Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

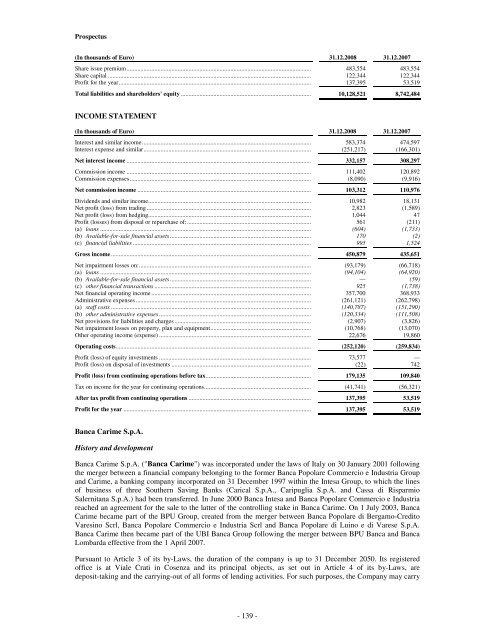

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Share issue premium....................................................................................................................... 483,554 483,554<br />

Share capital ................................................................................................................................... 122,344 122,344<br />

Profit for the year............................................................................................................................ 137,395 53,519<br />

Total liabilities and shareholders' equity .................................................................................... 10,128,521 8,742,484<br />

INCOME STATEMENT<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Interest and similar income............................................................................................................. 583,374 474,597<br />

Interest expense and similar............................................................................................................ (251,217) (166,301)<br />

Net interest income ....................................................................................................................... 332,157 308,297<br />

Commission income ....................................................................................................................... 111,402 120,892<br />

Commission expenses..................................................................................................................... (8,090) (9,916)<br />

Net commission income ................................................................................................................ 103,312 110,976<br />

Dividends and similar income......................................................................................................... 10,982 18,131<br />

Net profit (loss) from trading.......................................................................................................... 2,823 (1,589)<br />

Net profit (loss) from hedging......................................................................................................... 1,044 47<br />

Profit (losses) from disposal or repurchase of:................................................................................ 561 (211)<br />

(a) loans ........................................................................................................................................ (604) (1,733)<br />

(b) Available-for-sale financial assets ........................................................................................... 170 (2)<br />

(c) financial liabilities ................................................................................................................... 995 1,524<br />

Gross income ................................................................................................................................. 450,879 435,651<br />

Net impairment losses on:............................................................................................................... (93,179) (66,718)<br />

(a) loans ........................................................................................................................................ (94,104) (64,920)<br />

(b) Available-for-sale financial assets ........................................................................................... — (59)<br />

(c) other financial transactions ..................................................................................................... 925 (1,738)<br />

Net financial operating income ....................................................................................................... 357,700 368,933<br />

Administrative expenses ................................................................................................................. (261,121) (262,798)<br />

(a) staff costs ................................................................................................................................. (140,787) (151,290)<br />

(b) other administrative expenses .................................................................................................. (120,334) (111,508)<br />

Net provisions for liabilities and charges ........................................................................................ (2,907) (3,826)<br />

Net impairment losses on property, plan and equipment................................................................. (10,768) (13,070)<br />

Other operating income (expense) .................................................................................................. 22,676 19,860<br />

Operating costs.............................................................................................................................. (252,120) (259,834)<br />

Profit (loss) of equity investments .................................................................................................. 73,577 —<br />

Profit (loss) on disposal of investments .......................................................................................... (22) 742<br />

Profit (loss) from continuing operations before tax.................................................................... 179,135 109,840<br />

Tax on income for the year for continuing operations..................................................................... (41,741) (56,321)<br />

After tax profit from continuing operations ............................................................................... 137,395 53,519<br />

Profit for the year ......................................................................................................................... 137,395 53,519<br />

<strong>Banca</strong> Carime S.p.A.<br />

History and development<br />

<strong>Banca</strong> Carime S.p.A. ("<strong>Banca</strong> Carime") was incorporated under the laws of Italy on 30 January 2001 following<br />

the merger between a financial company belonging to the former <strong>Banca</strong> Popolare Commercio e Industria Group<br />

and Carime, a banking company incorporated on 31 December 1997 within the Intesa Group, to which the lines<br />

of business of three Southern Saving Banks (Carical S.p.A., Caripuglia S.p.A. and Cassa di Risparmio<br />

Salernitana S.p.A.) had been transferred. In June 2000 <strong>Banca</strong> Intesa and <strong>Banca</strong> Popolare Commercio e Industria<br />

reached an agreement for the sale to the latter of the controlling stake in <strong>Banca</strong> Carime. On 1 July 2003, <strong>Banca</strong><br />

Carime became part of the BPU Group, created from the merger between <strong>Banca</strong> Popolare di Bergamo-Credito<br />

Varesino Scrl, <strong>Banca</strong> Popolare Commercio e Industria Scrl and <strong>Banca</strong> Popolare di Luino e di Varese S.p.A.<br />

<strong>Banca</strong> Carime then became part of the <strong>UBI</strong> <strong>Banca</strong> Group following the merger between BPU <strong>Banca</strong> and <strong>Banca</strong><br />

Lombarda effective from the 1 April 2007.<br />

Pursuant to Article 3 of its by-Laws, the duration of the company is up to 31 December 2050. Its registered<br />

office is at Viale Crati in Cosenza and its principal objects, as set out in Article 4 of its by-Laws, are<br />

deposit-taking and the carrying-out of all forms of lending activities. For such purposes, the Company may carry<br />

- 139 -