2013/14 Recommended Budget - City of St. George

2013/14 Recommended Budget - City of St. George

2013/14 Recommended Budget - City of St. George

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TRANSPORTATION IMPROVEMENT FUND<br />

The Transportation Improvement Fund (TIF) is a Special Revenue fund used to account for revenues restricted as to their use for<br />

specific purposes either by statute or by <strong>City</strong> Policy. In 1998, voters authorized a 1/4 cent sales tax, also known as the Highway<br />

Option Sales Tax, to be used for transportation-related improvements. The <strong>City</strong> <strong>of</strong> <strong>St</strong>. <strong>George</strong> invoked the Highway Option Sales tax<br />

on January 1, 1999 and in 2007, the <strong>St</strong>ate Legislature passed an increase from .25% to .30% on non-food items while deleting the tax<br />

on food items.<br />

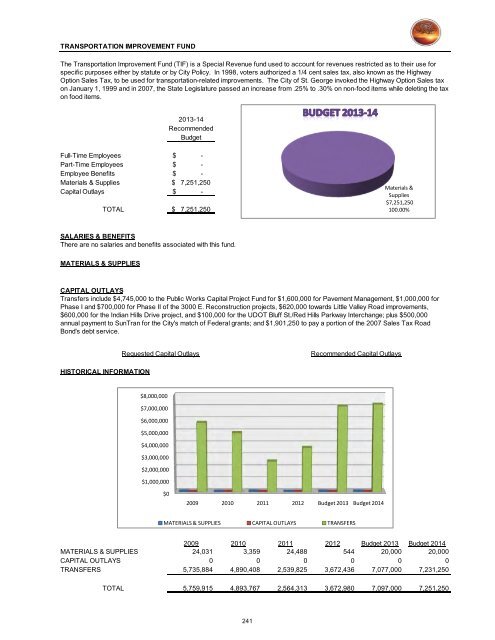

<strong>2013</strong>-<strong>14</strong><br />

<strong>Recommended</strong><br />

<strong>Budget</strong><br />

Full-Time Employees $ -<br />

Part-Time Employees $ -<br />

Employee Benefits $ -<br />

Materials & Supplies $ 7,251,250<br />

Capital Outlays $ -<br />

TOTAL $ 7,251,250<br />

Materials &<br />

Supplies<br />

$7,251,250<br />

100.00%<br />

SALARIES & BENEFITS<br />

There are no salaries and benefits associated with this fund.<br />

MATERIALS & SUPPLIES<br />

CAPITAL OUTLAYS<br />

Transfers include $4,745,000 to the Public Works Capital Project Fund for $1,600,000 for Pavement Management, $1,000,000 for<br />

Phase I and $700,000 for Phase II <strong>of</strong> the 3000 E. Reconstruction projects, $620,000 towards Little Valley Road improvements,<br />

$600,000 for the Indian Hills Drive project, and $100,000 for the UDOT Bluff <strong>St</strong>./Red Hills Parkway Interchange; plus $500,000<br />

annual payment to SunTran for the <strong>City</strong>'s match <strong>of</strong> Federal grants; and $1,901,250 to pay a portion <strong>of</strong> the 2007 Sales Tax Road<br />

Bond's debt service.<br />

Requested Capital Outlays<br />

<strong>Recommended</strong> Capital Outlays<br />

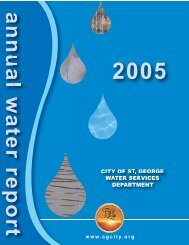

HISTORICAL INFORMATION<br />

$8,000,000<br />

$7,000,000<br />

$6,000,000<br />

$5,000,000<br />

$4,000,000<br />

$3,000,000<br />

$2,000,000<br />

$1,000,000<br />

$0<br />

2009 2010 2011 2012 <strong>Budget</strong> <strong>2013</strong> <strong>Budget</strong> 20<strong>14</strong><br />

MATERIALS & SUPPLIES CAPITAL OUTLAYS TRANSFERS<br />

2009 2010 2011 2012 <strong>Budget</strong> <strong>2013</strong> <strong>Budget</strong> 20<strong>14</strong><br />

MATERIALS & SUPPLIES 24,031 3,359 24,488 544 20,000 20,000<br />

CAPITAL OUTLAYS 0 0 0 0 0 0<br />

TRANSFERS 5,735,884 4,890,408 2,539,825 3,672,436 7,077,000 7,231,250<br />

TOTAL 5,759,915 4,893,767 2,564,313 3,672,980 7,097,000 7,251,250<br />

241