- Page 1:

Financial Conduct Authority Consult

- Page 4 and 5:

We are asking for comments on this

- Page 6 and 7:

CP13/6 CRD IV for Investment Firms

- Page 8 and 9:

CP13/6 CRD IV for Investment Firms

- Page 10 and 11:

CP13/6 CRD IV for Investment Firms

- Page 12 and 13:

CP13/6 CRD IV for Investment Firms

- Page 14 and 15:

CP13/6 CRD IV for Investment Firms

- Page 16 and 17:

CP13/6 CRD IV for Investment Firms

- Page 18 and 19:

CP13/6 CRD IV for Investment Firms

- Page 20 and 21:

CP13/6 CRD IV for Investment Firms

- Page 22 and 23: CP13/6 CRD IV for Investment Firms

- Page 24 and 25: CP13/6 CRD IV for Investment Firms

- Page 26 and 27: CP13/6 CRD IV for Investment Firms

- Page 28 and 29: CP13/6 CRD IV for Investment Firms

- Page 30 and 31: CP13/6 CRD IV for Investment Firms

- Page 32 and 33: CP13/6 CRD IV for Investment Firms

- Page 34 and 35: CP13/6 CRD IV for Investment Firms

- Page 36 and 37: CP13/6 CRD IV for Investment Firms

- Page 38 and 39: CP13/6 CRD IV for Investment Firms

- Page 40 and 41: CP13/6 CRD IV for Investment Firms

- Page 42 and 43: CP13/6 CRD IV for Investment Firms

- Page 44 and 45: CP13/6 CRD IV for Investment Firms

- Page 46 and 47: CP13/6 CRD IV for Investment Firms

- Page 48 and 49: CP13/6 CRD IV for Investment Firms

- Page 50 and 51: CP13/6 CRD IV for Investment Firms

- Page 52 and 53: CP13/6 CRD IV for Investment Firms

- Page 54 and 55: CP13/6 CRD IV for Investment Firms

- Page 56 and 57: CP13/6 CRD IV for Investment Firms

- Page 58 and 59: CP13/6 CRD IV for Investment Firms

- Page 60 and 61: CP13/6 CRD IV for Investment Firms

- Page 63 and 64: CRD IV for Investment Firms CP13/6

- Page 65 and 66: CRD IV for Investment Firms CP13/6

- Page 67 and 68: CRD IV for Investment Firms CP13/6

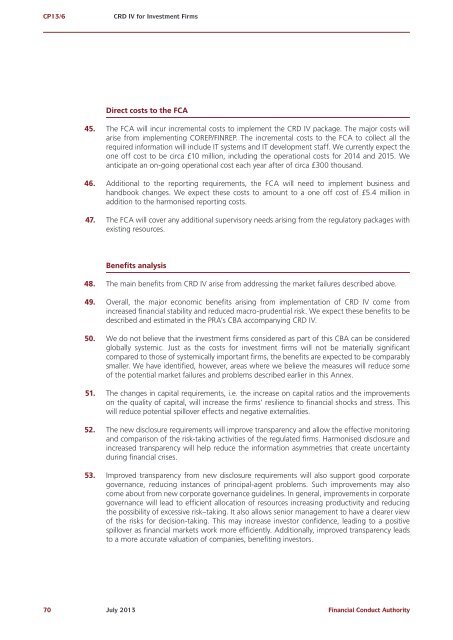

- Page 69 and 70: CRD IV for Investment Firms CP13/6

- Page 71: CRD IV for Investment Firms CP13/6

- Page 75 and 76: CRD IV for Investment Firms CP13/6

- Page 77 and 78: CRD IV for Investment Firms CP13/6

- Page 79 and 80: CRD IV for Investment Firms CP13/6

- Page 81 and 82: CRD IV for Investment Firms CP13/6

- Page 83 and 84: CRD IV for Investment Firms CP13/6

- Page 85 and 86: CRD IV for Investment Firms CP13/6

- Page 87 and 88: CRD IV for Investment Firms CP13/6

- Page 89 and 90: CRD IV for Investment Firms CP13/6

- Page 91 and 92: CRD IV for Investment Firms CP13/6

- Page 93 and 94: CRD IV for Investment Firms CP13/6

- Page 95 and 96: CRD IV for Investment Firms CP13/6

- Page 97 and 98: CRD IV for Investment Firms CP13/6

- Page 99 and 100: FCA 2013/xx Annex A Prudential sour

- Page 101 and 102: FCA 2013/xx (a) (b) deal on own acc

- Page 103 and 104: FCA 2013/xx 1.1.14 G A firm also fa

- Page 105 and 106: FCA 2013/xx connected with, its reg

- Page 107 and 108: FCA 2013/xx 2.1 Application 2.1.1 R

- Page 109 and 110: FCA 2013/xx (a) (b) (c) the nature

- Page 111 and 112: FCA 2013/xx losses because its inco

