Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

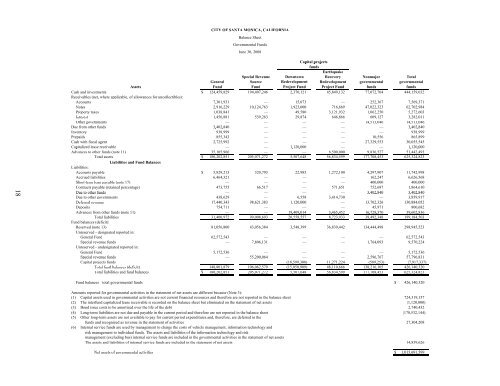

CITY OF SANTA MONICA, CALIFORNIA<br />

Balance Sheet<br />

Governmental Funds<br />

June 30, 2008<br />

18<br />

Capital p projectsp j<br />

funds<br />

Earthquake<br />

Special Revenue Downtown Recovery Nonmajor Total<br />

General Source Redevelopment Redevelopment governmental governmental<br />

Assets Fund Fund Project Fund Project Fund funds funds<br />

Cash and investments $ 124,459,829459 194,407,246407 2,370,121 45,849,132 77,072,704 704 444,159,032<br />

Receivables (net, where h applicable, <strong>of</strong> f allowances for uncollectibles):<br />

)<br />

Accounts 7,301,931 — 15,073 — 252,367 7,569,371<br />

Notes 2,916,229 10,124,763 1,923,000 716,669 47,022,323 62,702,984<br />

Property taxes 1,038,841 841 — 49,580 3,121,932 1,062,250 250 5,272,603<br />

Interest e t 1,456,881 539,263 29,874 646,866 609,127 3,282,011<br />

Other governments — — — — 14,513,046 14,513,046<br />

Due from other funds 3,402,840 , — — — — 3,402,840<br />

,<br />

Inventory 938,999999 — — — — 938,999999<br />

Prepaids 855,343 — — — 10,556 865,899899<br />

Cash with fiscal agent 2,725,992 — — — 27,329,553 30,055,545055 545<br />

Capitalized lease receivable — — 1,120,000 , — — 1,120,000<br />

,<br />

Advances to other funds (note 11) 35,105,966 — — 6,500,000 9,836,527 51,442,493<br />

Total assets $ 180,202,851<br />

851<br />

205,071,272071 272 5,507,648507 56,834,599 599 177,708,453708 625,324,823<br />

Liabilities i and Fund Balances<br />

Liabilities:<br />

Accounts payable $ 5,829,213<br />

213<br />

320,793 22,985 1,272,100 100 4,297,907 907 11,742,998<br />

Accrued liabilities 6,464,321 — — — 162,247247 6,626,568626 Short-term t loan payable (note 17) — — — — 400,000000 400,000000<br />

Contracts py payable (retained percentage) g)<br />

473,755 66,517 — 571,651 752,687 1,864,610<br />

Due to other funds — — — — 3,402,840 3,402,840<br />

Due to other governments 438,629 — 6,558 3,414,730 — 3,859,917<br />

917<br />

Df Deferred revenue 17,440,343 98,621,383 1,120,000120 000 — 13,702,326 326 130,884,052<br />

052<br />

Deposits 754,711 — — — 45,971 800,682<br />

Advances from other funds (note 11) — — 19,409,014 , 3,465,452 , 16,728,370 , 39,602,836<br />

,<br />

Total liabilities 31,400,972 99,008,693 20,558,557 557 8,723,933 39,492,348 348 199,184,503184 Fund balances (deficit):<br />

Reserved (note 13) 81,056,800 800 43,056,384 384 3,548,399 399 36,839,442 134,444,498444 498 298,945,523945 523<br />

Unreserved - designated g reported in:<br />

General Fund 62,572,543 — — — — 62,572,543<br />

Special revenue funds — 7,806,131 — — 1,764,093 9,570,224<br />

Unreserved - undesignated tdreported tdin:<br />

General Fund 5,172,536 — — — — 5,172,536<br />

Special revenue funds — 55,200,064 — — 2,596,767 57,796,831<br />

Capital projects funds — — (18,599,308) 11,271,224 224 (589,253) (7,917,337)<br />

Total fund balances (deficit) it) 148,801,879801 879 106,062,579062 (15,050,909) 48,110,666 138,216,105 105 426,140,320<br />

Total l liabilities i and d fund d balancesl $ 180,202,851 205,071,272 5,507,648 56,834,599 177,708,453 625,324,823<br />

Fund balances - total governmental funds $<br />

426,140,320<br />

Amounts reported for governmental activities in the statement <strong>of</strong> net assets are different because (Note 3):<br />

(1) Capital assets used in governmental activities are not current financial resources and therefore are not reported in the balance sheet 724,319,157<br />

,<br />

(2) The interfund capitalized lease receivable is recorded on the balance sheet but eliminated on the statement <strong>of</strong> net assets (1,120,000) 120 000)<br />

(3) Bond issue costs to be amortized over the life <strong>of</strong> the debt 2,740,432<br />

432<br />

(4) Long-term liabilities i are not due and d payable in the h current period i d and d therefore h f are not reported d in the h balance l sheet h (178,532,144) 8 144)<br />

(5) Other long-term assets are not available to pay for current period expenditures and, , therefore, , are deferred in the<br />

funds and recognized as revenue in the statement <strong>of</strong> activities 27,304,208<br />

208<br />

(6) Internal service funds are used by management to charge the costs <strong>of</strong> vehicle management, information technology and<br />

risk i k management t to individual id l funds. d The assets t and d liabilities <strong>of</strong> f the information f technology h l and d riski k<br />

management g (excluding g bus) ) internal service funds are included in the governmental activities in the statement <strong>of</strong> net assets<br />

The assets and liabilities <strong>of</strong> internal service funds are included in the statement <strong>of</strong> net assets 14,839,626<br />

Net t assets t <strong>of</strong> f governmental t l activities iti $ 1,015,691,599<br />

599