- Page 1 and 2:

2008 Budget Book Kitsap County Wash

- Page 3 and 4:

KITSAP COUNTY 2008 BUDGET Adopted b

- Page 5 and 6:

The Government Finance Officers Ass

- Page 7 and 8:

T A B L E O F C O N T E N T S Page

- Page 9:

KITSAP COUNTY OFFICIALS ELECTED OFF

- Page 12 and 13:

County Mission Kitsap County govern

- Page 14 and 15:

This page intentionally left blank

- Page 16 and 17:

This page intentionally left blank

- Page 18 and 19:

General Information and Economic In

- Page 20 and 21:

General Information and Economic In

- Page 22 and 23:

General Information and Economic In

- Page 24 and 25:

General Information and Economic In

- Page 26 and 27:

General Information and Economic In

- Page 28 and 29:

General Information and Economic In

- Page 30 and 31:

This page intentionally left blank

- Page 32:

This page intentionally left blank

- Page 36 and 37:

Fund Types in the Kitsap County Bud

- Page 38 and 39:

Law and Justice Program ($70,873,98

- Page 40 and 41:

Sources of Revenues for All Funds M

- Page 42 and 43:

This page intentionally left blank

- Page 44:

2008 Annual Budget Calendar Revised

- Page 53 and 54:

Program Budgets $254,819,751 Public

- Page 55 and 56:

Law and Justice Program $20,000,000

- Page 57 and 58:

38 Law & Justice Sheriff Purpose: T

- Page 59 and 60:

Performance Measures: Enhance commu

- Page 61 and 62:

Sheriff Agency Structure: 42

- Page 63 and 64:

Superior Court • We will promote

- Page 65 and 66:

Superior Court Staffing Level: Full

- Page 67 and 68:

District Court 2008 Goals & Objecti

- Page 69 and 70:

District Court Agency Structure: Di

- Page 71 and 72:

Clerk • Presented a budget for 20

- Page 73 and 74:

Clerk Agency Structure: Kitsap Coun

- Page 75 and 76:

Jail Performance Measures: Measure

- Page 77 and 78:

Jail Agency Structure: Superintende

- Page 79 and 80:

Performance Measures: Meet or excee

- Page 81 and 82:

Expenditures: Central Communication

- Page 83 and 84:

Prosecuting Attorney 2007 Accomplis

- Page 85 and 86:

Expenditures: 2005 Actual Departmen

- Page 87 and 88:

68 Law & Justice Juvenile Purpose:

- Page 89 and 90:

COURT SERVICES Measure 2006 Actual

- Page 91 and 92:

2008 Expenditures by Division: Admi

- Page 93 and 94:

Revenues: Law & Justice Jail & Juve

- Page 95 and 96:

Law & Justice - Other Funds Staffin

- Page 97 and 98:

Coroner 2008 Expenditures by Divisi

- Page 99 and 100:

General Government Program $7,000,0

- Page 101 and 102:

General Government General Administ

- Page 103 and 104:

General Government Auditor Purpose:

- Page 105 and 106:

85 Auditor 2008 Goals and Objective

- Page 107 and 108:

2008 Expenditures by Division: Admi

- Page 109 and 110:

General Government Assessor Purpose

- Page 111 and 112:

Expenditures: 2005 Actual Departmen

- Page 113 and 114:

Performance Measures: Measure Facil

- Page 115 and 116:

95 General Government Board of Coun

- Page 117 and 118:

Board of Commissioners & County Adm

- Page 119 and 120:

Expenditures: 2005 Actual Departmen

- Page 121 and 122:

101 General Government Administrati

- Page 123 and 124:

Administrative Services Purchasing

- Page 125 and 126:

Administrative Services Expenditure

- Page 127 and 128:

General Government - Other Funds Fu

- Page 129 and 130:

Treasurer • Manage number of days

- Page 131 and 132:

$10,000,000 Community Services Prog

- Page 133 and 134:

112 Community Service Special Reven

- Page 135 and 136:

Community Development To promote a

- Page 137 and 138:

Community Development Expenditures:

- Page 139 and 140:

Revenues: Community Service Parks C

- Page 141 and 142:

Parks & Recreation Identify and sec

- Page 143 and 144:

Revenues: 2005 Actual Operating Bud

- Page 145 and 146:

Revenues: Community Service Communi

- Page 147 and 148:

Community Service - Other Funds Add

- Page 149 and 150:

Emergency Management Performance Me

- Page 151 and 152:

Emergency Management Agency Structu

- Page 153 and 154:

Cooperative Extension • Ten adult

- Page 155 and 156:

Cooperative Extension Staffing Leve

- Page 157 and 158:

Health and Human Services Program $

- Page 159 and 160:

Health & Human Services Purpose: Th

- Page 161 and 162:

Health & Human Services • Expansi

- Page 163 and 164:

