Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CITY OF SANTA MONICA, CALIFORNIA<br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the fiscal year ended June 30, 2008<br />

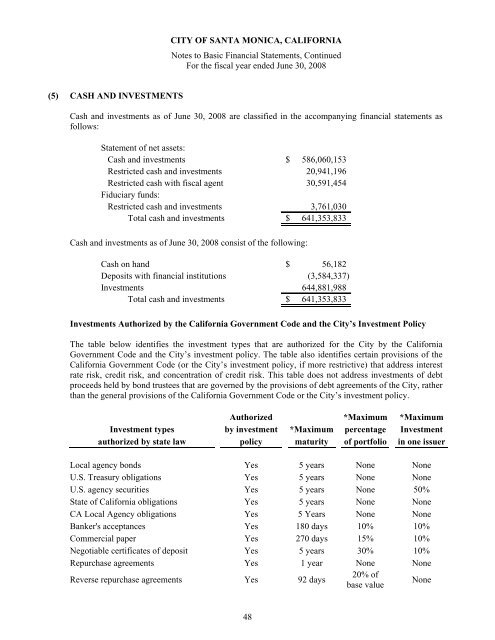

(5) CASH AND INVESTMENTS<br />

Cash and investments as <strong>of</strong> June 30, 2008 are classified in the accompanying financial statements as<br />

follows:<br />

Statement <strong>of</strong> net assets:<br />

Cash and investments $ 586,060,153<br />

Restricted cash and investments 20,941,196<br />

Restricted cash with fiscal agent 30,591,454<br />

Fiduciary funds:<br />

Restricted cash and investments 3,761,030<br />

Total cash and investments $ 641,353,833<br />

Cash and investments as <strong>of</strong> June 30, 2008 consist <strong>of</strong> the following:<br />

Cash on hand $ 56,182<br />

Deposits with financial institutions (3,584,337)<br />

Investments 644,881,988<br />

Total cash and investments $ 641,353,833<br />

Investments Authorized by the California Government Code and the <strong>City</strong>’s Investment Policy<br />

The table below identifies the investment types that are authorized for the <strong>City</strong> by the California<br />

Government Code and the <strong>City</strong>’s investment policy. The table also identifies certain provisions <strong>of</strong> the<br />

California Government Code (or the <strong>City</strong>’s investment policy, if more restrictive) that address interest<br />

rate risk, credit risk, and concentration <strong>of</strong> credit risk. This table does not address investments <strong>of</strong> debt<br />

proceeds held by bond trustees that are governed by the provisions <strong>of</strong> debt agreements <strong>of</strong> the <strong>City</strong>, rather<br />

than the general provisions <strong>of</strong> the California Government Code or the <strong>City</strong>’s investment policy.<br />

Authorized *Maximum *Maximum<br />

Investment types by investment *Maximum percentage Investment<br />

authorized by state law policy maturity <strong>of</strong> portfolio in one issuer<br />

Local agency bonds Yes 5 years None None<br />

U.S. Treasury obligations Yes 5 years None None<br />

U.S. agency securities Yes 5 years None 50%<br />

State <strong>of</strong> California obligations Yes 5 years None None<br />

CA Local Agency obligations Yes 5 Years None None<br />

Banker's acceptances Yes 180 days 10% 10%<br />

Commercial paper Yes 270 days 15% 10%<br />

Negotiable certificates <strong>of</strong> deposit Yes 5 years 30% 10%<br />

Repurchase agreements Yes 1 year None None<br />

Reverse repurchase agreements Yes 92 days<br />

20% <strong>of</strong><br />

base value<br />

None<br />

48