Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

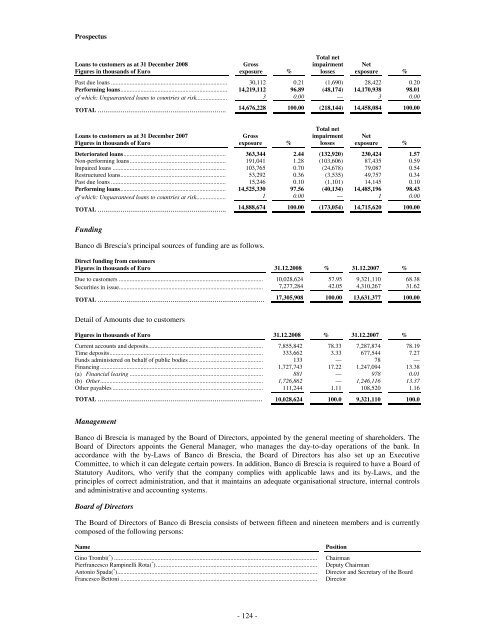

Loans to customers as at 31 December 2008<br />

Figures in thousands of Euro<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Past due loans ........................................................................... 30,112 0.21 (1,690) 28,422 0.20<br />

Performing loans..................................................................... 14,219,112 96.89 (48,174) 14,170,938 98.01<br />

of which: Unguaranteed loans to countries at risk.................... 3 0.00 — 3 0.00<br />

TOTAL ................................................................... 14,676,228 100.00 (218,144) 14,458,084 100.00<br />

Loans to customers as at 31 December 2007<br />

Figures in thousands of Euro<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans.................................................................. 363,344 2.44 (132,920) 230,424 1.57<br />

Non-performing loans.............................................................. 191,041 1.28 (103,606) 87,435 0.59<br />

Impaired loans ......................................................................... 103,765 0.70 (24,678) 79,087 0.54<br />

Restructured loans.................................................................... 53,292 0.36 (3,535) 49,757 0.34<br />

Past due loans .......................................................................... 15,246 0.10 (1,101) 14,145 0.10<br />

Performing loans.................................................................... 14,525,330 97.56 (40,134) 14,485,196 98.43<br />

of which: Unguaranteed loans to countries at risk................... 1 0.00 — 1 0.00<br />

TOTAL ................................................................... 14,888,674 100.00 (173,054) 14,715,620 100.00<br />

Funding<br />

Banco di Brescia's principal sources of funding are as follows.<br />

Direct funding from customers<br />

Figures in thousands of Euro 31.12.2008 % 31.12.2007 %<br />

Due to customers ............................................................................................. 10,028,624 57.95 9,321,110 68.38<br />

Securities in issue............................................................................................. 7,277,284 42.05 4,310,267 31.62<br />

TOTAL ....................................................................................... 17,305,908 100.00 13,631,377 100.00<br />

Detail of Amounts due to customers<br />

Figures in thousands of Euro 31.12.2008 % 31.12.2007 %<br />

Current accounts and deposits.......................................................................... 7,855,842 78.33 7,287,874 78.19<br />

Time deposits................................................................................................... 333,662 3.33 677,544 7.27<br />

Funds administered on behalf of public bodies ................................................ 133 — 78 —<br />

Financing ......................................................................................................... 1,727,743 17.22 1,247,094 13.38<br />

(a) Financial leasing ...................................................................................... 881 — 978 0.01<br />

(b) Other......................................................................................................... 1,726,862 — 1,246,116 13.37<br />

Other payables ................................................................................................. 111,244 1.11 108,520 1.16<br />

TOTAL ...................................................................................... 10,028,624 100.0 9,321,110 100.0<br />

Management<br />

Banco di Brescia is managed by the Board of Directors, appointed by the general meeting of shareholders. The<br />

Board of Directors appoints the General Manager, who manages the day-to-day operations of the bank. In<br />

accordance with the by-Laws of Banco di Brescia, the Board of Directors has also set up an Executive<br />

Committee, to which it can delegate certain powers. In addition, Banco di Brescia is required to have a Board of<br />

Statutory Auditors, who verify that the company complies with applicable laws and its by-Laws, and the<br />

principles of correct administration, and that it maintains an adequate organisational structure, internal controls<br />

and administrative and accounting systems.<br />

Board of Directors<br />

The Board of Directors of Banco di Brescia consists of between fifteen and nineteen members and is currently<br />

composed of the following persons:<br />

Name<br />

Gino Trombi( * ) ...................................................................................................................................<br />

Pierfrancesco Rampinelli Rota( * )........................................................................................................<br />

Antonio Spada( * ).................................................................................................................................<br />

Francesco Bettoni ...............................................................................................................................<br />

Position<br />

Chairman<br />

Deputy Chairman<br />

Director and Secretary of the Board<br />

Director<br />

- 124 -