Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Projected Costs of Generating Electricity - OECD Nuclear Energy ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

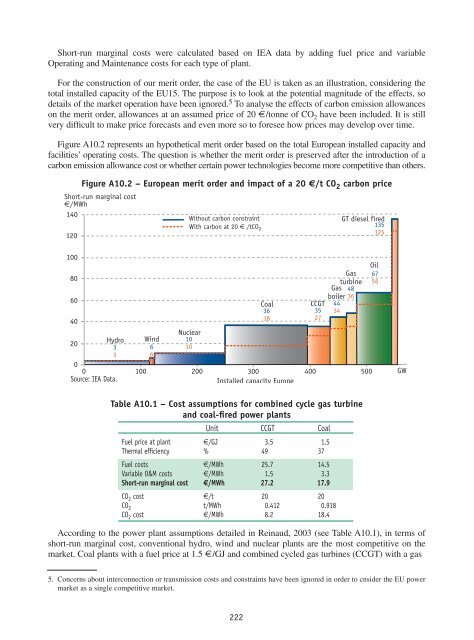

Short-run marginal costs were calculated based on IEA data by adding fuel price and variable<br />

Operating and Maintenance costs for each type <strong>of</strong> plant.<br />

For the construction <strong>of</strong> our merit order, the case <strong>of</strong> the EU is taken as an illustration, considering the<br />

total installed capacity <strong>of</strong> the EU15. The purpose is to look at the potential magnitude <strong>of</strong> the effects, so<br />

details <strong>of</strong> the market operation have been ignored. 5 To analyse the effects <strong>of</strong> carbon emission allowances<br />

on the merit order, allowances at an assumed price <strong>of</strong> 20 €/tonne <strong>of</strong> CO 2 have been included. It is still<br />

very difficult to make price forecasts and even more so to foresee how prices may develop over time.<br />

Figure A10.2 represents an hypothetical merit order based on the total European installed capacity and<br />

facilities’ operating costs. The question is whether the merit order is preserved after the introduction <strong>of</strong> a<br />

carbon emission allowance cost or whether certain power technologies become more competitive than others.<br />

Short-run marginal cost<br />

€/MWh<br />

140<br />

120<br />

Figure A10.2 – European merit order and impact <strong>of</strong> a 20 €/t CO 2 carbon price<br />

Without carbon constraint<br />

With carbon at 20 € /tCO 2<br />

GT diesel fired<br />

135<br />

125<br />

100<br />

Oil<br />

80<br />

Gas 67<br />

turbine 56<br />

Gas 48<br />

60<br />

boiler 36<br />

Coal CCGT 44<br />

36<br />

35 34<br />

40<br />

18<br />

27<br />

<strong>Nuclear</strong><br />

20<br />

Hydro Wind 10<br />

3 6 10<br />

3 6<br />

Source: IEA Data.<br />

Installed capacity Europe<br />

Table A10.1 – Cost assumptions for combined cycle gas turbine<br />

and coal-fired power plants<br />

Unit CCGT Coal<br />

Fuel price at plant €/GJ 3.5 1.5<br />

Thermal efficiency % 49 37<br />

Fuel costs €/MWh 25.7 14.5<br />

Variable O&M costs €/MWh 1.5 3.3<br />

Short-run marginal cost €/MWh 27.2 17.9<br />

CO 2 cost €/t 20 20<br />

CO 2 t/MWh 0.412 0.918<br />

CO 2 cost €/MWh 8.2 18.4<br />

500 GW<br />

According to the power plant assumptions detailed in Reinaud, 2003 (see Table A10.1), in terms <strong>of</strong><br />

short-run marginal cost, conventional hydro, wind and nuclear plants are the most competitive on the<br />

market. Coal plants with a fuel price at 1.5 €/GJ and combined cycled gas turbines (CCGT) with a gas<br />

5. Concerns about interconnection or transmission costs and constraints have been ignored in order to cnsider the EU power<br />

market as a single competitive market.<br />

222