Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

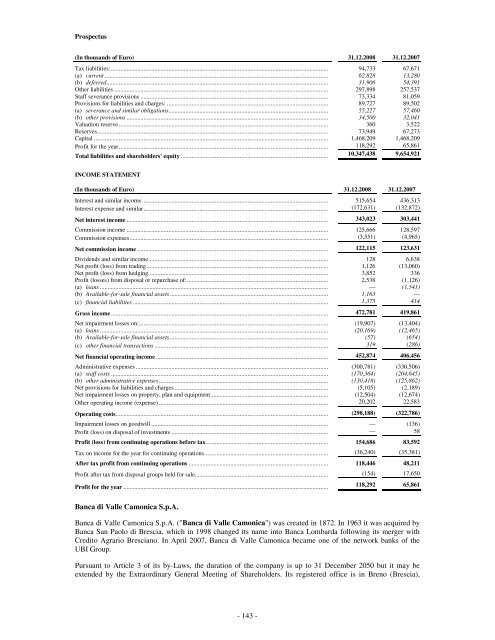

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Tax liabilities:............................................................................................................................................ 94,733 67,671<br />

(a) current ................................................................................................................................................ 62,828 13,280<br />

(b) deferred............................................................................................................................................... 31,906 54,391<br />

Other liabilities .......................................................................................................................................... 297,898 257,537<br />

Staff severance provisions ......................................................................................................................... 73,334 81,059<br />

Provisions for liabilities and charges: ........................................................................................................ 89,727 89,502<br />

(a) severance and similar obligations....................................................................................................... 55,227 57,460<br />

(b) other provisions .................................................................................................................................. 34,500 32,041<br />

Valuation reserve ....................................................................................................................................... 360 3,522<br />

Reserves..................................................................................................................................................... 73,949 67,273<br />

Capital ....................................................................................................................................................... 1,468,209 1,468,209<br />

Profit for the year....................................................................................................................................... 118,292 65,861<br />

Total liabilities and shareholders' equity ............................................................................................... 10,347,438 9,654,921<br />

INCOME STATEMENT<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Interest and similar income........................................................................................................................ 515,654 436,313<br />

Interest expense and similar....................................................................................................................... (172,631) (132,872)<br />

Net interest income .................................................................................................................................. 343,023 303,441<br />

Commission income .................................................................................................................................. 125,666 128,597<br />

Commission expenses................................................................................................................................ (3,551) (4,965)<br />

Net commission income ........................................................................................................................... 122,115 123,631<br />

Dividends and similar income.................................................................................................................... 128 6,638<br />

Net profit (loss) from trading..................................................................................................................... 1,126 (13,060)<br />

Net profit (loss) from hedging.................................................................................................................... 3,852 336<br />

Profit (losses) from disposal or repurchase of:........................................................................................... 2,538 (1,126)<br />

(a) loans ................................................................................................................................................... — (1,541)<br />

(b) Available-for-sale financial assets ...................................................................................................... 1,163 —<br />

(c) financial liabilities .............................................................................................................................. 1,375 414<br />

Gross income ............................................................................................................................................ 472,781 419,861<br />

Net impairment losses on:.......................................................................................................................... (19,907) (13,404)<br />

(a) loans ................................................................................................................................................... (20,169) (12,465)<br />

(b) Available-for-sale financial assets ...................................................................................................... (57) (654)<br />

(c) other financial transactions ................................................................................................................ 319 (286)<br />

Net financial operating income ............................................................................................................... 452,874 406,456<br />

Administrative expenses ............................................................................................................................ (300,781) (330,506)<br />

(a) staff costs ............................................................................................................................................ (170,364) (204,645)<br />

(b) other administrative expenses ............................................................................................................. (130,418) (125,862)<br />

Net provisions for liabilities and charges ................................................................................................... (5,105) (2,189)<br />

Net impairment losses on property, plan and equipment............................................................................ (12,504) (12,674)<br />

Other operating income (expense) ............................................................................................................. 20,202 22,583<br />

Operating costs......................................................................................................................................... (298,188) (322,786)<br />

Impairment losses on goodwill .................................................................................................................. — (136)<br />

Profit (loss) on disposal of investments ..................................................................................................... — 58<br />

Profit (loss) from continuing operations before tax............................................................................... 154,686 83,592<br />

Tax on income for the year for continuing operations................................................................................ (36,240) (35,381)<br />

After tax profit from continuing operations .......................................................................................... 118,446 48,211<br />

Profit after tax from disposal groups held for sale...................................................................................... (154) 17,650<br />

Profit for the year .................................................................................................................................... 118,292 65,861<br />

<strong>Banca</strong> di Valle Camonica S.p.A.<br />

<strong>Banca</strong> di Valle Camonica S.p.A. ("<strong>Banca</strong> di Valle Camonica") was created in 1872. In 1963 it was acquired by<br />

<strong>Banca</strong> San Paolo di Brescia, which in 1998 changed its name into <strong>Banca</strong> Lombarda following its merger with<br />

Credito Agrario Bresciano. In April 2007, <strong>Banca</strong> di Valle Camonica became one of the network banks of the<br />

<strong>UBI</strong> Group.<br />

Pursuant to Article 3 of its by-Laws, the duration of the company is up to 31 December 2050 but it may be<br />

extended by the Extraordinary General Meeting of Shareholders. Its registered office is in Breno (Brescia),<br />

- 143 -