Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

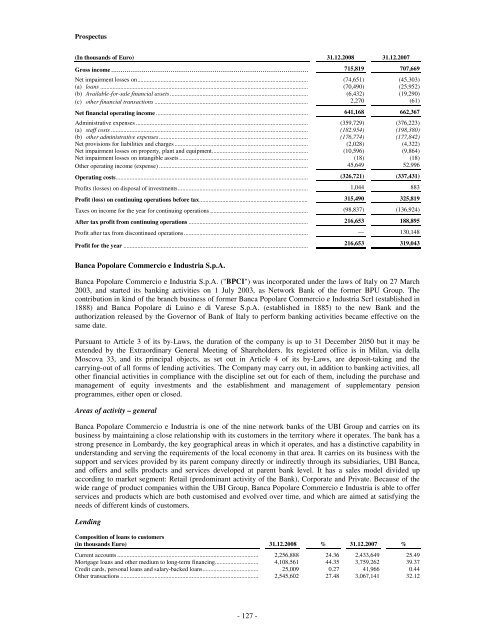

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Gross income....................................................................................................... 715,819 707,669<br />

Net impairment losses on.............................................................................................................. (74,651) (45,303)<br />

(a) loans ...................................................................................................................................... (70,490) (25,952)<br />

(b) Available-for-sale financial assets ......................................................................................... (6,432) (19,290)<br />

(c) other financial transactions ................................................................................................... 2,270 (61)<br />

Net financial operating income .................................................................................................. 641,168 662,367<br />

Administrative expenses ............................................................................................................... (359,729) (376,223)<br />

(a) staff costs ............................................................................................................................... (182,954) (198,380)<br />

(b) other administrative expenses ................................................................................................ (176,774) (177,842)<br />

Net provisions for liabilities and charges ...................................................................................... (2,028) (4,322)<br />

Net impairment losses on property, plant and equipment.............................................................. (10,596) (9,864)<br />

Net impairment losses on intangible assets ................................................................................... (18) (18)<br />

Other operating income (expense) ................................................................................................ 45,649 52,996<br />

Operating costs............................................................................................................................ (326,721) (337,431)<br />

Profits (losses) on disposal of investments.................................................................................... 1,044 883<br />

Profit (loss) on continuing operations before tax...................................................................... 315,490 325,819<br />

Taxes on income for the year for continuing operations ............................................................... (98,837) (136,924)<br />

After tax profit from continuing operations ............................................................................. 216,653 188,895<br />

Profit after tax from discontinued operations................................................................................ — 130,148<br />

Profit for the year ....................................................................................................................... 216,653 319,043<br />

<strong>Banca</strong> Popolare Commercio e Industria S.p.A.<br />

<strong>Banca</strong> Popolare Commercio e Industria S.p.A. ("BPCI") was incorporated under the laws of Italy on 27 March<br />

2003, and started its banking activities on 1 July 2003, as Network Bank of the former BPU Group. The<br />

contribution in kind of the branch business of former <strong>Banca</strong> Popolare Commercio e Industria Scrl (established in<br />

1888) and <strong>Banca</strong> Popolare di Luino e di Varese S.p.A. (established in 1885) to the new Bank and the<br />

authorization released by the Governor of Bank of Italy to perform banking activities became effective on the<br />

same date.<br />

Pursuant to Article 3 of its by-Laws, the duration of the company is up to 31 December 2050 but it may be<br />

extended by the Extraordinary General Meeting of Shareholders. Its registered office is in Milan, via della<br />

Moscova 33, and its principal objects, as set out in Article 4 of its by-Laws, are deposit-taking and the<br />

carrying-out of all forms of lending activities. The Company may carry out, in addition to banking activities, all<br />

other financial activities in compliance with the discipline set out for each of them, including the purchase and<br />

management of equity investments and the establishment and management of supplementary pension<br />

programmes, either open or closed.<br />

Areas of activity – general<br />

<strong>Banca</strong> Popolare Commercio e Industria is one of the nine network banks of the <strong>UBI</strong> Group and carries on its<br />

business by maintaining a close relationship with its customers in the territory where it operates. The bank has a<br />

strong presence in Lombardy, the key geographical areas in which it operates, and has a distinctive capability in<br />

understanding and serving the requirements of the local economy in that area. It carries on its business with the<br />

support and services provided by its parent company directly or indirectly through its subsidiaries, <strong>UBI</strong> <strong>Banca</strong>,<br />

and offers and sells products and services developed at parent bank level. It has a sales model divided up<br />

according to market segment: Retail (predominant activity of the Bank), Corporate and Private. Because of the<br />

wide range of product companies within the <strong>UBI</strong> Group, <strong>Banca</strong> Popolare Commercio e Industria is able to offer<br />

services and products which are both customised and evolved over time, and which are aimed at satisfying the<br />

needs of different kinds of customers.<br />

Lending<br />

Composition of loans to customers<br />

(in thousands Euro) 31.12.2008 % 31.12.2007 %<br />

Current accounts ........................................................................................... 2,256,888 24.36 2,433,649 25.49<br />

Mortgage loans and other medium to long-term financing............................ 4,108,561 44.35 3,759,262 39.37<br />

Credit cards, personal loans and salary-backed loans.................................... 25,009 0.27 41,966 0.44<br />

Other transactions ......................................................................................... 2,545,602 27.48 3,067,141 32.12<br />

- 127 -