- Page 113 and 114: FCA 2013/xx 2.2.18 R A firm must ha

- Page 115 and 116: FCA 2013/xx [Note: article 83(3) of

- Page 117 and 118: FCA 2013/xx (b) (c) sudden and seve

- Page 119 and 120: FCA 2013/xx (b) provide the resolut

- Page 121 and 122: FCA 2013/xx between each firm which

- Page 123 and 124:

FCA 2013/xx in a number of risk cat

- Page 125 and 126:

FCA 2013/xx Capital planning 2.2.73

- Page 127 and 128:

FCA 2013/xx approving and actioning

- Page 129 and 130:

FCA 2013/xx financial situations or

- Page 131 and 132:

FCA 2013/xx activities (IFPRU 2.2.1

- Page 133 and 134:

FCA 2013/xx suggested. 2.3.17 G The

- Page 135 and 136:

FCA 2013/xx (3) what plan is in pla

- Page 137 and 138:

FCA 2013/xx 2.3.35 G For a firm tha

- Page 139 and 140:

FCA 2013/xx that considers the poss

- Page 141 and 142:

FCA 2013/xx unexpected cash flows l

- Page 143 and 144:

FCA 2013/xx (1) a failure by a firm

- Page 145 and 146:

FCA 2013/xx single counterparty; (b

- Page 147 and 148:

FCA 2013/xx (4) that it has in plac

- Page 149 and 150:

FCA 2013/xx that firm. Calculation

- Page 151 and 152:

FCA 2013/xx 3.2.8 R A firm must dem

- Page 153 and 154:

FCA 2013/xx 126(2), 178(1)(b), 243(

- Page 155 and 156:

FCA 2013/xx (1) whether there is an

- Page 157 and 158:

FCA 2013/xx 4.3.8 G A significant I

- Page 159 and 160:

FCA 2013/xx set out but are outside

- Page 161 and 162:

FCA 2013/xx requirements in article

- Page 163 and 164:

FCA 2013/xx standards for data qual

- Page 165 and 166:

FCA 2013/xx Definition of default:

- Page 167 and 168:

FCA 2013/xx Variable scalar conside

- Page 169 and 170:

FCA 2013/xx Data considerations 4.3

- Page 171 and 172:

FCA 2013/xx (b) (c) (eg, external a

- Page 173 and 174:

FCA 2013/xx will allow such cures t

- Page 175 and 176:

FCA 2013/xx and not be based purely

- Page 177 and 178:

FCA 2013/xx downturn conditions, a

- Page 179 and 180:

FCA 2013/xx Direct estimates of EAD

- Page 181 and 182:

FCA 2013/xx Netting 4.3.119 G For c

- Page 183 and 184:

FCA 2013/xx 4.3.131 G As with all a

- Page 185 and 186:

FCA 2013/xx Low default portfolios

- Page 187 and 188:

FCA 2013/xx Other requirements 4.3.

- Page 189 and 190:

FCA 2013/xx 4.4.4 G A firm should n

- Page 191 and 192:

FCA 2013/xx significant risk transf

- Page 193 and 194:

FCA 2013/xx risk transfer notificat

- Page 195 and 196:

FCA 2013/xx EU CRR) should be revie

- Page 197 and 198:

FCA 2013/xx being recognised or the

- Page 199 and 200:

FCA 2013/xx with traded debt instru

- Page 201 and 202:

FCA 2013/xx Duration of the credit

- Page 203 and 204:

FCA 2013/xx Track record and financ

- Page 205 and 206:

FCA 2013/xx Pledge of assets, takin

- Page 207 and 208:

FCA 2013/xx complete and stabilised

- Page 209 and 210:

FCA 2013/xx properties are diversif

- Page 211 and 212:

FCA 2013/xx assets are highly liqui

- Page 213 and 214:

FCA 2013/xx market asset when it co

- Page 215 and 216:

