Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

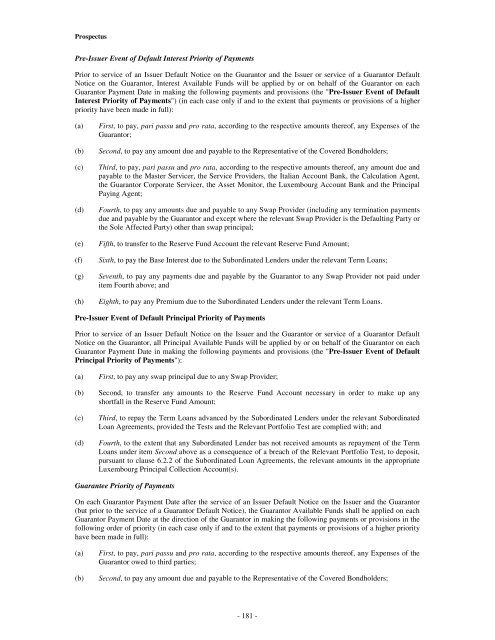

Pre-Issuer Event of Default Interest Priority of Payments<br />

Prior to service of an Issuer Default Notice on the Guarantor and the Issuer or service of a Guarantor Default<br />

Notice on the Guarantor, Interest Available Funds will be applied by or on behalf of the Guarantor on each<br />

Guarantor Payment Date in making the following payments and provisions (the "Pre-Issuer Event of Default<br />

Interest Priority of Payments") (in each case only if and to the extent that payments or provisions of a higher<br />

priority have been made in full):<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

(e)<br />

(f)<br />

(g)<br />

(h)<br />

First, to pay, pari passu and pro rata, according to the respective amounts thereof, any Expenses of the<br />

Guarantor;<br />

Second, to pay any amount due and payable to the Representative of the <strong>Covered</strong> <strong>Bond</strong>holders;<br />

Third, to pay, pari passu and pro rata, according to the respective amounts thereof, any amount due and<br />

payable to the Master Servicer, the Service Providers, the Italian Account Bank, the Calculation Agent,<br />

the Guarantor Corporate Servicer, the Asset Monitor, the Luxembourg Account Bank and the Principal<br />

Paying Agent;<br />

Fourth, to pay any amounts due and payable to any Swap Provider (including any termination payments<br />

due and payable by the Guarantor and except where the relevant Swap Provider is the Defaulting Party or<br />

the Sole Affected Party) other than swap principal;<br />

Fifth, to transfer to the Reserve Fund Account the relevant Reserve Fund Amount;<br />

Sixth, to pay the Base Interest due to the Subordinated Lenders under the relevant Term Loans;<br />

Seventh, to pay any payments due and payable by the Guarantor to any Swap Provider not paid under<br />

item Fourth above; and<br />

Eighth, to pay any Premium due to the Subordinated Lenders under the relevant Term Loans.<br />

Pre-Issuer Event of Default Principal Priority of Payments<br />

Prior to service of an Issuer Default Notice on the Issuer and the Guarantor or service of a Guarantor Default<br />

Notice on the Guarantor, all Principal Available Funds will be applied by or on behalf of the Guarantor on each<br />

Guarantor Payment Date in making the following payments and provisions (the "Pre-Issuer Event of Default<br />

Principal Priority of Payments"):<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

First, to pay any swap principal due to any Swap Provider;<br />

Second, to transfer any amounts to the Reserve Fund Account necessary in order to make up any<br />

shortfall in the Reserve Fund Amount;<br />

Third, to repay the Term Loans advanced by the Subordinated Lenders under the relevant Subordinated<br />

Loan Agreements, provided the Tests and the Relevant Portfolio Test are complied with; and<br />

Fourth, to the extent that any Subordinated Lender has not received amounts as repayment of the Term<br />

Loans under item Second above as a consequence of a breach of the Relevant Portfolio Test, to deposit,<br />

pursuant to clause 6.2.2 of the Subordinated Loan Agreements, the relevant amounts in the appropriate<br />

Luxembourg Principal Collection Account(s).<br />

Guarantee Priority of Payments<br />

On each Guarantor Payment Date after the service of an Issuer Default Notice on the Issuer and the Guarantor<br />

(but prior to the service of a Guarantor Default Notice), the Guarantor Available Funds shall be applied on each<br />

Guarantor Payment Date at the direction of the Guarantor in making the following payments or provisions in the<br />

following order of priority (in each case only if and to the extent that payments or provisions of a higher priority<br />

have been made in full):<br />

(a)<br />

(b)<br />

First, to pay, pari passu and pro rata, according to the respective amounts thereof, any Expenses of the<br />

Guarantor owed to third parties;<br />

Second, to pay any amount due and payable to the Representative of the <strong>Covered</strong> <strong>Bond</strong>holders;<br />

- 181 -