Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

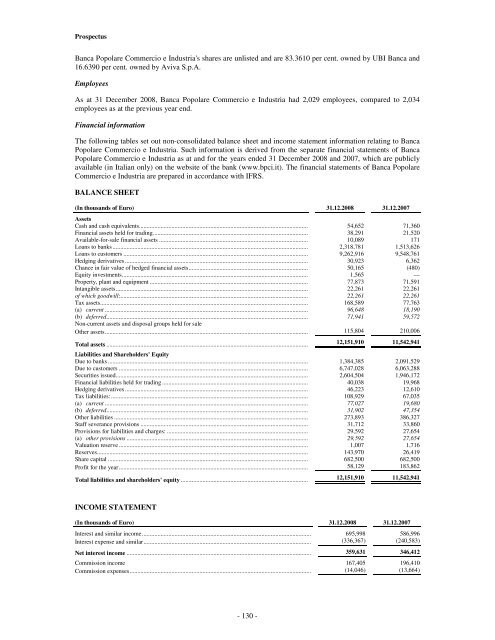

<strong>Prospectus</strong><br />

<strong>Banca</strong> Popolare Commercio e Industria's shares are unlisted and are 83.3610 per cent. owned by <strong>UBI</strong> <strong>Banca</strong> and<br />

16.6390 per cent. owned by Aviva S.p.A.<br />

Employees<br />

As at 31 December 2008, <strong>Banca</strong> Popolare Commercio e Industria had 2,029 employees, compared to 2,034<br />

employees as at the previous year end.<br />

Financial information<br />

The following tables set out non-consolidated balance sheet and income statement information relating to <strong>Banca</strong><br />

Popolare Commercio e Industria. Such information is derived from the separate financial statements of <strong>Banca</strong><br />

Popolare Commercio e Industria as at and for the years ended 31 December 2008 and 2007, which are publicly<br />

available (in Italian only) on the website of the bank (www.bpci.it). The financial statements of <strong>Banca</strong> Popolare<br />

Commercio e Industria are prepared in accordance with IFRS.<br />

BALANCE SHEET<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Assets<br />

Cash and cash equivalents............................................................................................................. 54,652 71,360<br />

Financial assets held for trading.................................................................................................... 38,291 21,520<br />

Available-for-sale financial assets ................................................................................................ 10,089 171<br />

Loans to banks .............................................................................................................................. 2,318,781 1,513,626<br />

Loans to customers ....................................................................................................................... 9,262,916 9,548,761<br />

Hedging derivatives ...................................................................................................................... 30,923 6,362<br />

Chance in fair value of hedged financial assets............................................................................. 50,165 (480)<br />

Equity investments........................................................................................................................ 1,565 —<br />

Property, plant and equipment ...................................................................................................... 77,873 71,591<br />

Intangible assets............................................................................................................................ 22,261 22,261<br />

of which goodwill:......................................................................................................................... 22,261 22,261<br />

Tax assets...................................................................................................................................... 168,589 77,763<br />

(a) current ................................................................................................................................... 96,648 18,190<br />

(b) deferred.................................................................................................................................. 71,941 59,572<br />

Non-current assets and disposal groups held for sale<br />

Other assets................................................................................................................................... 115,804 210,006<br />

Total assets .................................................................................................................................. 12,151,910 11,542,941<br />

Liabilities and Shareholders' Equity<br />

Due to banks ................................................................................................................................. 1,384,385 2,091,529<br />

Due to customers .......................................................................................................................... 6,747,028 6,063,288<br />

Securities issued............................................................................................................................ 2,604,504 1,946,172<br />

Financial liabilities held for trading .............................................................................................. 40,038 19,968<br />

Hedging derivatives ...................................................................................................................... 46,223 12,610<br />

Tax liabilities:............................................................................................................................... 108,929 67,035<br />

(a) current ................................................................................................................................... 77,027 19,680<br />

(b) deferred.................................................................................................................................. 31,902 47,354<br />

Other liabilities ............................................................................................................................. 273,893 386,327<br />

Staff severance provisions ............................................................................................................ 31,712 33,860<br />

Provisions for liabilities and charges: ........................................................................................... 29,592 27,654<br />

(a) other provisions ..................................................................................................................... 29,592 27,654<br />

Valuation reserve .......................................................................................................................... 1,007 1,716<br />

Reserves........................................................................................................................................ 143,970 26,419<br />

Share capital ................................................................................................................................. 682,500 682,500<br />

Profit for the year.......................................................................................................................... 58,129 183,862<br />

Total liabilities and shareholders' equity .................................................................................. 12,151,910 11,542,941<br />

INCOME STATEMENT<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Interest and similar income............................................................................................................. 695,998 586,996<br />

Interest expense and similar............................................................................................................ (336,367) (240,583)<br />

Net interest income ....................................................................................................................... 359,631 346,412<br />

Commission income 167,405 196,410<br />

Commission expenses..................................................................................................................... (14,046) (13,664)<br />

- 130 -