Revenues: 2005 Actual Health & Huma

- Page 165 and 166:

Revenues: Health & Human Services D

- Page 167 and 168:

Revenues: Health & Human Services S

- Page 169 and 170: Health & Human Services General Fun

- Page 171 and 172: Health & Human Services - Other Fun

- Page 173 and 174: Public Works Program $25,000,000 Pu

- Page 175 and 176: Public Works Roads Purpose: The Pub

- Page 177 and 178: Revenues: County Roads Budget 2005

- Page 179 and 180: 154 Roads

- Page 181 and 182: Solid Waste We will contribute to I

- Page 183 and 184: Solid Waste Staffing Level: Full Ti

- Page 185 and 186: Revenues: 2005 Actual Operating Bud

- Page 187 and 188: Public Works Wastewater Purpose: Th

- Page 189 and 190: Wastewater 2008 Expenditures by Div

- Page 191 and 192: Public Works Surface & Stormwater M

- Page 193 and 194: Expenditures: 2005 Actual 2006 Actu

- Page 195 and 196: Public Works Surface & Stormwater C

- Page 197 and 198: Other Funds $48,184,125 Internal Se

- Page 199 and 200: Other Funds Real Estate Excise Tax

- Page 201 and 202: Internal Service Funds $20,354,529

- Page 203 and 204: Internal Service Funds Equipment Re

- Page 205 and 206: Equipment Rental & Revolving Staffi

- Page 207 and 208: Information Services • Server Roo

- Page 209 and 210: Information Services 2008 Expenditu

- Page 211 and 212: Risk Management EFFICIENCY 2006 Act

- Page 213 and 214: Capital Project Funds $6,007,665 20

- Page 215 and 216: Capital Project Funds Capital Progr

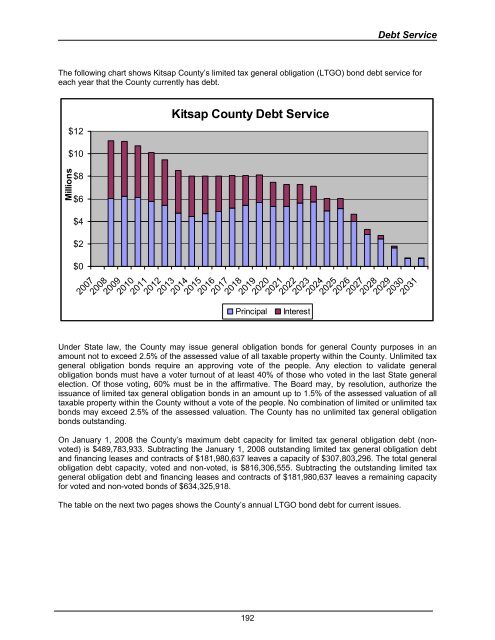

- Page 217 and 218: Debt Service Funds $13,858,873 Reve

- Page 219: Debt Service Funds The County uses

- Page 223 and 224: DEBT SERVICE REQUIREMENTS FOR LTGO

- Page 225 and 226: Appendices

- Page 227 and 228: Appendix A Policies Budget Policy T

- Page 229 and 230: Appendix A Policies Investment Poli

- Page 231 and 232: Appendix A Policies Collateral is t

- Page 233 and 234: Appendix A Policies Debt Policy Res

- Page 235 and 236: Appendix A Policies The County will

- Page 237 and 238: Appendix A Policies The County Audi

- Page 239 and 240: Appendix B Glossary G L O S S A R Y

- Page 241 and 242: Appendix B Glossary ENDING FUND BAL

- Page 243 and 244: Appendix B Glossary RESERVE - An ac

- Page 245 and 246: Appendix C Tax Levies 2007 KITSAP C

- Page 247 and 248: Appendix C Tax Levies T.E.D. = Timb

- Page 249 and 250: Appendix D Synopsis of Property Tax

- Page 251 and 252: Appendix D Synopsis of Property Tax

- Page 253 and 254: Appendix E General Administration &

- Page 255 and 256: Appendix F Staffing Levels KITSAP C

- Page 257 and 258: Appendix F Staffing Levels KITSAP C

- Page 259 and 260: Appendix F Staffing Levels KITSAP C

- Page 261 and 262: Appendix F Staffing Levels KITSAP C

- Page 263 and 264: Appendix F Staffing Levels KITSAP C

- Page 265 and 266: Appendix F Staffing Levels KITSAP C

- Page 267 and 268: Appendix F Staffing Levels KITSAP C

- Page 269 and 270: Appendix G Revenue Projection Kitsa

- Page 271 and 272:

Appendix G Expenditure Projection A

- Page 273 and 274:

Appendix H Statement of Changes in

- Page 275 and 276:

Appendix I Capital Facilities Summa

- Page 277 and 278:

Appendix J General Fund Trends Appe