Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

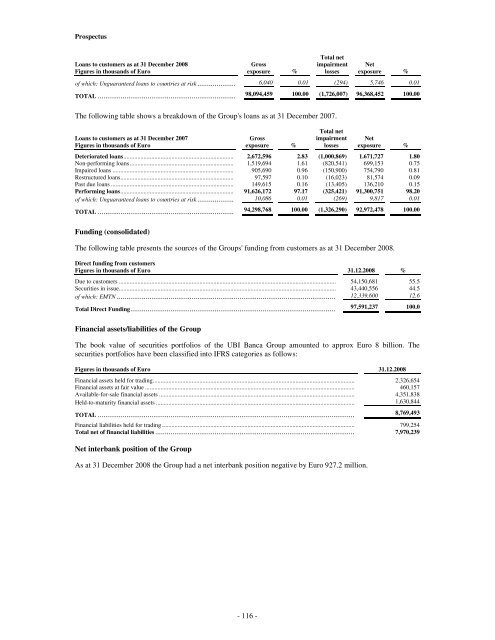

Loans to customers as at 31 December 2008<br />

Figures in thousands of Euro<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

of which: Unguaranteed loans to countries at risk.................... 6,040 0.01 (294) 5,746 0.01<br />

TOTAL ........................................................................ 98,094,459 100.00 (1,726,007) 96,368,452 100.00<br />

The following table shows a breakdown of the Group's loans as at 31 December 2007.<br />

Loans to customers as at 31 December 2007<br />

Figures in thousands of Euro<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans....................................................................... 2,672,596 2.83 (1,000,869) 1.671,727 1.80<br />

Non-performing loans................................................................... 1,519,694 1.61 (820,541) 699,153 0.75<br />

Impaired loans .............................................................................. 905,690 0.96 (150,900) 754,790 0.81<br />

Restructured loans......................................................................... 97,597 0.10 (16,023) 81,574 0.09<br />

Past due loans ............................................................................... 149,615 0.16 (13,405) 136,210 0.15<br />

Performing loans......................................................................... 91,626,172 97.17 (325,421) 91,300,751 98.20<br />

of which: Unguaranteed loans to countries at risk................... 10,086 0.01 (269) 9,817 0.01<br />

TOTAL ....................................................................... 94,298,768 100.00 (1,326,290) 92,972,478 100.00<br />

Funding (consolidated)<br />

The following table presents the sources of the Groups' funding from customers as at 31 December 2008.<br />

Direct funding from customers<br />

Figures in thousands of Euro 31.12.2008 %<br />

Due to customers ............................................................................................................................................ 54,150,681 55.5<br />

Securities in issue............................................................................................................................................ 43,440,556 44.5<br />

of which: EMTN .................................................................................................................. 12,339,600 12.6<br />

Total Direct Funding........................................................................................................... 97,591,237 100.0<br />

Financial assets/liabilities of the Group<br />

The book value of securities portfolios of the <strong>UBI</strong> <strong>Banca</strong> Group amounted to approx Euro 8 billion. The<br />

securities portfolios have been classified into IFRS categories as follows:<br />

Figures in thousands of Euro 31.12.2008<br />

Financial assets held for trading.................................................................................................................................. 2,326,654<br />

Financial assets at fair value ....................................................................................................................................... 460,157<br />

Available-for-sale financial assets .............................................................................................................................. 4,351,838<br />

Held-to-maturity financial assets ................................................................................................................................ 1,630,844<br />

TOTAL ...................................................................................................................................... 8,769,493<br />

Financial liabilities held for trading ............................................................................................................................ 799,254<br />

Total net of financial liabilities........................................................................................................ 7,970,239<br />

Net interbank position of the Group<br />

As at 31 December 2008 the Group had a net interbank position negative by Euro 927.2 million.<br />

- 116 -