FCA 2013/xx Financial strength of t

- Page 217 and 218:

FCA 2013/xx (f) (g) The effect of t

- Page 219 and 220:

FCA 2013/xx (2) contains the rule t

- Page 221 and 222:

FCA 2013/xx 6.1.8 G The pricing mod

- Page 223 and 224:

FCA 2013/xx 6.2.3 G Futures, forwar

- Page 225 and 226:

FCA 2013/xx 6.2.11 G This table bel

- Page 227 and 228:

FCA 2013/xx (b) (c) equal to a frac

- Page 229 and 230:

FCA 2013/xx demonstrate this by hav

- Page 231 and 232:

FCA 2013/xx shifts for both VaR and

- Page 233 and 234:

FCA 2013/xx individual basis if it

- Page 235 and 236:

FCA 2013/xx material practical or l

- Page 237 and 238:

FCA 2013/xx the financial situation

- Page 239 and 240:

FCA 2013/xx consolidated situation

- Page 241 and 242:

FCA 2013/xx applications against ar

- Page 243 and 244:

FCA 2013/xx Calculation of counterc

- Page 245 and 246:

FCA 2013/xx connection with common

- Page 247 and 248:

FCA 2013/xx “Qn” indicates the

- Page 249 and 250:

FCA 2013/xx [9.7 Exemptions 9.7.1 G

- Page 251 and 252:

FCA 2013/xx Permission 1 Internal R

- Page 253 and 254:

FCA 2013/xx consolidated basis for

- Page 255 and 256:

FCA 2013/xx 15 Own funds requiremen

- Page 257 and 258:

FCA 2013/xx 3.4 R For the purposes

- Page 259 and 260:

FCA 2013/xx (4) 40% for the period

- Page 261 and 262:

FCA 2013/xx (3) 0.6 during the peri

- Page 263 and 264:

FCA 2013/xx IFPRU 9.3 (Countercycli

- Page 265 and 266:

FCA 2013/xx 3.2.6R enter into a con

- Page 267 and 268:

FCA 2013/xx group members in excess

- Page 269 and 270:

FCA 2013/xx FCA to grant a waiver t

- Page 271 and 272:

FCA 2013/xx consolidated basis cons

- Page 273 and 274:

FCA 2013/xx that is not excluded un

- Page 275 and 276:

FCA 2013/xx third country countercy

- Page 277 and 278:

FCA 2013/xx purpose of BIPRU 10 (La

- Page 279 and 280:

FCA 2013/xx (ii) any private or pub

- Page 281 and 282:

FCA 2013/xx EEA prudential sectoral

- Page 283 and 284:

FCA 2013/xx financial instrument (1

- Page 285 and 286:

FCA 2013/xx (2) (in accordance with

- Page 287 and 288:

FCA 2013/xx basis under Article 73(

- Page 289 and 290:

FCA 2013/xx (3) (in BIPRU 12 (Liqui

- Page 291 and 292:

FCA 2013/xx 2.3 (Supervisory review

- Page 293 and 294:

FCA 2013/xx Annex C Amendments to t

- Page 295 and 296:

FCA 2013/xx CAPITAL REQUIREMENTS DI

- Page 297 and 298:

FCA 2013/xx (b) has a branch in the

- Page 299 and 300:

FCA 2013/xx 1.3 Valuation … … P

- Page 301 and 302:

FCA 2013/xx … Calculation of the

- Page 303 and 304:

FCA 2013/xx The table in GENPRU 2.1

- Page 305 and 306:

FCA 2013/xx ... … 2.2.220R; GENPR

- Page 307 and 308:

FCA 2013/xx … Limits on the use o

- Page 309 and 310:

FCA 2013/xx Core tier one capital:

- Page 311 and 312:

FCA 2013/xx 6R consolidated supervi

- Page 313 and 314:

FCA 2013/xx 8.13 R … … IPRU(BSO

- Page 315 and 316:

FCA 2013/xx 8B.3 R The Royal Bank o

- Page 317 and 318:

FCA 2013/xx GENPRU 2.2.174R GENPRU

- Page 319 and 320:

FCA 2013/xx 1.1.5 G Guidance on the

- Page 321 and 322:

FCA 2013/xx … (da) (e) (f) apply

- Page 323 and 324:

FCA 2013/xx purpose of the 5% test

- Page 325 and 326:

FCA 2013/xx as it applies to the IR

- Page 327 and 328:

