Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

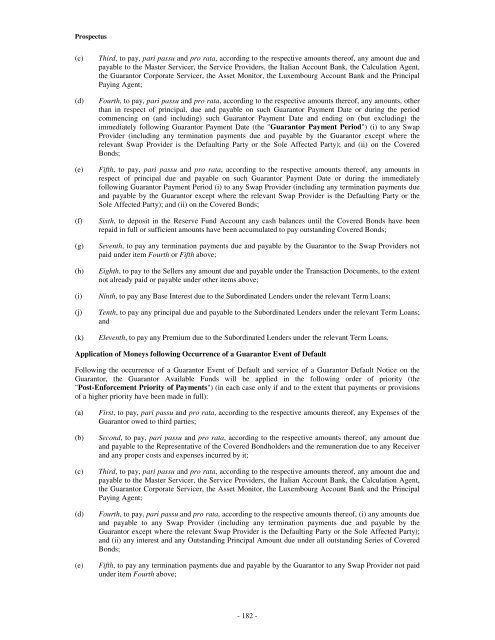

<strong>Prospectus</strong><br />

(c)<br />

(d)<br />

(e)<br />

(f)<br />

(g)<br />

(h)<br />

(i)<br />

(j)<br />

(k)<br />

Third, to pay, pari passu and pro rata, according to the respective amounts thereof, any amount due and<br />

payable to the Master Servicer, the Service Providers, the Italian Account Bank, the Calculation Agent,<br />

the Guarantor Corporate Servicer, the Asset Monitor, the Luxembourg Account Bank and the Principal<br />

Paying Agent;<br />

Fourth, to pay, pari passu and pro rata, according to the respective amounts thereof, any amounts, other<br />

than in respect of principal, due and payable on such Guarantor Payment Date or during the period<br />

commencing on (and including) such Guarantor Payment Date and ending on (but excluding) the<br />

immediately following Guarantor Payment Date (the "Guarantor Payment Period") (i) to any Swap<br />

Provider (including any termination payments due and payable by the Guarantor except where the<br />

relevant Swap Provider is the Defaulting Party or the Sole Affected Party); and (ii) on the <strong>Covered</strong><br />

<strong>Bond</strong>s;<br />

Fifth, to pay, pari passu and pro rata, according to the respective amounts thereof, any amounts in<br />

respect of principal due and payable on such Guarantor Payment Date or during the immediately<br />

following Guarantor Payment Period (i) to any Swap Provider (including any termination payments due<br />

and payable by the Guarantor except where the relevant Swap Provider is the Defaulting Party or the<br />

Sole Affected Party); and (ii) on the <strong>Covered</strong> <strong>Bond</strong>s;<br />

Sixth, to deposit in the Reserve Fund Account any cash balances until the <strong>Covered</strong> <strong>Bond</strong>s have been<br />

repaid in full or sufficient amounts have been accumulated to pay outstanding <strong>Covered</strong> <strong>Bond</strong>s;<br />

Seventh, to pay any termination payments due and payable by the Guarantor to the Swap Providers not<br />

paid under item Fourth or Fifth above;<br />

Eighth, to pay to the Sellers any amount due and payable under the Transaction Documents, to the extent<br />

not already paid or payable under other items above;<br />

Ninth, to pay any Base Interest due to the Subordinated Lenders under the relevant Term Loans;<br />

Tenth, to pay any principal due and payable to the Subordinated Lenders under the relevant Term Loans;<br />

and<br />

Eleventh, to pay any Premium due to the Subordinated Lenders under the relevant Term Loans.<br />

Application of Moneys following Occurrence of a Guarantor Event of Default<br />

Following the occurrence of a Guarantor Event of Default and service of a Guarantor Default Notice on the<br />

Guarantor, the Guarantor Available Funds will be applied in the following order of priority (the<br />

"Post-Enforcement Priority of Payments") (in each case only if and to the extent that payments or provisions<br />

of a higher priority have been made in full):<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

(e)<br />

First, to pay, pari passu and pro rata, according to the respective amounts thereof, any Expenses of the<br />

Guarantor owed to third parties;<br />

Second, to pay, pari passu and pro rata, according to the respective amounts thereof, any amount due<br />

and payable to the Representative of the <strong>Covered</strong> <strong>Bond</strong>holders and the remuneration due to any Receiver<br />

and any proper costs and expenses incurred by it;<br />

Third, to pay, pari passu and pro rata, according to the respective amounts thereof, any amount due and<br />

payable to the Master Servicer, the Service Providers, the Italian Account Bank, the Calculation Agent,<br />

the Guarantor Corporate Servicer, the Asset Monitor, the Luxembourg Account Bank and the Principal<br />

Paying Agent;<br />

Fourth, to pay, pari passu and pro rata, according to the respective amounts thereof, (i) any amounts due<br />

and payable to any Swap Provider (including any termination payments due and payable by the<br />

Guarantor except where the relevant Swap Provider is the Defaulting Party or the Sole Affected Party);<br />

and (ii) any interest and any Outstanding Principal Amount due under all outstanding Series of <strong>Covered</strong><br />

<strong>Bond</strong>s;<br />

Fifth, to pay any termination payments due and payable by the Guarantor to any Swap Provider not paid<br />

under item Fourth above;<br />

- 182 -