Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Projected Costs of Generating Electricity - OECD Nuclear Energy ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Two US economic analyses <strong>of</strong> nuclear power, one carried out at the Massachusetts Institute <strong>of</strong><br />

Technology (the “MIT study”) 10 and the second for the US Department <strong>of</strong> <strong>Energy</strong> (Near Term<br />

Deployment Group or NTDG) 11 attempt to correct for the additional risk involved with nuclear power<br />

investment in the United States. Both studies assumed that investors in nuclear power plants in the United<br />

States require higher returns on equity and a higher share <strong>of</strong> relatively costly equity in the capital investment<br />

for nuclear power investment compared to natural gas.<br />

The analysis shows that inclusion <strong>of</strong> income tax also more heavily affects the more capital intensive<br />

technology. This observation has implications with respect to comparing the weighted average cost <strong>of</strong><br />

capital used in various analyses <strong>of</strong> cost <strong>of</strong> generating electricity from various technologies.<br />

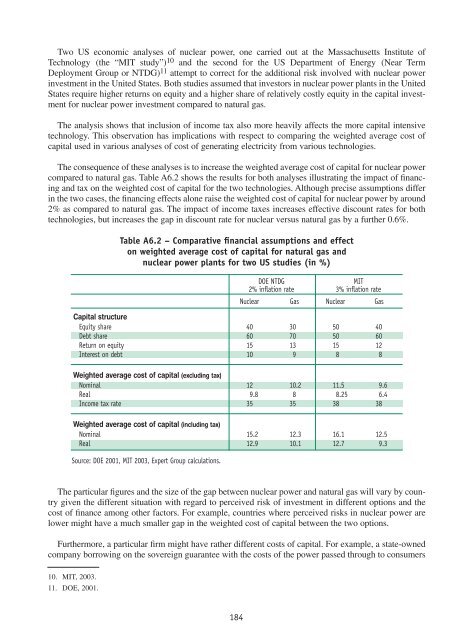

The consequence <strong>of</strong> these analyses is to increase the weighted average cost <strong>of</strong> capital for nuclear power<br />

compared to natural gas. Table A6.2 shows the results for both analyses illustrating the impact <strong>of</strong> financing<br />

and tax on the weighted cost <strong>of</strong> capital for the two technologies. Although precise assumptions differ<br />

in the two cases, the financing effects alone raise the weighted cost <strong>of</strong> capital for nuclear power by around<br />

2% as compared to natural gas. The impact <strong>of</strong> income taxes increases effective discount rates for both<br />

technologies, but increases the gap in discount rate for nuclear versus natural gas by a further 0.6%.<br />

Table A6.2 – Comparative financial assumptions and effect<br />

on weighted average cost <strong>of</strong> capital for natural gas and<br />

nuclear power plants for two US studies (in %)<br />

DOE NTDG<br />

MIT<br />

2% inflation rate 3% inflation rate<br />

<strong>Nuclear</strong> Gas <strong>Nuclear</strong> Gas<br />

Capital structure<br />

Equity share 40 30 50 40<br />

Debt share 60 70 50 60<br />

Return on equity 15 13 15 12<br />

Interest on debt 10 9 8 8<br />

Weighted average cost <strong>of</strong> capital (excluding tax)<br />

Nominal 12 10.2 11.5 9.6<br />

Real 9.8 8 8.25 6.4<br />

Income tax rate 35 35 38 38<br />

Weighted average cost <strong>of</strong> capital (including tax)<br />

Nominal 15.2 12.3 16.1 12.5<br />

Real 12.9 10.1 12.7 9.3<br />

Source: DOE 2001, MIT 2003, Expert Group calculations.<br />

The particular figures and the size <strong>of</strong> the gap between nuclear power and natural gas will vary by country<br />

given the different situation with regard to perceived risk <strong>of</strong> investment in different options and the<br />

cost <strong>of</strong> finance among other factors. For example, countries where perceived risks in nuclear power are<br />

lower might have a much smaller gap in the weighted cost <strong>of</strong> capital between the two options.<br />

Furthermore, a particular firm might have rather different costs <strong>of</strong> capital. For example, a state-owned<br />

company borrowing on the sovereign guarantee with the costs <strong>of</strong> the power passed through to consumers<br />

10. MIT, 2003.<br />

11. DOE, 2001.<br />

184