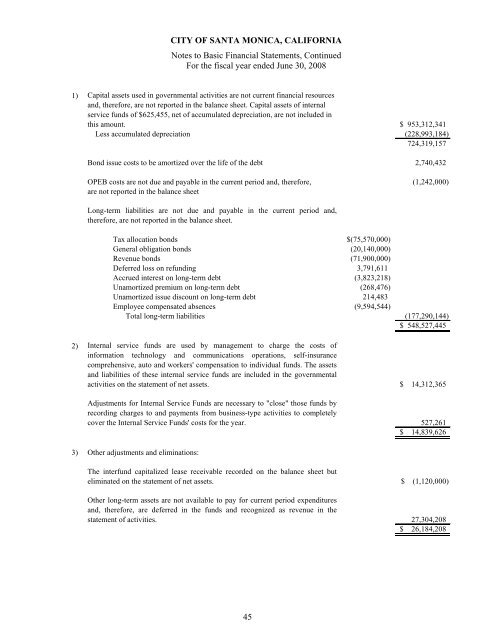

CITY OF SANTA MONICA, CALIFORNIA Notes to Basic <strong>Financial</strong> Statements, Continued For the fiscal year ended June 30, 2008 1) Capital assets used in governmental activities are not current financial resources and, therefore, are not reported in the balance sheet. Capital assets <strong>of</strong> internal service funds <strong>of</strong> $625,455, net <strong>of</strong> accumulated depreciation, are not included in this amount. $ 953,312,341 Less accumulated depreciation (228,993,184) 724,319,157 Bond issue costs to be amortized over the life <strong>of</strong> the debt 2,740,432 OPEB costs are not due and payable in the current period and, therefore, (1,242,000) are not reported in the balance sheet Long-term liabilities are not due and payable in the current period and, therefore, are not reported in the balance sheet. Tax allocation bonds $ (75,570,000) General obligation bonds (20,140,000) Revenue bonds (71,900,000) Deferred loss on refunding 3,791,611 Accrued interest on long-term debt (3,823,218) Unamortized premium on long-term debt (268,476) Unamortized issue discount on long-term debt 214,483 Employee compensated absences (9,594,544) Total long-term liabilities (177,290,144) $ 548,527,445 2) Internal service funds are used by management to charge the costs <strong>of</strong> information technology and communications operations, self-insurance comprehensive, auto and workers' compensation to individual funds. The assets and liabilities <strong>of</strong> these internal service funds are included in the governmental activities on the statement <strong>of</strong> net assets. $ 14,312,365 Adjustments for Internal Service Funds are necessary to "close" those funds by recording charges to and payments from business-type activities to completely cover the Internal Service Funds' costs for the year. $ 527,261 14,839,626 3) Other adjustments and eliminations: The interfund capitalized lease receivable recorded on the balance sheet but eliminated on the statement <strong>of</strong> net assets. Other long-term assets are not available to pay for current period expenditures and, therefore, are deferred in the funds and recognized as revenue in the statement <strong>of</strong> activities. $ $ (1,120,000) 27,304,208 26,184,208 45

