CITY OF SANTA MONICA, CALIFORNIA Notes to Basic <strong>Financial</strong> Statements, Continued For the fiscal year ended June 30, 2008 (7) CAPITAL ASSETS Capital assets activity for the primary government for year ended June 30, 2008 is as follows: Balance at July 1, 2007 as restated Increases Decreases (1) Transfers (1) Balance at June 30, 2008 Governmental activities: Capital assets, not being depreciated: Land $ 112,070,378 33,170,130 — — 145,240,508 Land held under easement 72,066,823 171,000 — — 72,237,823 Construction in progress 23,236,388 25,005,482 (395,836) (4,539,297) 43,306,737 Total capital assets, not being depreciated 207,373,589 58,346,612 (395,836) (4,539,297) 260,785,068 Capital assets, being depreciated: Buildings 237,269,287 1,406,215 (1,138,561) 16,317,332 253,854,273 Improvements other than buildings 91,707,172 1,022,537 (1,431,384) (14,104,263) 77,194,062 Utility Systems 3,575,000 173,272 — 1,450,296 5,198,568 Machinery and equipment 33,886,085 902,973 (2,071,710) 323,932 33,041,280 Infrastructure 323,765,332 740,984 (281,488) 552,000 324,776,828 Total capital assets being depreciated 690,202,876 4,245,981 (4,923,143) 4,539,297 694,065,011 Less accumulated depreciation for: Buildings (32,467,630) (6,333,244) 737,123 (5,167,548) (43,231,299) Improvements other than buildings (41,025,352) (2,855,140) 927,544 5,236,514 (37,716,434) Utility Systems (128,104) (75,212) — — (203,316) Machinery and equipment (20,785,144) (2,653,517) 1,987,996 (106,796) (21,557,461) Infrastructure (117,121,989) (10,225,240) 112,442 37,830 (127,196,957) Total accumulated depreciation (211,528,219) (22,142,353) 3,765,105 — (229,905,467) Total capital assets, being depreciated, net 478,674,657 (17,896,372) (1,158,038) 4,539,297 464,159,544 Subtotal governmental activities 686,048,246 40,450,240 (1,553,874) — 724,944,612 Business-type activities: Capital assets, not being depreciated: Land 69,634,413 3,000,000 — — 72,634,413 Construction in progress 30,426,373 23,500,964 (248,616) (10,793,760) 42,884,961 Total capital assets, not being depreciated 100,060,786 26,500,964 (248,616) (10,793,760) 115,519,374 Capital assets, being depreciated: Buildings 59,279,645 554,779 (2,550,181) 10,656,602 67,940,845 Improvements other than buildings 35,934,110 857,487 (2,445,906) (11,124,431) 23,221,260 Machinery and equipment 114,251,058 9,995,639 (753,603) 2,938,661 126,431,755 Infrastructure 254,442,114 2,423,254 (589,281) 8,322,928 264,599,015 Total capital assets being depreciated 463,906,927 13,831,159 (6,338,971) 10,793,760 482,192,875 Less accumulated depreciation for: Buildings (19,929,030) (2,703,645) 1,616,326 (7,406,751) (28,423,100) Improvements other than buildings (27,293,493) (599,403) 2,351,384 8,896,819 (16,644,693) Machinery and equipment (64,255,270) (14,515,779) 585,598 (1,490,068) (79,675,519) Infrastructure (48,849,467) (7,317,052) 212,407 — (55,954,112) Total accumulated depreciation (160,327,260) (25,135,879) 4,765,715 — (180,697,424) Total capital assets, being depreciated, net 303,579,667 (11,304,720) (1,573,256) 10,793,760 301,495,451 Subtotal business-type activities 403,640,453 15,196,244 (1,821,872) — 417,014,825 Total $ 1,089,688,699 55,646,484 (3,375,746) — 1,141,959,437 (1) In FY07-08, as a result <strong>of</strong> a review <strong>of</strong> assets categorized as improvements, certain assets were reclassified between category types and assets that did not meet the capitalization thresholds were disposed. 59

