2008 Budget Book - Kitsap County Government

2008 Budget Book - Kitsap County Government

2008 Budget Book - Kitsap County Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

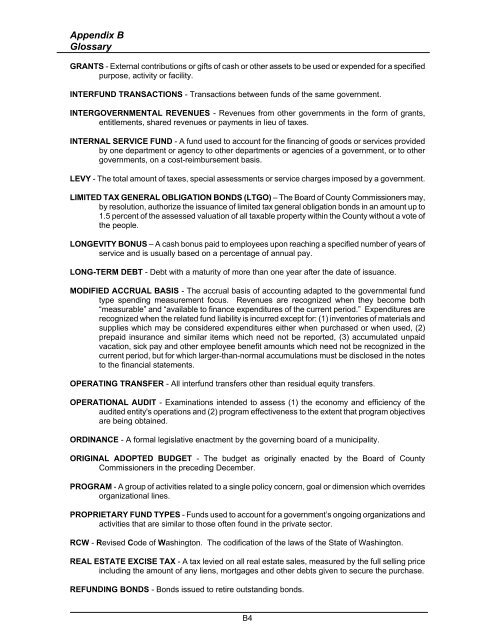

Appendix B<br />

Glossary<br />

GRANTS - External contributions or gifts of cash or other assets to be used or expended for a specified<br />

purpose, activity or facility.<br />

INTERFUND TRANSACTIONS - Transactions between funds of the same government.<br />

INTERGOVERNMENTAL REVENUES - Revenues from other governments in the form of grants,<br />

entitlements, shared revenues or payments in lieu of taxes.<br />

INTERNAL SERVICE FUND - A fund used to account for the financing of goods or services provided<br />

by one department or agency to other departments or agencies of a government, or to other<br />

governments, on a cost-reimbursement basis.<br />

LEVY - The total amount of taxes, special assessments or service charges imposed by a government.<br />

LIMITED TAX GENERAL OBLIGATION BONDS (LTGO) – The Board of <strong>County</strong> Commissioners may,<br />

by resolution, authorize the issuance of limited tax general obligation bonds in an amount up to<br />

1.5 percent of the assessed valuation of all taxable property within the <strong>County</strong> without a vote of<br />

the people.<br />

LONGEVITY BONUS – A cash bonus paid to employees upon reaching a specified number of years of<br />

service and is usually based on a percentage of annual pay.<br />

LONG-TERM DEBT - Debt with a maturity of more than one year after the date of issuance.<br />

MODIFIED ACCRUAL BASIS - The accrual basis of accounting adapted to the governmental fund<br />

type spending measurement focus. Revenues are recognized when they become both<br />

“measurable” and “available to finance expenditures of the current period.” Expenditures are<br />

recognized when the related fund liability is incurred except for: (1) inventories of materials and<br />

supplies which may be considered expenditures either when purchased or when used, (2)<br />

prepaid insurance and similar items which need not be reported, (3) accumulated unpaid<br />

vacation, sick pay and other employee benefit amounts which need not be recognized in the<br />

current period, but for which larger-than-normal accumulations must be disclosed in the notes<br />

to the financial statements.<br />

OPERATING TRANSFER - All interfund transfers other than residual equity transfers.<br />

OPERATIONAL AUDIT - Examinations intended to assess (1) the economy and efficiency of the<br />

audited entity's operations and (2) program effectiveness to the extent that program objectives<br />

are being obtained.<br />

ORDINANCE - A formal legislative enactment by the governing board of a municipality.<br />

ORIGINAL ADOPTED BUDGET - The budget as originally enacted by the Board of <strong>County</strong><br />

Commissioners in the preceding December.<br />

PROGRAM - A group of activities related to a single policy concern, goal or dimension which overrides<br />

organizational lines.<br />

PROPRIETARY FUND TYPES - Funds used to account for a government’s ongoing organizations and<br />

activities that are similar to those often found in the private sector.<br />

RCW - Revised Code of Washington. The codification of the laws of the State of Washington.<br />

REAL ESTATE EXCISE TAX - A tax levied on all real estate sales, measured by the full selling price<br />

including the amount of any liens, mortgages and other debts given to secure the purchase.<br />

REFUNDING BONDS - Bonds issued to retire outstanding bonds.<br />

B4