Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

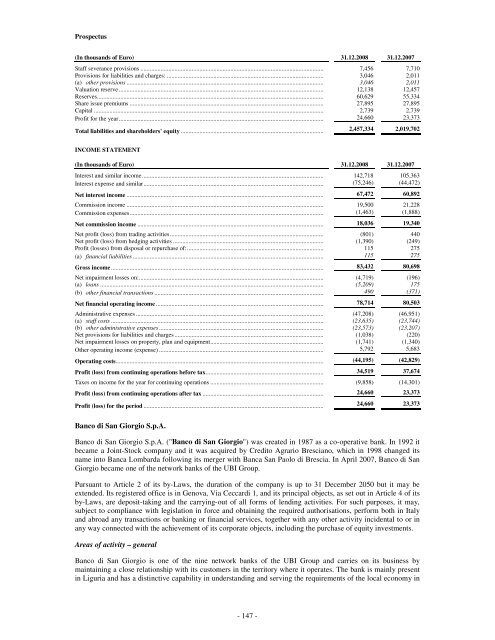

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Staff severance provisions ...................................................................................................................... 7,456 7,710<br />

Provisions for liabilities and charges: ..................................................................................................... 3,046 2,011<br />

(a) other provisions ............................................................................................................................... 3,046 2,011<br />

Valuation reserve .................................................................................................................................... 12,138 12,457<br />

Reserves.................................................................................................................................................. 60,629 55,334<br />

Share issue premiums ............................................................................................................................. 27,895 27,895<br />

Capital .................................................................................................................................................... 2,739 2,739<br />

Profit for the year.................................................................................................................................... 24,660 23,373<br />

Total liabilities and shareholders' equity ............................................................................................ 2,457,334 2,019,702<br />

INCOME STATEMENT<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Interest and similar income..................................................................................................................... 142,718 105,363<br />

Interest expense and similar.................................................................................................................... (75,246) (44,472)<br />

Net interest income ............................................................................................................................... 67,472 60,892<br />

Commission income ............................................................................................................................... 19,500 21,228<br />

Commission expenses............................................................................................................................. (1,463) (1,888)<br />

Net commission income ........................................................................................................................ 18,036 19,340<br />

Net profit (loss) from trading activities................................................................................................... (801) 440<br />

Net profit (loss) from hedging activities ................................................................................................. (1,390) (249)<br />

Profit (losses) from disposal or repurchase of:........................................................................................ 115 275<br />

(a) financial liabilities ........................................................................................................................... 115 275<br />

Gross income ......................................................................................................................................... 83,432 80,698<br />

Net impairment losses on:....................................................................................................................... (4,719) (196)<br />

(a) loans ................................................................................................................................................ (5,209) 175<br />

(b) other financial transactions ............................................................................................................. 490 (371)<br />

Net financial operating income ............................................................................................................ 78,714 80,503<br />

Administrative expenses ......................................................................................................................... (47,208) (46,951)<br />

(a) staff costs ......................................................................................................................................... (23,635) (23,744)<br />

(b) other administrative expenses .......................................................................................................... (23,573) (23,207)<br />

Net provisions for liabilities and charges ................................................................................................ (1,038) (220)<br />

Net impairment losses on property, plan and equipment......................................................................... (1,741) (1,340)<br />

Other operating income (expense) .......................................................................................................... 5,792 5,683<br />

Operating costs...................................................................................................................................... (44,195) (42,829)<br />

Profit (loss) from continuing operations before tax............................................................................ 34,519 37,674<br />

Taxes on income for the year for continuing operations ......................................................................... (9,858) (14,301)<br />

Profit (loss) from continuing operations after tax .............................................................................. 24,660 23,373<br />

Profit (loss) for the period .................................................................................................................... 24,660 23,373<br />

Banco di San Giorgio S.p.A.<br />

Banco di San Giorgio S.p.A. ("Banco di San Giorgio") was created in 1987 as a co-operative bank. In 1992 it<br />

became a Joint-Stock company and it was acquired by Credito Agrario Bresciano, which in 1998 changed its<br />

name into <strong>Banca</strong> Lombarda following its merger with <strong>Banca</strong> San Paolo di Brescia. In April 2007, Banco di San<br />

Giorgio became one of the network banks of the <strong>UBI</strong> Group.<br />

Pursuant to Article 2 of its by-Laws, the duration of the company is up to 31 December 2050 but it may be<br />

extended. Its registered office is in Genova, Via Ceccardi 1, and its principal objects, as set out in Article 4 of its<br />

by-Laws, are deposit-taking and the carrying-out of all forms of lending activities. For such purposes, it may,<br />

subject to compliance with legislation in force and obtaining the required authorisations, perform both in Italy<br />

and abroad any transactions or banking or financial services, together with any other activity incidental to or in<br />

any way connected with the achievement of its corporate objects, including the purchase of equity investments.<br />

Areas of activity – general<br />

Banco di San Giorgio is one of the nine network banks of the <strong>UBI</strong> Group and carries on its business by<br />

maintaining a close relationship with its customers in the territory where it operates. The bank is mainly present<br />

in Liguria and has a distinctive capability in understanding and serving the requirements of the local economy in<br />

- 147 -