Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CITY OF SANTA MONICA, CALIFORNIA<br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the fiscal year ended June 30, 2008<br />

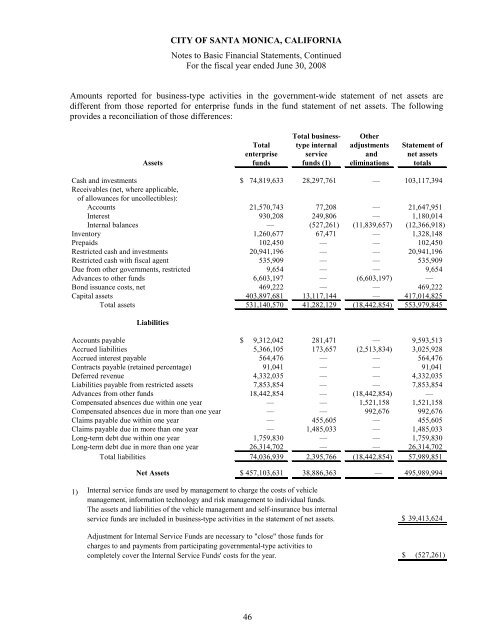

Amounts reported for business-type activities in the government-wide statement <strong>of</strong> net assets are<br />

different from those reported for enterprise funds in the fund statement <strong>of</strong> net assets. The following<br />

provides a reconciliation <strong>of</strong> those differences:<br />

Assets<br />

Total business- Other<br />

Total type internal adjustments Statement <strong>of</strong><br />

enterprise service and net assets<br />

funds funds (1) eliminations totals<br />

Cash and investments $ 74,819,633 28,297,761 — 103,117,394<br />

Receivables (net, where applicable,<br />

<strong>of</strong> allowances for uncollectibles):<br />

Accounts 21,570,743 77,208 — 21,647,951<br />

Interest 930,208 249,806 — 1,180,014<br />

Internal balances — (527,261) (11,839,657) (12,366,918)<br />

Inventory 1,260,677 67,471 — 1,328,148<br />

Prepaids 102,450 — — 102,450<br />

Restricted cash and investments 20,941,196 — — 20,941,196<br />

Restricted cash with fiscal agent 535,909 — — 535,909<br />

Due from other governments, restricted 9,654 — — 9,654<br />

Advances to other funds 6,603,197 — (6,603,197) —<br />

Bond issuance costs, net 469,222 — — 469,222<br />

Capital assets 403,897,681 13,117,144 — 417,014,825<br />

Total assets 531,140,570 41,282,129 (18,442,854) 553,979,845<br />

Liabilities<br />

Accounts payable $ 9,312,042 281,471 — 9,593,513<br />

Accrued liabilities 5,366,105 173,657 (2,513,834) 3,025,928<br />

Accrued interest payable 564,476 — — 564,476<br />

Contracts payable (retained percentage) 91,041 — — 91,041<br />

Deferred revenue 4,332,035 — — 4,332,035<br />

Liabilities payable from restricted assets 7,853,854 — — 7,853,854<br />

Advances from other funds 18,442,854 — (18,442,854) —<br />

Compensated absences due within one year — — 1,521,158 1,521,158<br />

Compensated absences due in more than one year — — 992,676 992,676<br />

Claims payable due within one year — 455,605 — 455,605<br />

Claims payable due in more than one year — 1,485,033 — 1,485,033<br />

Long-term debt due within one year 1,759,830 — — 1,759,830<br />

Long-term debt due in more than one year 26,314,702 — — 26,314,702<br />

Total liabilities 74,036,939 2,395,766 (18,442,854) 57,989,851<br />

Net Assets<br />

$ 457,103,631 38,886,363 — 495,989,994<br />

1)<br />

Internal service funds are used by management to charge the costs <strong>of</strong> vehicle<br />

management, information technology and risk management to individual funds.<br />

The assets and liabilities <strong>of</strong> the vehicle management and self-insurance bus internal<br />

service funds are included in business-type activities in the statement <strong>of</strong> net assets.<br />

$ 39,413,624<br />

Adjustment for Internal Service Funds are necessary to "close" those funds for<br />

charges to and payments from participating governmental-type activities to<br />

completely cover the Internal Service Funds' costs for the year.<br />

$<br />

(527,261)<br />

46