- Page 1:

NUCLEAR ENERGY AGENCY INTERNATIONAL

- Page 4:

ORGANISATION FOR ECONOMIC CO-OPERAT

- Page 9 and 10:

Table of Contents Table of Contents

- Page 11:

Figures Figure 3.1 Specific overnig

- Page 14 and 15:

The introduction of liberalisation

- Page 16 and 17:

150 USD/MWh at a 5% discount rate a

- Page 18 and 19:

The technologies and plant types co

- Page 20 and 21:

locations and/or very favourable co

- Page 22 and 23:

conclusions of the study were used

- Page 25 and 26:

Chapter 2 Input Data and Cost Calcu

- Page 27 and 28:

equipped with emission control devi

- Page 29 and 30:

Table 2.2 - Exchange rates (as of 1

- Page 31 and 32:

Table 2.4 - Coal plant specificatio

- Page 33 and 34:

Table 2.7 - Wind and solar power pl

- Page 35:

Table 2.10 - Other plant specificat

- Page 38 and 39:

Figure 3.1 - Specific overnight con

- Page 40 and 41:

exchange rates, the coal prices var

- Page 42 and 43:

Construction time Gas-fired power p

- Page 44 and 45:

USD/MWh 70 60 Figure 3.5 - Levelise

- Page 46 and 47:

O&M costs The specific annual O&M c

- Page 48 and 49:

Cost ranges for coal, gas and nucle

- Page 50 and 51:

Ratio 1.9 Figure 3.12 - Cost ratios

- Page 52 and 53:

Table 3.11 - Overnight construction

- Page 54 and 55:

Table 3.14 - Projected generation c

- Page 56 and 57:

Except for the offshore plant in th

- Page 58 and 59:

At 10% discount rate, the levelised

- Page 60 and 61:

At 5% discount rate, hydroelectrici

- Page 62 and 63:

Table 4.4 - Overnight construction

- Page 64 and 65:

Table 4.6 - Projected generation co

- Page 66 and 67:

A CHP plant typically supplies heat

- Page 68 and 69:

Table 5.1 - Overnight construction

- Page 70 and 71:

Figure 5.2 - Levelised costs of ele

- Page 72 and 73:

lower unit capital and operating co

- Page 74 and 75:

Table 6.5 - Overnight construction

- Page 76 and 77:

cost calculation for some 130 power

- Page 78 and 79:

It should be stressed that the plan

- Page 80 and 81:

Concluding remarks The lowest level

- Page 82 and 83:

Portugal Mr. António B. Gomes EDP

- Page 84 and 85:

Table A2.1 - Nuclear plant investme

- Page 86 and 87:

Overnight Capital Costs: Constructi

- Page 88 and 89:

Table A2.7 - Gas-fired (including C

- Page 90 and 91:

Table A2.10 - Wind plant investment

- Page 92 and 93:

Overnight Capital Costs: Constructi

- Page 94 and 95:

Overnight Capital Costs: Constructi

- Page 96 and 97:

Cost structure of supported green e

- Page 98 and 99:

The highest investment cost arises

- Page 100 and 101:

The expected development of the per

- Page 102 and 103:

● ● Autoproducers. These firms

- Page 104 and 105:

Canada The electricity market situa

- Page 106 and 107:

Natural gas - combined cycle gas tu

- Page 108 and 109:

Denmark Basic data Denmark has abou

- Page 110 and 111:

In the future, both an increase in

- Page 112 and 113:

nuclear operator Teollisuuden Voima

- Page 114 and 115:

these power generation methods. Two

- Page 116 and 117:

Figure 5 - Competitiveness of vario

- Page 118 and 119:

2004. It envisages the gradual incr

- Page 120 and 121:

Table 4 - Gross electricity supply

- Page 122 and 123:

● ● ● ● ● ● ● ● ●

- Page 124 and 125:

Electricity generation costs The to

- Page 126 and 127:

photovoltaic device. Finally the su

- Page 128 and 129:

Table 1 - Installed electric power

- Page 130 and 131:

Japan Consumers in Japan are suppli

- Page 132 and 133:

BPE will be established not as a bi

- Page 134 and 135:

Coal Coal fired power plants have b

- Page 136 and 137:

A new sewage treatment plant with a

- Page 138 and 139: The interconnections between Portug

- Page 140 and 141: In order to respond to these basic

- Page 142 and 143: efficient energies and is reducing

- Page 144 and 145: Liberalisation Basic restructuring

- Page 146 and 147: External costs for electricity prod

- Page 148 and 149: At the beginning of plant operation

- Page 150 and 151: and high ash, moisture and sulphur

- Page 152 and 153: The White Paper did not contain pro

- Page 154 and 155: Table 7 shows the projected load fa

- Page 156 and 157: other investment options available

- Page 158 and 159: The impurities contained in coal ar

- Page 160 and 161: “ultra-supercritical” condition

- Page 162 and 163: unmineable coal seams. All three pr

- Page 164 and 165: Light water reactors require enrich

- Page 166 and 167: concerns. Consequently, the natural

- Page 168 and 169: generators and power electronics el

- Page 170 and 171: conventional fossil-fired plants. B

- Page 172 and 173: ● ● very effective and is used

- Page 175 and 176: Appendix 5 Cost Estimation Methodol

- Page 177: into account in the real price of g

- Page 180 and 181: ● ● ● ● Factors under the c

- Page 182 and 183: and small power plants. Although th

- Page 184 and 185: The general approach remains useful

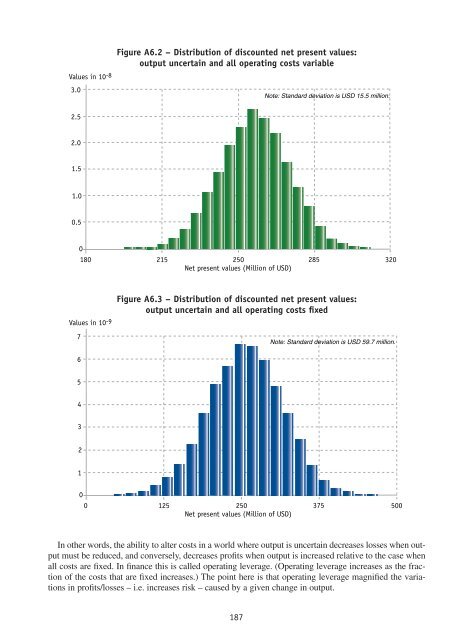

- Page 186 and 187: Two US economic analyses of nuclear

- Page 190 and 191: The effects of price risk on techno

- Page 192 and 193: The option to delay is embedded in

- Page 195 and 196: Appendix 7 Allocating the Costs and

- Page 197 and 198: Further Fourier’s law for heat tr

- Page 199 and 200: Figure A7.4 - The energy conversion

- Page 201 and 202: This yields: β = 0.153 α. If α e

- Page 203: It is emphasised that depending on

- Page 206 and 207: 1 st oil shock 2 nd oil shock Saudi

- Page 208 and 209: Table A8.2 - Expected lower and upp

- Page 210 and 211: Reliability in electricity systems

- Page 212 and 213: is also highly dependent on the typ

- Page 214 and 215: In the ILEX study 5 and in another

- Page 216 and 217: an increasing share of wind is the

- Page 218 and 219: able to work out the optimal operat

- Page 221 and 222: Appendix 10 Impact of Carbon Emissi

- Page 223 and 224: costs of generation. The introducti

- Page 225 and 226: price at 3.5 €/GJ are the next fa

- Page 227 and 228: Figure A10.5 - Steam coal price var

- Page 229 and 230: The longer term impact on investmen

- Page 231 and 232: Appendix 11 List of Main Abbreviati

- Page 233: OECD PUBLICATIONS, 2 rue André-Pas