Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Comprehensive Annual Financial Report - City of Santa Monica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CITY OF SANTA MONICA, CALIFORNIA<br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the fiscal year ended June 30, 2008<br />

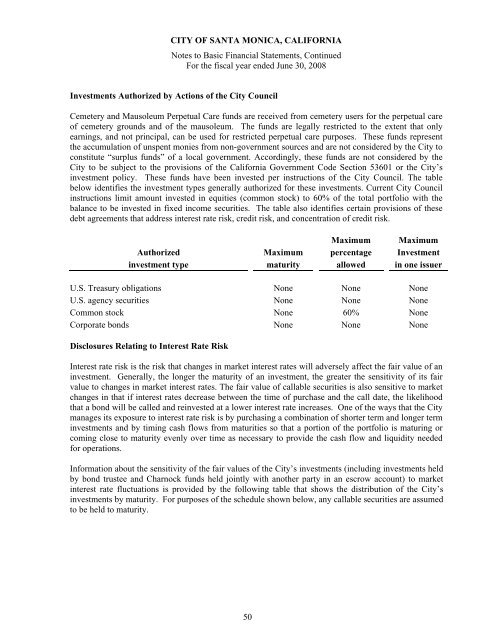

Investments Authorized by Actions <strong>of</strong> the <strong>City</strong> Council<br />

Cemetery and Mausoleum Perpetual Care funds are received from cemetery users for the perpetual care<br />

<strong>of</strong> cemetery grounds and <strong>of</strong> the mausoleum. The funds are legally restricted to the extent that only<br />

earnings, and not principal, can be used for restricted perpetual care purposes. These funds represent<br />

the accumulation <strong>of</strong> unspent monies from non-government sources and are not considered by the <strong>City</strong> to<br />

constitute “surplus funds” <strong>of</strong> a local government. Accordingly, these funds are not considered by the<br />

<strong>City</strong> to be subject to the provisions <strong>of</strong> the California Government Code Section 53601 or the <strong>City</strong>’s<br />

investment policy. These funds have been invested per instructions <strong>of</strong> the <strong>City</strong> Council. The table<br />

below identifies the investment types generally authorized for these investments. Current <strong>City</strong> Council<br />

instructions limit amount invested in equities (common stock) to 60% <strong>of</strong> the total portfolio with the<br />

balance to be invested in fixed income securities. The table also identifies certain provisions <strong>of</strong> these<br />

debt agreements that address interest rate risk, credit risk, and concentration <strong>of</strong> credit risk.<br />

Maximum Maximum<br />

Authorized Maximum percentage Investment<br />

investment type maturity allowed in one issuer<br />

U.S. Treasury obligations None None None<br />

U.S. agency securities None None None<br />

Common stock None 60% None<br />

Corporate bonds None None None<br />

Disclosures Relating to Interest Rate Risk<br />

Interest rate risk is the risk that changes in market interest rates will adversely affect the fair value <strong>of</strong> an<br />

investment. Generally, the longer the maturity <strong>of</strong> an investment, the greater the sensitivity <strong>of</strong> its fair<br />

value to changes in market interest rates. The fair value <strong>of</strong> callable securities is also sensitive to market<br />

changes in that if interest rates decrease between the time <strong>of</strong> purchase and the call date, the likelihood<br />

that a bond will be called and reinvested at a lower interest rate increases. One <strong>of</strong> the ways that the <strong>City</strong><br />

manages its exposure to interest rate risk is by purchasing a combination <strong>of</strong> shorter term and longer term<br />

investments and by timing cash flows from maturities so that a portion <strong>of</strong> the portfolio is maturing or<br />

coming close to maturity evenly over time as necessary to provide the cash flow and liquidity needed<br />

for operations.<br />

Information about the sensitivity <strong>of</strong> the fair values <strong>of</strong> the <strong>City</strong>’s investments (including investments held<br />

by bond trustee and Charnock funds held jointly with another party in an escrow account) to market<br />

interest rate fluctuations is provided by the following table that shows the distribution <strong>of</strong> the <strong>City</strong>’s<br />

investments by maturity. For purposes <strong>of</strong> the schedule shown below, any callable securities are assumed<br />

to be held to maturity.<br />

50