Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

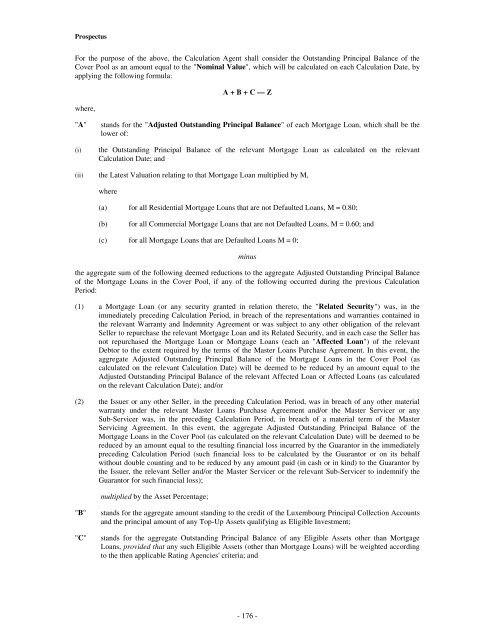

For the purpose of the above, the Calculation Agent shall consider the Outstanding Principal Balance of the<br />

Cover Pool as an amount equal to the "Nominal Value", which will be calculated on each Calculation Date, by<br />

applying the following formula:<br />

where,<br />

A + B + C — Z<br />

"A"<br />

(i)<br />

stands for the "Adjusted Outstanding Principal Balance" of each Mortgage Loan, which shall be the<br />

lower of:<br />

the Outstanding Principal Balance of the relevant Mortgage Loan as calculated on the relevant<br />

Calculation Date; and<br />

(ii) the Latest Valuation relating to that Mortgage Loan multiplied by M,<br />

where<br />

(a) for all Residential Mortgage Loans that are not Defaulted Loans, M = 0.80;<br />

(b)<br />

for all Commercial Mortgage Loans that are not Defaulted Loans, M = 0.60; and<br />

(c) for all Mortgage Loans that are Defaulted Loans M = 0;<br />

minus<br />

the aggregate sum of the following deemed reductions to the aggregate Adjusted Outstanding Principal Balance<br />

of the Mortgage Loans in the Cover Pool, if any of the following occurred during the previous Calculation<br />

Period:<br />

(1) a Mortgage Loan (or any security granted in relation thereto, the "Related Security") was, in the<br />

immediately preceding Calculation Period, in breach of the representations and warranties contained in<br />

the relevant Warranty and Indemnity Agreement or was subject to any other obligation of the relevant<br />

Seller to repurchase the relevant Mortgage Loan and its Related Security, and in each case the Seller has<br />

not repurchased the Mortgage Loan or Mortgage Loans (each an "Affected Loan") of the relevant<br />

Debtor to the extent required by the terms of the Master Loans Purchase Agreement. In this event, the<br />

aggregate Adjusted Outstanding Principal Balance of the Mortgage Loans in the Cover Pool (as<br />

calculated on the relevant Calculation Date) will be deemed to be reduced by an amount equal to the<br />

Adjusted Outstanding Principal Balance of the relevant Affected Loan or Affected Loans (as calculated<br />

on the relevant Calculation Date); and/or<br />

(2) the Issuer or any other Seller, in the preceding Calculation Period, was in breach of any other material<br />

warranty under the relevant Master Loans Purchase Agreement and/or the Master Servicer or any<br />

Sub-Servicer was, in the preceding Calculation Period, in breach of a material term of the Master<br />

Servicing Agreement. In this event, the aggregate Adjusted Outstanding Principal Balance of the<br />

Mortgage Loans in the Cover Pool (as calculated on the relevant Calculation Date) will be deemed to be<br />

reduced by an amount equal to the resulting financial loss incurred by the Guarantor in the immediately<br />

preceding Calculation Period (such financial loss to be calculated by the Guarantor or on its behalf<br />

without double counting and to be reduced by any amount paid (in cash or in kind) to the Guarantor by<br />

the Issuer, the relevant Seller and/or the Master Servicer or the relevant Sub-Servicer to indemnify the<br />

Guarantor for such financial loss);<br />

multiplied by the Asset Percentage;<br />

"B"<br />

"C"<br />

stands for the aggregate amount standing to the credit of the Luxembourg Principal Collection Accounts<br />

and the principal amount of any Top-Up Assets qualifying as Eligible Investment;<br />

stands for the aggregate Outstanding Principal Balance of any Eligible Assets other than Mortgage<br />

Loans, provided that any such Eligible Assets (other than Mortgage Loans) will be weighted according<br />

to the then applicable Rating Agencies' criteria; and<br />

- 176 -