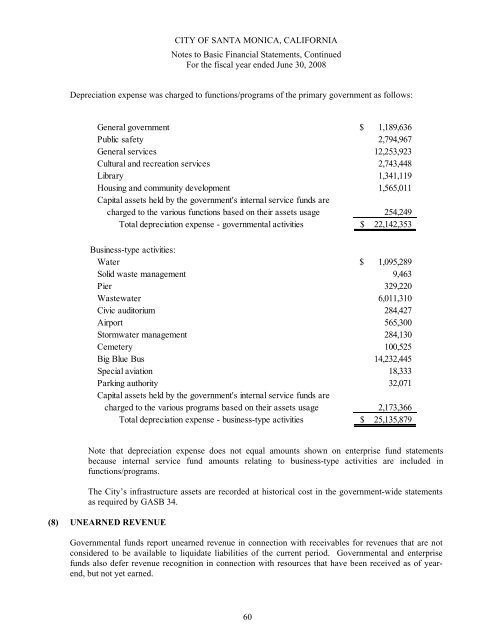

CITY OF SANTA MONICA, CALIFORNIA Notes to Basic <strong>Financial</strong> Statements, Continued For the fiscal year ended June 30, 2008 Depreciation expense was charged to functions/programs <strong>of</strong> the primary government as follows: General government $ 1,189,636 Public safety 2,794,967 General services 12,253,923 Cultural and recreation services 2,743,448 Library 1,341,119 Housing and community development 1,565,011 Capital assets held by the government's internal service funds are charged to the various functions based on their assets usage 254,249 Total depreciation expense - governmental activities $ 22,142,353 Business-type activities: Water $ 1,095,289 Solid waste management 9,463 Pier 329,220 Wastewater 6,011,310 Civic auditorium 284,427 Airport 565,300 Stormwater management 284,130 Cemetery 100,525 Big Blue Bus 14,232,445 Special aviation 18,333 Parking authority 32,071 Capital assets held by the government's internal service funds are charged to the various programs based on their assets usage 2,173,366 Total depreciation expense - business-type activities $ 25,135,879 Note that depreciation expense does not equal amounts shown on enterprise fund statements because internal service fund amounts relating to business-type activities are included in functions/programs. The <strong>City</strong>’s infrastructure assets are recorded at historical cost in the government-wide statements as required by GASB 34. (8) UNEARNED REVENUE Governmental funds report unearned revenue in connection with receivables for revenues that are not considered to be available to liquidate liabilities <strong>of</strong> the current period. Governmental and enterprise funds also defer revenue recognition in connection with resources that have been received as <strong>of</strong> yearend, but not yet earned. 60

- Page 1 and 2:

City of Santa Monica Comprehensive

- Page 3 and 4:

City of Santa Monica, California Ye

- Page 5 and 6:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 7:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 10 and 11:

Master Plan; (2) an ongoing commitm

- Page 12 and 13:

needs of City infrastructure and fa

- Page 15 and 16:

OFFICIALS OF THE CITY OF SANTA MONI

- Page 17 and 18:

Certificate of Achievement for Exce

- Page 19 and 20:

The Honorable Mayor and City Counci

- Page 21 and 22:

CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 23 and 24:

CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 25 and 26:

CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 27 and 28: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 29 and 30: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 31 and 32: CITY OF SANTA MONICA, CALIFORNIA Ma