CITY OF SANTA MONICA, CALIFORNIA Notes to Basic <strong>Financial</strong> Statements, Continued For the fiscal year ended June 30, 2008 Amounts reported for business-type activities in the government-wide statement <strong>of</strong> net assets are different from those reported for enterprise funds in the fund statement <strong>of</strong> net assets. The following provides a reconciliation <strong>of</strong> those differences: Assets Total business- Other Total type internal adjustments Statement <strong>of</strong> enterprise service and net assets funds funds (1) eliminations totals Cash and investments $ 74,819,633 28,297,761 — 103,117,394 Receivables (net, where applicable, <strong>of</strong> allowances for uncollectibles): Accounts 21,570,743 77,208 — 21,647,951 Interest 930,208 249,806 — 1,180,014 Internal balances — (527,261) (11,839,657) (12,366,918) Inventory 1,260,677 67,471 — 1,328,148 Prepaids 102,450 — — 102,450 Restricted cash and investments 20,941,196 — — 20,941,196 Restricted cash with fiscal agent 535,909 — — 535,909 Due from other governments, restricted 9,654 — — 9,654 Advances to other funds 6,603,197 — (6,603,197) — Bond issuance costs, net 469,222 — — 469,222 Capital assets 403,897,681 13,117,144 — 417,014,825 Total assets 531,140,570 41,282,129 (18,442,854) 553,979,845 Liabilities Accounts payable $ 9,312,042 281,471 — 9,593,513 Accrued liabilities 5,366,105 173,657 (2,513,834) 3,025,928 Accrued interest payable 564,476 — — 564,476 Contracts payable (retained percentage) 91,041 — — 91,041 Deferred revenue 4,332,035 — — 4,332,035 Liabilities payable from restricted assets 7,853,854 — — 7,853,854 Advances from other funds 18,442,854 — (18,442,854) — Compensated absences due within one year — — 1,521,158 1,521,158 Compensated absences due in more than one year — — 992,676 992,676 Claims payable due within one year — 455,605 — 455,605 Claims payable due in more than one year — 1,485,033 — 1,485,033 Long-term debt due within one year 1,759,830 — — 1,759,830 Long-term debt due in more than one year 26,314,702 — — 26,314,702 Total liabilities 74,036,939 2,395,766 (18,442,854) 57,989,851 Net Assets $ 457,103,631 38,886,363 — 495,989,994 1) Internal service funds are used by management to charge the costs <strong>of</strong> vehicle management, information technology and risk management to individual funds. The assets and liabilities <strong>of</strong> the vehicle management and self-insurance bus internal service funds are included in business-type activities in the statement <strong>of</strong> net assets. $ 39,413,624 Adjustment for Internal Service Funds are necessary to "close" those funds for charges to and payments from participating governmental-type activities to completely cover the Internal Service Funds' costs for the year. $ (527,261) 46

- Page 1 and 2:

City of Santa Monica Comprehensive

- Page 3 and 4:

City of Santa Monica, California Ye

- Page 5 and 6:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 7:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 10 and 11:

Master Plan; (2) an ongoing commitm

- Page 12 and 13:

needs of City infrastructure and fa

- Page 15 and 16: OFFICIALS OF THE CITY OF SANTA MONI

- Page 17 and 18: Certificate of Achievement for Exce

- Page 19 and 20: The Honorable Mayor and City Counci

- Page 21 and 22: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 23 and 24: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 25 and 26: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 27 and 28: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 29 and 30: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 31 and 32: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 33 and 34: City of Santa Monica, California Ye