FCA 2013/xx applicable, the Banking

- Page 329 and 330:

FCA 2013/xx … 8.3.14 G The financ

- Page 331 and 332:

FCA 2013/xx GENPRU 2 Annex 6R requi

- Page 333 and 334:

FCA 2013/xx … 8.6 Consolidated ca

- Page 335 and 336:

FCA 2013/xx [deleted] 8.7.4 G BIPRU

- Page 337 and 338:

FCA 2013/xx apply differently for d

- Page 339 and 340:

FCA 2013/xx Part 1 (Non-EEA regulat

- Page 341 and 342:

FCA 2013/xx Disclosure: Operational

- Page 343 and 344:

FCA 2013/xx [Note: annex V paragrap

- Page 345 and 346:

FCA 2013/xx 86(11) (part) of CRD]

- Page 347 and 348:

FCA 2013/xx … 13.1.4 G Pursuant t

- Page 349 and 350:

FCA 2013/xx resources requirement i

- Page 351 and 352:

FCA 2013/xx Paragraph 22(2) of chap

- Page 353 and 354:

FCA 2013/XX Annex A Amendments to t

- Page 355 and 356:

FCA 2013/XX [deleted] … 4.2 Perso

- Page 357 and 358:

FCA 2013/XX [Note: article 91(9) of

- Page 359 and 360:

FCA 2013/XX 4.3A.5R to SYSC 4.3A.12

- Page 361 and 362:

FCA 2013/XX 7.1.18 R (1) A CRR firm

- Page 363 and 364:

FCA 2013/XX 12.4.-1R, BIPRU 12.4.5A

- Page 365 and 366:

FCA 2013/XX http://www.eba.europa.e

- Page 367 and 368:

FCA 2013/XX 19A.3.12 A 19A.3.12 B

- Page 369 and 370:

FCA 2013/XX 19A.3.29 R A firm must

- Page 371 and 372:

FCA 2013/XX … 19A.3.47 R (1) …

- Page 373 and 374:

FCA 2013/XX (b) (c) a firm's passpo

- Page 375 and 376:

FCA 2013/XX Remuneration policies m

- Page 377 and 378:

FCA 2013/XX 19C.3.1 R (1) A firm mu

- Page 379 and 380:

FCA 2013/XX Structured finance Lend

- Page 381 and 382:

FCA 2013/XX (b) in line with the ac

- Page 383 and 384:

FCA 2013/XX current and future risk

- Page 385 and 386:

FCA 2013/XX insurance to undermine

- Page 387 and 388:

FCA 2013/XX (1) is exceptional; (2)

- Page 389 and 390:

FCA 2013/XX component unless a subs

- Page 391 and 392:

[Note: article 91(3) of the CRD] FC

- Page 393 and 394:

PART A: INTRODUCTION & INTERPRETATI

- Page 395 and 396:

Table 1: Glossary of terms defined

- Page 397 and 398:

PART C: LEVELS PROCESS FOR DIVIDING

- Page 399 and 400:

solo Remuneration Code firm. (2) Wh

- Page 401 and 402:

Disapplication of certain remunerat

- Page 403 and 404:

(5) Sub-paragraph (6) applies where

- Page 405 and 406:

APPENDIX 1: SUPPLEMENTAL GUIDANCE O

- Page 408 and 409:

This document has no legal effect a

- Page 410 and 411:

This document has no legal effect a

- Page 412 and 413:

This document has no legal effect a

- Page 414 and 415:

This document has no legal effect a

- Page 416 and 417:

This document has no legal effect a

- Page 418 and 419:

This document has no legal effect a

- Page 420 and 421:

This document has no legal effect a

- Page 422 and 423:

This document has no legal effect a

- Page 424 and 425:

This document has no legal effect a

- Page 426 and 427:

This document has no legal effect a

- Page 428 and 429:

This document has no legal effect a

- Page 430 and 431:

This document has no legal effect a

- Page 432 and 433:

GENERAL GUIDANCE ON PROPORTIONALITY

- Page 434 and 435:

PART A: INTRODUCTION & INTERPRETATI

- Page 436 and 437:

Table 1: Defined expression group G

- Page 438 and 439:

proportionality rule. Part-year Rem

- Page 440 and 441:

(d) The rule on guaranteed variable

- Page 442 and 443:

APPENDIX 1: PILLAR 3 DISCLOSURE REQ