- Page 33 and 34: City of Santa Monica, California Ye

- Page 35 and 36: CITY OF SANTA MONICA, CALIFORNIA St

- Page 37 and 38: CITY OF SANTA MONICA, CALIFORNIA Ba

- Page 39 and 40: CITY OF SANTA MONICA, CALIFORNIA Re

- Page 41 and 42: CITY OF SANTA MONICA, CALIFORNIA St

- Page 43 and 44: CITY OF SANTA MONICA, CALIFORNIA St

- Page 45 and 46: THIS PAGE INTENTIONALLY LEFT BLANK

- Page 47 and 48: CITY OF SANTA MONICA, CALIFORNIA St

- Page 49 and 50: CITY OF SANTA MONICA, CALIFORNIA St

- Page 51 and 52: CITY OF SANTA MONICA, CALIFORNIA St

- Page 53 and 54: CITY OF SANTA MONICA, CALIFORNIA St

- Page 55 and 56: CITY OF SANTA MONICA, CALIFORNIA No

- Page 57 and 58: CITY OF SANTA MONICA, CALIFORNIA No

- Page 59 and 60: CITY OF SANTA MONICA, CALIFORNIA No

- Page 61 and 62: CITY OF SANTA MONICA, CALIFORNIA No

- Page 63 and 64: CITY OF SANTA MONICA, CALIFORNIA No

- Page 65 and 66: CITY OF SANTA MONICA, CALIFORNIA No

- Page 67 and 68: CITY OF SANTA MONICA, CALIFORNIA No

- Page 69 and 70: CITY OF SANTA MONICA, CALIFORNIA No

- Page 71 and 72: CITY OF SANTA MONICA, CALIFORNIA No

- Page 73 and 74: CITY OF SANTA MONICA, CALIFORNIA No

- Page 75 and 76: CITY OF SANTA MONICA, CALIFORNIA No

- Page 77: CITY OF SANTA MONICA, CALIFORNIA No

- Page 81 and 82: CITY OF SANTA MONICA, CALIFORNIA No

- Page 83 and 84: CITY OF SANTA MONICA, CALIFORNIA No

- Page 85 and 86: CITY OF SANTA MONICA, CALIFORNIA No

- Page 87 and 88: CITY OF SANTA MONICA, CALIFORNIA No

- Page 89 and 90: CITY OF SANTA MONICA, CALIFORNIA No

- Page 91 and 92: CITY OF SANTA MONICA, CALIFORNIA No

- Page 93 and 94: CITY OF SANTA MONICA, CALIFORNIA No

- Page 95 and 96: CITY OF SANTA MONICA, CALIFORNIA No

- Page 97 and 98: CITY OF SANTA MONICA, CALIFORNIA No

- Page 99 and 100: CITY OF SANTA MONICA, CALIFORNIA No

- Page 101 and 102: THIS PAGE INTENTIONALLY LEFT BLANK

- Page 103 and 104: CITY OF SANTA MONICA, CALIFORNIA Re

- Page 106 and 107: CITY OF SANTA MONICA, CALIFORNIA No

- Page 108 and 109: THIS PAGE INTENTIONALLY LEFT BLANK

- Page 110 and 111: CITY OF SANTA MONICA, CALIFORNIA Co

- Page 112 and 113: Total nonmajor Citizens special Mis

- Page 114 and 115: Total nonmajor Citizens special Mis

- Page 116 and 117: CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 118 and 119: CITY OF SANTA MONICA, CALIFORNIA St

- Page 120 and 121: CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 122 and 123: CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 124 and 125: CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 126 and 127: CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 128 and 129:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 130 and 131:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 132 and 133:

CITY OF SANTA MONICA, CALIFORNIA Sc

- Page 134 and 135:

THIS PAGE INTENTIONALLY LEFT BLANK

- Page 136 and 137:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 138 and 139:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 140 and 141:

CITY OF SANTA MONICA, CALIFORNIA No

- Page 142 and 143:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 144 and 145:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 146 and 147:

CITY OF SANTA MONICA, CALIFORNIA In

- Page 148 and 149:

CITY OF SANTA MONICA, CALIFORNIA St

- Page 150 and 151:

CITY OF SANTA MONICA, CALIFORNIA Fi

- Page 152 and 153:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 154 and 155:

City of Santa Monica, California Ye

- Page 156 and 157:

CITY OF SANTA MONICA, CALIFORNIA Fo

- Page 158 and 159:

CITY OF SANTA MONICA, CALIFORNIA Ch

- Page 160 and 161:

CITY OF SANTA MONICA, CALIFORNIA Fu

- Page 162 and 163:

CITY OF SANTA MONICA, CALIFORNIA Ch

- Page 164 and 165:

CITY OF SANTA MONICA, CALIFORNIA As

- Page 166 and 167:

CITY OF SANTA MONICA, CALIFORNIA Pr

- Page 168 and 169:

CITY OF SANTA MONICA, CALIFORNIA Ta

- Page 170 and 171:

CITY OF SANTA MONICA, CALIFORNIA Ra

- Page 172 and 173:

CITY OF SANTA MONICA, CALIFORNIA Co

- Page 174 and 175:

CITY OF SANTA MONICA, CALIFORNIA Re

- Page 176 and 177:

CITY OF SANTA MONICA, CALIFORNIA Re

- Page 178 and 179:

CITY OF SANTA MONICA, CALIFORNIA Pr

- Page 180 and 181:

CITY OF SANTA MONICA, CALIFORNIA Op

- Page 182:

THIS PAGE INTENTIONALLY LEFT BLANK