Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Projected Costs of Generating Electricity - OECD Nuclear Energy ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

price at 3.5 €/GJ are the next facilities in the merit order. Their relative competitiveness is sensitive to<br />

fuel price. Gas prices have to decline to approximately 2.23 €/GJ before the two facilities have the same<br />

short-run marginal cost. At gas prices lower than this, CCGT technologies are more competitive.<br />

A variation in the carbon emission price has a similar effect on the plants’ competitiveness as a change<br />

in fuel prices. There can be a change in merit order when a carbon emission price is included as an additional<br />

variable cost because gas has lower CO 2 emission per unit <strong>of</strong> power produced than coal. At a CO 2<br />

price <strong>of</strong> 20 €/tonne, the competitiveness order for coal and CCGT power plants reverses.<br />

This breakeven price between an existing coal-fired power plant and an existing gas-fired power plant<br />

is clearly sensitive to a number <strong>of</strong> the assumptions:<br />

● Gas prices. Gas prices are volatile. According to the World <strong>Energy</strong> Outlook 2002, in 2010 the average<br />

gas price <strong>of</strong> European imports is projected to decrease to 2.8 USD/MBtu (or 3.1 €/GJ). This price is<br />

nevertheless expected to increase to 3.3 USD/MBtu in 2020. Therefore, as a CCGT would operate for<br />

approximately 25 years, the fuel costs would vary considerably which could in turn influence the<br />

plants’ competitiveness.<br />

● Efficiency rate. Some analysis suggest that the CCGT starting operation around 2010 could reach an<br />

average efficiency rate <strong>of</strong> 57%, which would bring down the costs for running such a plant as well as<br />

lower the carbon dioxide emissions. Similarly, a coal plant starting operation in 2010 could expect an<br />

efficiency <strong>of</strong> 46%.<br />

● Other costs driven by other environmental policies. In the EU, the Large Combustion Plant<br />

Directive might also affect the plants’ operating costs. Investment decisions made on implementing fluidised<br />

gas desulphurisation at coal plants could have impacts on the plants’ emissions.<br />

● Operating and Maintenance costs.<br />

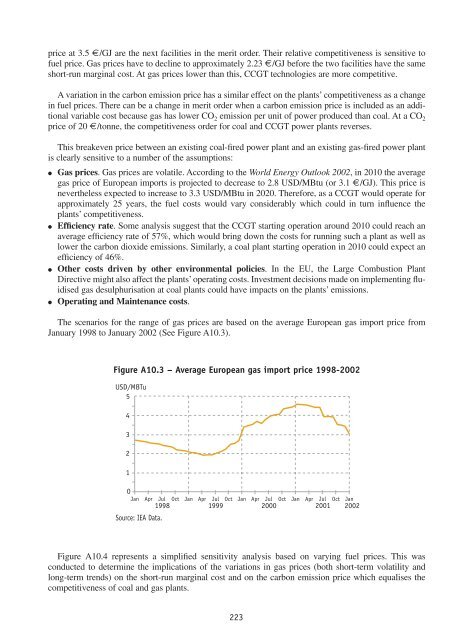

The scenarios for the range <strong>of</strong> gas prices are based on the average European gas import price from<br />

January 1998 to January 2002 (See Figure A10.3).<br />

Figure A10.3 – Average European gas import price 1998-2002<br />

USD/MBTu<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan<br />

1998 1999<br />

2000 2001 2002<br />

Source: IEA Data.<br />

Figure A10.4 represents a simplified sensitivity analysis based on varying fuel prices. This was<br />

conducted to determine the implications <strong>of</strong> the variations in gas prices (both short-term volatility and<br />

long-term trends) on the short-run marginal cost and on the carbon emission price which equalises the<br />

competitiveness <strong>of</strong> coal and gas plants.<br />

223