

technology as it historically was the second largest<br />

exporter after Algeria. All these factors allow us to<br />

conclude that Libya possesses a large potential that<br />

could certainly benefit EU’s energy security. The<br />

government has shown clear interest in increasing<br />

gas production, especially for supplying the domestic<br />

market since much of the power generation is gasfired,<br />

alongside developing an export strategy.<br />

Libya’s population, at 6 million, is much smaller<br />

than Algeria’s; consequently, even if the domestic<br />

consumption increases by 2030 – from 6 bcm/yr now<br />

to 12 bcm/yr then – the impact on export capacities<br />

will remain minor.<br />

On the political side, the international situation<br />

of Libya has drastically improved since the lifting<br />

of EU <strong>and</strong> US sanctions in 2004. The largest risk<br />

comes from more internal factors <strong>and</strong> concerns the<br />

underdevelopment of government institutions <strong>and</strong><br />

the total absence of an institutional framework for<br />

the succession to the colonel.<br />

0<br />

2.4.3 egypt<br />

Egypt is, for the moment, a very<br />

small supplier of gas (5.7bcm in 2007<br />

to the EU out of a production of<br />

58bcm), but its geopolitical interest<br />

is great. It possesses around 2.13tcm<br />

of proved reserves, <strong>and</strong> there could<br />

be some 3.3tcm still to be found. This<br />

would position Egypt as an even<br />

larger potential supplier than Libya.<br />

Conversely, Egypt’s population is<br />

much larger than Libya’s <strong>and</strong> when the<br />

OME predicts that Egypt’s domestic<br />

gas consumption will reach 70bcm/yr<br />

in 2030, it leaves a much smaller share<br />

available for export. It is hoped that<br />

new fields coming on-stream will allow<br />

surplus volumes to grow in parallel<br />

with the domestic appetite. It must be<br />

noted that regulations require that a<br />

significant share of the reserves be left untouched. If<br />

production grows sufficiently to reach 120bcm/yr by<br />

2030 (OME’s <strong>project</strong>ions), around 50bcm/yr would be<br />

available for exports. The short-term problem is that<br />

Egypt lacks the infrastructure for large-scale exports.<br />

Only two solutions are available: LNG or the Arab<br />

Gas Pipeline, which bypasses Israel. This pipeline<br />

could potentially fill up Nabucco, but the realization<br />

of such a scenario is still very vague, <strong>and</strong> Egypt alone<br />

could not sustain Nabucco.<br />

2.5 The Fourth Corridor - Central Asia <strong>and</strong> the<br />

<strong>Gulf</strong> Region<br />

The so-called fourth corridor could potentially<br />

pool the resources from several areas: the Caucasus<br />

(Azerbaijan), the Caspian basin countries (Central<br />

Asia <strong>and</strong> Iran), <strong>and</strong> the Middle East countries (Iraq,<br />

Egypt, <strong>and</strong> potentially, Qatar), thus acting as an<br />

alternative route allowing Europe to diversify away<br />

from Russia, Norway <strong>and</strong> the Maghreb.<br />

The primary means of attracting those<br />

resources has materialized as the Nabucco<br />

pipeline. The pipeline, favored by the EU <strong>and</strong> the<br />

United States would rely, as of today, on Azeri<br />

production. Azerbaijan possesses the giant Shah<br />

Deniz field that could produce between 30 <strong>and</strong>