Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

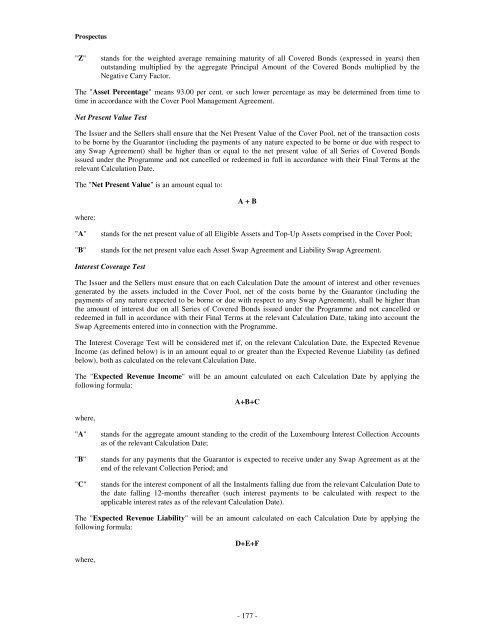

"Z"<br />

stands for the weighted average remaining maturity of all <strong>Covered</strong> <strong>Bond</strong>s (expressed in years) then<br />

outstanding multiplied by the aggregate Principal Amount of the <strong>Covered</strong> <strong>Bond</strong>s multiplied by the<br />

Negative Carry Factor.<br />

The "Asset Percentage" means 93.00 per cent. or such lower percentage as may be determined from time to<br />

time in accordance with the Cover Pool Management Agreement.<br />

Net Present Value Test<br />

The Issuer and the Sellers shall ensure that the Net Present Value of the Cover Pool, net of the transaction costs<br />

to be borne by the Guarantor (including the payments of any nature expected to be borne or due with respect to<br />

any Swap Agreement) shall be higher than or equal to the net present value of all Series of <strong>Covered</strong> <strong>Bond</strong>s<br />

issued under the <strong>Programme</strong> and not cancelled or redeemed in full in accordance with their Final Terms at the<br />

relevant Calculation Date.<br />

The "Net Present Value" is an amount equal to:<br />

where:<br />

A + B<br />

"A"<br />

"B"<br />

stands for the net present value of all Eligible Assets and Top-Up Assets comprised in the Cover Pool;<br />

stands for the net present value each Asset Swap Agreement and Liability Swap Agreement.<br />

Interest Coverage Test<br />

The Issuer and the Sellers must ensure that on each Calculation Date the amount of interest and other revenues<br />

generated by the assets included in the Cover Pool, net of the costs borne by the Guarantor (including the<br />

payments of any nature expected to be borne or due with respect to any Swap Agreement), shall be higher than<br />

the amount of interest due on all Series of <strong>Covered</strong> <strong>Bond</strong>s issued under the <strong>Programme</strong> and not cancelled or<br />

redeemed in full in accordance with their Final Terms at the relevant Calculation Date, taking into account the<br />

Swap Agreements entered into in connection with the <strong>Programme</strong>.<br />

The Interest Coverage Test will be considered met if, on the relevant Calculation Date, the Expected Revenue<br />

Income (as defined below) is in an amount equal to or greater than the Expected Revenue Liability (as defined<br />

below), both as calculated on the relevant Calculation Date.<br />

The "Expected Revenue Income" will be an amount calculated on each Calculation Date by applying the<br />

following formula:<br />

where,<br />

A+B+C<br />

"A"<br />

"B"<br />

"C"<br />

stands for the aggregate amount standing to the credit of the Luxembourg Interest Collection Accounts<br />

as of the relevant Calculation Date;<br />

stands for any payments that the Guarantor is expected to receive under any Swap Agreement as at the<br />

end of the relevant Collection Period; and<br />

stands for the interest component of all the Instalments falling due from the relevant Calculation Date to<br />

the date falling 12-months thereafter (such interest payments to be calculated with respect to the<br />

applicable interest rates as of the relevant Calculation Date).<br />

The "Expected Revenue Liability" will be an amount calculated on each Calculation Date by applying the<br />

following formula:<br />

where,<br />

D+E+F<br />

- 177 -