- Page 35 and 36: CITY OF SANTA MONICA, CALIFORNIA St

- Page 37 and 38: CITY OF SANTA MONICA, CALIFORNIA Ba

- Page 39 and 40: CITY OF SANTA MONICA, CALIFORNIA Re

- Page 41 and 42: CITY OF SANTA MONICA, CALIFORNIA St

- Page 43 and 44: CITY OF SANTA MONICA, CALIFORNIA St

- Page 45 and 46: THIS PAGE INTENTIONALLY LEFT BLANK

- Page 47 and 48: CITY OF SANTA MONICA, CALIFORNIA St

- Page 49 and 50: CITY OF SANTA MONICA, CALIFORNIA St

- Page 51 and 52: CITY OF SANTA MONICA, CALIFORNIA St

- Page 53 and 54: CITY OF SANTA MONICA, CALIFORNIA St

- Page 55 and 56: CITY OF SANTA MONICA, CALIFORNIA No

- Page 57 and 58: CITY OF SANTA MONICA, CALIFORNIA No

- Page 59 and 60: CITY OF SANTA MONICA, CALIFORNIA No

- Page 61 and 62: CITY OF SANTA MONICA, CALIFORNIA No

- Page 63: CITY OF SANTA MONICA, CALIFORNIA No

- Page 67 and 68: CITY OF SANTA MONICA, CALIFORNIA No

- Page 69 and 70: CITY OF SANTA MONICA, CALIFORNIA No

- Page 71 and 72: CITY OF SANTA MONICA, CALIFORNIA No

- Page 73 and 74: CITY OF SANTA MONICA, CALIFORNIA No

- Page 75 and 76: CITY OF SANTA MONICA, CALIFORNIA No

- Page 77 and 78: CITY OF SANTA MONICA, CALIFORNIA No

- Page 79 and 80: CITY OF SANTA MONICA, CALIFORNIA No

- Page 81 and 82: CITY OF SANTA MONICA, CALIFORNIA No

- Page 83 and 84: CITY OF SANTA MONICA, CALIFORNIA No

- Page 85 and 86: CITY OF SANTA MONICA, CALIFORNIA No

- Page 87 and 88: CITY OF SANTA MONICA, CALIFORNIA No

- Page 89 and 90: CITY OF SANTA MONICA, CALIFORNIA No

- Page 91 and 92: CITY OF SANTA MONICA, CALIFORNIA No

- Page 93 and 94: CITY OF SANTA MONICA, CALIFORNIA No

- Page 95 and 96: CITY OF SANTA MONICA, CALIFORNIA No

- Page 97 and 98: CITY OF SANTA MONICA, CALIFORNIA No

- Page 99 and 100: CITY OF SANTA MONICA, CALIFORNIA No

- Page 101 and 102: THIS PAGE INTENTIONALLY LEFT BLANK

- Page 103 and 104: CITY OF SANTA MONICA, CALIFORNIA Re

- Page 106 and 107: CITY OF SANTA MONICA, CALIFORNIA No

- Page 108 and 109: THIS PAGE INTENTIONALLY LEFT BLANK

- Page 110 and 111: CITY OF SANTA MONICA, CALIFORNIA Co

- Page 112 and 113: Total nonmajor Citizens special Mis

- Page 114 and 115:

Total nonmajor Citizens special Mis

- Page 116 and 117:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 118 and 119:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 120 and 121:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 122 and 123:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 124 and 125:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 126 and 127:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 128 and 129:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 130 and 131:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 132 and 133:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 134 and 135:

THIS PAGE INTENTIONALLY LEFT BLANK

- Page 136 and 137:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 138 and 139:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 140 and 141:

CITY OF SANTA MONICA, CALIFORNIA No

- Page 142 and 143:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 144 and 145:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 146 and 147:

CITY OF SANTA MONICA, CALIFORNIA In

- Page 148 and 149:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 150 and 151:

CITY OF SANTA MONICA, CALIFORNIA Fi

- Page 152 and 153:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 154 and 155:

City of Santa Monica, California Ye

- Page 156 and 157:

CITY OF SANTA MONICA, CALIFORNIA Fo

- Page 158 and 159:

CITY OF SANTA MONICA, CALIFORNIA Ch

- Page 160 and 161:

CITY OF SANTA MONICA, CALIFORNIA Fu

- Page 162 and 163:

CITY OF SANTA MONICA, CALIFORNIA Ch

- Page 164 and 165:

CITY OF SANTA MONICA, CALIFORNIA As

- Page 166 and 167:

CITY OF SANTA MONICA, CALIFORNIA Pr

- Page 168 and 169:

CITY OF SANTA MONICA, CALIFORNIA Ta

- Page 170 and 171:

CITY OF SANTA MONICA, CALIFORNIA Ra

- Page 172 and 173:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 174 and 175:

CITY OF SANTA MONICA, CALIFORNIA Re

- Page 176 and 177:

CITY OF SANTA MONICA, CALIFORNIA Re

- Page 178 and 179:

CITY OF SANTA MONICA, CALIFORNIA Pr

- Page 180 and 181:

CITY OF SANTA MONICA, CALIFORNIA Op

- Page 182:

THIS PAGE INTENTIONALLY LEFT BLANK