Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

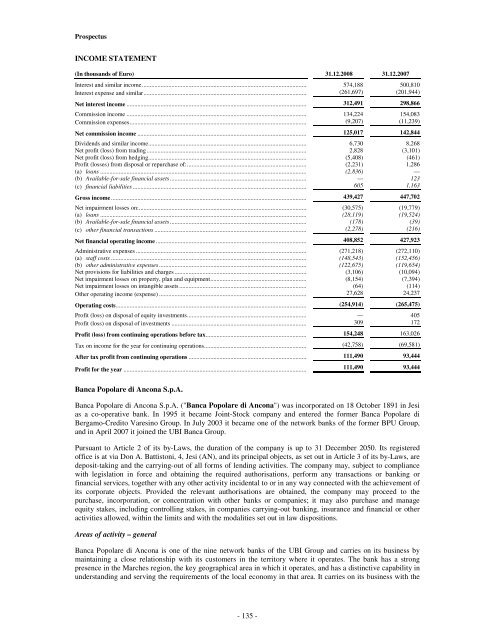

INCOME STATEMENT<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Interest and similar income.......................................................................................................... 574,188 500,810<br />

Interest expense and similar......................................................................................................... (261,697) (201,944)<br />

Net interest income .................................................................................................................... 312,491 298,866<br />

Commission income .................................................................................................................... 134,224 154,083<br />

Commission expenses.................................................................................................................. (9,207) (11,239)<br />

Net commission income ............................................................................................................. 125,017 142,844<br />

Dividends and similar income...................................................................................................... 6,730 8,268<br />

Net profit (loss) from trading....................................................................................................... 2,828 (3,101)<br />

Net profit (loss) from hedging...................................................................................................... (5,408) (461)<br />

Profit (losses) from disposal or repurchase of:............................................................................. (2,231) 1,286<br />

(a) loans ..................................................................................................................................... (2,836) —<br />

(b) Available-for-sale financial assets ........................................................................................ — 123<br />

(c) financial liabilities ................................................................................................................ 605 1,163<br />

Gross income .............................................................................................................................. 439,427 447,702<br />

Net impairment losses on:............................................................................................................ (30,575) (19,779)<br />

(a) loans ..................................................................................................................................... (28,119) (19,524)<br />

(b) Available-for-sale financial assets ........................................................................................ (178) (39)<br />

(c) other financial transactions .................................................................................................. (2,278) (216)<br />

Net financial operating income ................................................................................................. 408,852 427,923<br />

Administrative expenses .............................................................................................................. (271,218) (272,110)<br />

(a) staff costs .............................................................................................................................. (148,543) (152,456)<br />

(b) other administrative expenses ............................................................................................... (122,675) (119,654)<br />

Net provisions for liabilities and charges ..................................................................................... (3,106) (10,094)<br />

Net impairment losses on property, plan and equipment.............................................................. (8,154) (7,394)<br />

Net impairment losses on intangible assets .................................................................................. (64) (114)<br />

Other operating income (expense) ............................................................................................... 27,628 24,237<br />

Operating costs........................................................................................................................... (254,914) (265,475)<br />

Profit (loss) on disposal of equity investments............................................................................. — 405<br />

Profit (loss) on disposal of investments ....................................................................................... 309 172<br />

Profit (loss) from continuing operations before tax................................................................. 154,248 163,026<br />

Tax on income for the year for continuing operations.................................................................. (42,758) (69,581)<br />

After tax profit from continuing operations ............................................................................ 111,490 93,444<br />

Profit for the year ...................................................................................................................... 111,490 93,444<br />

<strong>Banca</strong> Popolare di Ancona S.p.A.<br />

<strong>Banca</strong> Popolare di Ancona S.p.A. ("<strong>Banca</strong> Popolare di Ancona") was incorporated on 18 October 1891 in Jesi<br />

as a co-operative bank. In 1995 it became Joint-Stock company and entered the former <strong>Banca</strong> Popolare di<br />

Bergamo-Credito Varesino Group. In July 2003 it became one of the network banks of the former BPU Group,<br />

and in April 2007 it joined the <strong>UBI</strong> <strong>Banca</strong> Group.<br />

Pursuant to Article 2 of its by-Laws, the duration of the company is up to 31 December 2050. Its registered<br />

office is at via Don A. Battistoni, 4, Jesi (AN), and its principal objects, as set out in Article 3 of its by-Laws, are<br />

deposit-taking and the carrying-out of all forms of lending activities. The company may, subject to compliance<br />

with legislation in force and obtaining the required authorisations, perform any transactions or banking or<br />

financial services, together with any other activity incidental to or in any way connected with the achievement of<br />

its corporate objects. Provided the relevant authorisations are obtained, the company may proceed to the<br />

purchase, incorporation, or concentration with other banks or companies; it may also purchase and manage<br />

equity stakes, including controlling stakes, in companies carrying-out banking, insurance and financial or other<br />

activities allowed, within the limits and with the modalities set out in law dispositions.<br />

Areas of activity – general<br />

<strong>Banca</strong> Popolare di Ancona is one of the nine network banks of the <strong>UBI</strong> Group and carries on its business by<br />

maintaining a close relationship with its customers in the territory where it operates. The bank has a strong<br />

presence in the Marches region, the key geographical area in which it operates, and has a distinctive capability in<br />

understanding and serving the requirements of the local economy in that area. It carries on its business with the<br />

- 135 -