Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Projected Costs of Generating Electricity - OECD Nuclear Energy ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Values in 1O-10<br />

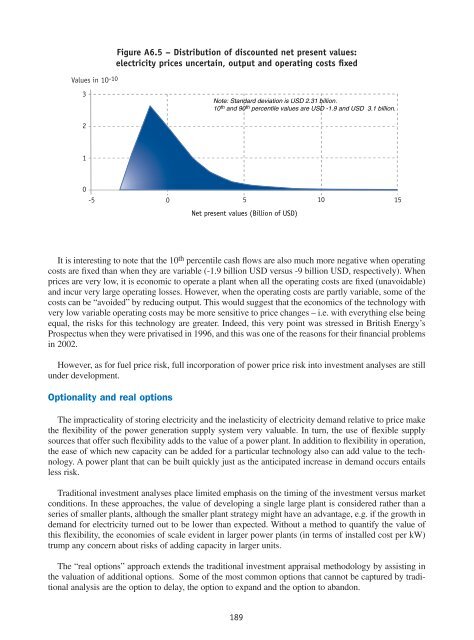

Figure A6.5 – Distribution <strong>of</strong> discounted net present values:<br />

electricity prices uncertain, output and operating costs fixed<br />

3<br />

Note: Standard deviation is USD 2.31 billion.<br />

10 th and 90 th percentile values are USD -1.9 and USD 3.1 billion.<br />

2<br />

1<br />

0<br />

-5 0 5<br />

10 15<br />

Net present values (Billion <strong>of</strong> USD)<br />

It is interesting to note that the 10 th percentile cash flows are also much more negative when operating<br />

costs are fixed than when they are variable (-1.9 billion USD versus -9 billion USD, respectively). When<br />

prices are very low, it is economic to operate a plant when all the operating costs are fixed (unavoidable)<br />

and incur very large operating losses. However, when the operating costs are partly variable, some <strong>of</strong> the<br />

costs can be “avoided” by reducing output. This would suggest that the economics <strong>of</strong> the technology with<br />

very low variable operating costs may be more sensitive to price changes – i.e. with everything else being<br />

equal, the risks for this technology are greater. Indeed, this very point was stressed in British <strong>Energy</strong>’s<br />

Prospectus when they were privatised in 1996, and this was one <strong>of</strong> the reasons for their financial problems<br />

in 2002.<br />

However, as for fuel price risk, full incorporation <strong>of</strong> power price risk into investment analyses are still<br />

under development.<br />

Optionality and real options<br />

The impracticality <strong>of</strong> storing electricity and the inelasticity <strong>of</strong> electricity demand relative to price make<br />

the flexibility <strong>of</strong> the power generation supply system very valuable. In turn, the use <strong>of</strong> flexible supply<br />

sources that <strong>of</strong>fer such flexibility adds to the value <strong>of</strong> a power plant. In addition to flexibility in operation,<br />

the ease <strong>of</strong> which new capacity can be added for a particular technology also can add value to the technology.<br />

A power plant that can be built quickly just as the anticipated increase in demand occurs entails<br />

less risk.<br />

Traditional investment analyses place limited emphasis on the timing <strong>of</strong> the investment versus market<br />

conditions. In these approaches, the value <strong>of</strong> developing a single large plant is considered rather than a<br />

series <strong>of</strong> smaller plants, although the smaller plant strategy might have an advantage, e.g. if the growth in<br />

demand for electricity turned out to be lower than expected. Without a method to quantify the value <strong>of</strong><br />

this flexibility, the economies <strong>of</strong> scale evident in larger power plants (in terms <strong>of</strong> installed cost per kW)<br />

trump any concern about risks <strong>of</strong> adding capacity in larger units.<br />

The “real options” approach extends the traditional investment appraisal methodology by assisting in<br />

the valuation <strong>of</strong> additional options. Some <strong>of</strong> the most common options that cannot be captured by traditional<br />

analysis are the option to delay, the option to expand and the option to abandon.<br />

189