Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

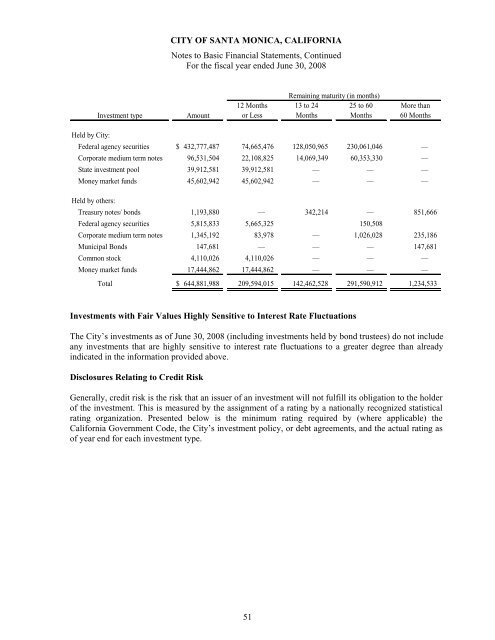

CITY OF SANTA MONICA, CALIFORNIA<br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the fiscal year ended June 30, 2008<br />

Investment type<br />

Amount<br />

12 Months<br />

or Less<br />

Remaining maturity (in months)<br />

13 to 24 25 to 60<br />

Months Months<br />

More than<br />

60 Months<br />

Held by <strong>City</strong>:<br />

Federal agency securities $ 432,777,487 74,665,476 128,050,965 230,061,046 —<br />

Corporate medium term notes 96,531,504 22,108,825 14,069,349 60,353,330 —<br />

State investment pool 39,912,581 39,912,581 — — —<br />

Money market funds 45,602,942 45,602,942 — — —<br />

Held by others:<br />

Treasury notes/ bonds 1,193,880 — 342,214 — 851,666<br />

Federal agency securities 5,815,833 5,665,325 150,508<br />

Corporate medium term notes 1,345,192 83,978 — 1,026,028 235,186<br />

Municipal Bonds 147,681 — — — 147,681<br />

Common stock 4,110,026 4,110,026 — — —<br />

Money market funds 17,444,862 17,444,862 — — —<br />

Total $ 644,881,988 209,594,015 142,462,528 291,590,912 1,234,533<br />

Investments with Fair Values Highly Sensitive to Interest Rate Fluctuations<br />

The <strong>City</strong>’s investments as <strong>of</strong> June 30, 2008 (including investments held by bond trustees) do not include<br />

any investments that are highly sensitive to interest rate fluctuations to a greater degree than already<br />

indicated in the information provided above.<br />

Disclosures Relating to Credit Risk<br />

Generally, credit risk is the risk that an issuer <strong>of</strong> an investment will not fulfill its obligation to the holder<br />

<strong>of</strong> the investment. This is measured by the assignment <strong>of</strong> a rating by a nationally recognized statistical<br />

rating organization. Presented below is the minimum rating required by (where applicable) the<br />

California Government Code, the <strong>City</strong>’s investment policy, or debt agreements, and the actual rating as<br />

<strong>of</strong> year end for each investment type.<br />

51